Struggling Manufacturers, Precise Ukrainian Drones

One way to measure global and regional economic health is to follow the worldwide activities of manufacturers. The latest snapshot is anything but encouraging. Call it what you will—tariff headwinds, high interest rates, inflation anxiety, or stuttering aggregate demand—factories were forced to scale back production in November. Apart from the few bright spots of the UK and smaller Southeast Asian nations, the manufacturing sector contracted in China, Japan, South Korea, Taiwan, the eurozone, and the US, while growth in India decelerated to a nine-month trough. No wonder risk was dumped.

Although the slowdown in global manufacturing cast a long shadow over oil demand prospects, our beloved market chiefly took its cue from developments on the supply side of the equation. None of these factors was inconceivably price-supportive on its own, but when taken together, they warranted an 80-cent-per-barrel jump in the two major crude oil contracts. OPEC+ decided to pause its unwinding of production cuts. While this was expected, it provided a nudge north, but it is worth emphasising that (a) spare capacity therefore remains ample, and (b) stock builds are still widely anticipated next year. Donald Trump’s impromptu move to threaten the closure of Venezuelan airspace was another constructive piece of yesterday’s puzzle, but it can also be viewed as a step toward removing an autocrat in an OPEC nation, potentially entailing a rise in production further down the line.

The real support came from Ukrainian drone attacks on two shadow-fleet tankers and on a CPC oil terminal in the Black Sea, even as peace talks are ongoing. Their effect, however, ought to be transitory (though this “transition” has been lasting for months now), and the adverse impact on oil supply and exports mitigated by the partial resumption of loadings at the CPC terminal, by perceived and actual progress in peace talks, and by the relatively comfortable supply cushion cited above. The chances of challenging the June peaks are, therefore, well-nigh improbable.

Bleak Prospects of Real Peace

Under Joe Biden, the chances of brokering a peace deal between Russia and Ukraine were less than slim. Then came Donald Trump, and the odds of some kind of agreement increased almost exponentially. Of course, there is an immeasurable difference between peace and an accord to halt fighting. The former is a consensus that is mutually beneficial for the warring parties; the latter is something that might be born out of necessity or coercion, where one party loses and the other wins. From this perspective, and judging by recent attempts to establish a ceasefire, peace remains highly elusive. The yawning chasm in the ultimate objectives of Ukraine and Russia makes it virtually impossible to square the circle of war. One insists on sovereignty; the other will not stop hostilities unless that very sovereignty is diminished or obliterated.

Winston Churchill astutely observed that war does not determine who is right—only who is left. Yet it is beyond dispute or doubt that, in this conflict, Ukraine has the moral high ground and, consequently, should be supported in every possible way to prevail over the aggressor. The “root causes” of the conflict, according to the official Russian narrative, are the eastward expansion of the NATO military alliance, purportedly an existential threat to Russia, and the denial of Ukraine’s right to exist as an independent state. After all, “Russia and Ukraine were one people,” Vladimir Putin asserted in a 2021 essay. But whether Ukraine joins NATO is a mutually negotiated decision between the two parties, unlike invading a sovereign country. Secondly, NATO is a defensive organisation, whereas Russia, just after WWII, launched seven major foreign invasions, including those of Hungary, Czechoslovakia, Afghanistan, Transnistria, Georgia, Crimea and now Ukraine. To place an equals sign between Russia and Ukraine is historically inaccurate, as the latter’s culture and identity have existed for centuries independently of Russia. The icing on the cake is Russia’s brazen violation of the 1994 Budapest Memorandum and the failed 2014–2015 Minsk agreements, which provided security assurances to Ukraine, among others. This war is impossible to justify historically, culturally or politically, but perhaps not ideologically.

The invasion of Ukraine is seemingly part of Russia’s expansionist intentions. Once this tenet is accepted, and admittedly, it is a subjective presumption, the question arises of how this conflict could end. The most implausible scenario is practical co-operation with Russia on military, political and economic fronts. Reinvigorating NATO–Russia relations would go a long way toward mitigating tensions, similar to the NATO–Russia Permanent Joint Council of 1997, later replaced by the NATO–Russia Council of 2002, when suggestions of Russia even joining the alliance surfaced. With the election of President Putin in 2000 and especially following the annexation of Crimea, these initiatives gradually died. Although the Russian President is adamant that his country's joining the EU would not be in the interest of either side, economic partnership might also be considered for the benefit of both.

A more drastic but realistic approach is sanctions that push Russia beyond its pain threshold. In fact, evidence shows that existing punitive measures do have explicit effects on the Russian economy. Wars are expensive; they must be financed, and a war economy can be sustained only for so long. A Bloomberg roundup found that although inflation retreated to 6.8% in early November, this was due to plunging aggregate demand. Fashion retailers are closing almost weekly, the electronics market is declining at its fastest pace in 30 years, car sales plummeted by a quarter in the January–September period, the steel industry is shrinking, the budget deficit reached 1.9% of GDP in October and is expected to rise to 2.6% by year-end, and economic growth estimates are being revised continually downward.

Oil and gas revenues are falling: they dropped more than 20% in January–October compared with the same period last year, Bloomberg calculates. As US sanctions on two major producers were introduced, the Urals discount to Brent in the Mediterranean widened by nearly $9/bbl in just over two weeks. Further tightening the sanctions screw while providing almost unconditional financial and military support to Ukraine would transform the current tilting at windmills into a very real prospect of forcing Russia to the negotiating table, with a genuine chance of ending the conflict. Chinese collaboration on squeezing the Russian economy further, the most powerful weapon, nevertheless, is not practical.

Although Ukraine has been given carte blanche to strike critical Russian energy infrastructure, with devastating effect, the political will to further promote sanctions, particularly from the US, is AWOL. Whether this mediocre and insufficient support is due to the ostensibly justified fear of Russia using its nuclear arsenal in case of escalation or simply a desire to make a deal at any cost is unclear. What is increasingly obvious is that the third possibility is the most realistic one: Ukraine giving up part of its territory, being barred from joining NATO and possibly limiting the size of its military; in other words, ceding at least part of its sovereignty. Enduring peace? To paraphrase Marshal Foch’s view of the Treaty of Versailles: this would not be peace; it would be an armistice for a few months or years, with all its geopolitical and economic consequences, of which oil is an integral part.

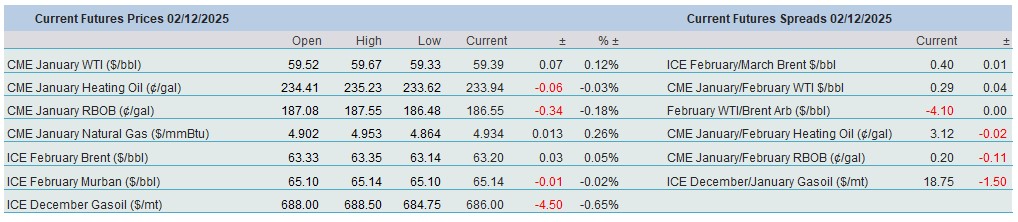

Overnight Pricing:

02 Dec 2025