Strong Faith in the US Economy

The CME FedWatch tool did not lie. The US central banks opted to lower the cost of borrowing by 0.5% to the 4.75%-5.00% range with one of the governors opting for a 0.25% decrease. The Federal Reserve has ‘greater confidence’ about inflation and sees a rough balance between achieving price stability and a healthy labour market, its two critical mandates. The updated ‘dot-plot’, the interest rate forecast of the US monetary luminaries, revealed further reductions in benchmark rates as most policymakers see borrowing costs in the 4.25%-4.50 range by the year-end. It is the most sanguine view the central bank has expressed on inflation for at least a year.

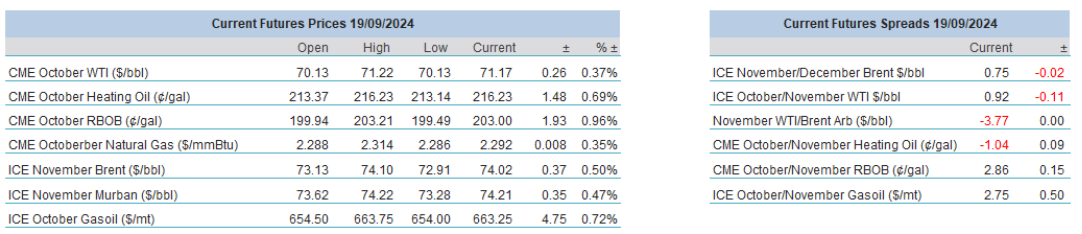

The beginning of the new cycle will reverberate through the US and the global economy. Life will be cheaper, lending and investment will be encouraged, consumer spending should rise, and the dollar will unlikely rally. The latest Fed move, nonetheless, does not entail an unbroken ascent to the top. The welcome move is only one of the many, albeit very significant, ingredients that impact the price of risk assets. Equities and oil stayed little changed, the dollar was stable, and bond yields moved higher.

Soon focus will inevitably shift to the fundamentals of the

oil market, a part of which is the weekly EIA statistics. It showed slightly more attractive values than the API with crude oil stocks drawing and gasoline and distillate inventories remaining broadly unchanged. Curiously, crude oil stocks in the USGC increased despite the Francine-related production shutdown. Total commercial stockpiles rose by 3.4 million bbls. China’s economic misfortunes is considered a downside risk. The escalation of the Israel-Palestine conflict has the potential to drag Iran into the war, which could engulf the region in flames, alas, triggering a violent rally. As usual, numerous factors must be contemplated but after yesterday’s US rate cut it is reasonable to conclude that the Fed played its indubitable part in providing a solid economic backdrop, which helps set a floor under the price of oil.

Hard Choices

During industrial gatherings or just chatting with those intimately involved in the oil world the role of the OPEC+ group in balancing the oil market is inevitably and intensely discussed. The original production alliance, OPEC is or maybe better put, used to be called the central bank of the oil market for a reason. In the same way as central banks can and do provide price stability by lowering or raising interest rates, OPEC was able to offer the same stable backdrop by cutting or increasing production. The group’s market power suffered a blow about 10 years ago with the emergence of the US shale sector. Its answer was to invite producers from outside the organization and expand the original cartel to what became known as OPEC+.

After Russia’s invasion of Ukraine and the ensuing weakness in oil prices, the producer group is seemingly struggling to re-assert its authority, possibly for two reasons. Firstly, the transition from fossil fuel to renewables is undisputably underway. Secondly, technological advances provide invaluable support for producers outside the organization who are happy and willing to pick up the slack as OPEC+ attempts to balance the market and maximize its revenue. The numbers speak for themselves. Between September 2023 and August 2024, the group, including those with no output ceilings, the likes of Iran, Libya, Mexico and Venezuela, have decreased its collective production by more than 2 mbpd, from 42.734 mbpd to 40.656 mbpd. The OPEC basket price has plunged from $96.40/bbl to $78.41/bbl in these 12 months resulting in a loss of $855 million in daily revenue using the basket price as the point of reference.

This simple calculation confirms that the group’s grip on the supply market is slipping for the reasons mentioned above. It invites the question of what can be done or whether anything can be done to tighten the oil balance and drive prices north again. It is the latter that weighs more in answering the question as OPEC+ presumably looks at their own figures, which, despite the recent downward revisions in global oil demand, still show an unquenchable thirst for the group’s oil implying a necessary increase in output, something that has not been impending.

Price is the salient factor in shaping the thinking – just compare the Saudi budget price of $96.20/bbl (IMF estimates) with the current level. Fulfilling the Kingdom’s medium-term vision is in jeopardy. The other heavyweight, Russia, is in even more dire need of petrodollars as it has a war to finance with the end is anything but nigh. Smaller producers for miscellaneous social and political reasons also make every effort, perceptible or implicit, to make the most out of the contemporary situation.

The first point is to decide whether the targets that are set are short or long-term ones. Once it is determined the best or the least inauspicious of three possible options can be picked. These are 1.) do nothing and stick with the current quotas until prices reach the desired level, 2.) go all-in and increase production in the anticipation that short-term pain will be followed by long-term gain or 3.) cut further.

The consensus is that next year will bring declining demand growth and robust non-OPEC supply growth with it, therefore maintaining the present output policy might put a floor, wherever it can be, under the market but unlikely to support it. Increasing output, intentionally or because of growing discontent between members sparks a supply war, could hurt competitors and at the same time stimulate demand. It is, however, worth remembering that the breakeven price for US shale oil for this year is $54/bbl (Rystad Energy) and several other projects, Guyana’s Stabroek is a fitting example, have breakeven costs of closer to $30/bbl. It is not clear whether the long-term gain would make the short-term pain worthwhile. Tightening the output belt further appears to be the most effective solution. It would, however, be close to impossible to implement without triggering internal resentment and therefore it Is not feasible either. Prospects look grim but lest we forget that the alliance still controls around 40% of the entire market and whilst it might not be able to support prices the way it used to be able to it can prevent a meltdown – provided that a healthy level of cohesion within the group is maintained.

Overnight Pricing

19 Sep 2024