Supply Concerns Help Oil Amidst Growing Economic Gloom

Apart from oil risk appetite suffered from nausea and for good reasons. The trade war initiated by the US is in full swing as discussed below and it is being mirrored in hard economic data. It is more of a harbinger of what lies ahead and must not be ignored. Although the European manufacturing sector is on the mend as its PMI rose to 49.4 in May from 49.0 in April, factory activity in several Asian economies is struggling to gain traction. The sector’s reference index showed a contraction in Japan and South Korea. Manufacturing slowed in China and India, an unmistakable sign of the US tariffs on the regions’ export capabilities, which did not spare the instigator either. Activity in the US shrank for the third consecutive month in May, and suppliers took the longest to deliver input for almost three years, an ominous sign of renewed inflationary pressure and a bleak prospect.

Yet, oil defied financial gravity and registered a nearly $2/bbl gain on the day after OPEC+, as discussed below, stuck to the latest script and increased supply, the Canadian wildfire, according to a Reuters calculation, impacted around 7% of the country’s production and Russia laid down cynical conditions for peace talks, which is likely to be a non-starter. Bullish supply-side developments, nonetheless, will have the lifespan of a mayfly and we would expect yesterday’s rally to be transient.

Like it or Not, Oil Balance is Getting Looser

The seemingly perplexing oil price rally yesterday came after a weekend dominated by worryingly negative economic and supply-side developments. The trade war between China and the US intensifies as mutual accusations are fired back and forth between the world’s two largest economies. The US President, in his tilting at the windmills, upped the ante and promised to double the tariffs on steel and aluminium imports from 25% to 50% days after a federal court ruling against blanket import taxes. The dollar weekend and bond yield rose but surprisingly equities eked out small gains. The third successive monthly 411,000 bpd meeting in OPEC+ output was also deemed inauspicious for anyone with a bullish propensity.

Yet, the market reaction was a rally of $1.85/bbl. Since the economic outlook deteriorated, the jump can only be attributed to a.) the escalating military tension between Ukraine and Russia which makes any tentative peace talks between the warring parties a futile attempt and b.) a reverse Gulf War I syndrome after the OPEC+ decision, where an expected outcome is built in the price and when the event takes place the market changes course. There are no signs of an immediate Russian supply disruption therefore if it is the Ukrainian attacks on Russian airfields that are responsible for the jump, its impact is to be brief and so is the effect of the Canadian supply disruption. A deeper look at the oil balance in the light of the latest OPEC+ decision also reveals a picture, which is less than ebullient.

Before looking at the actual numbers it is only reasonable to establish that the change in OPEC+ policy, to prioritize re-gaining market share at the expense of supporting prices is now irrevocable. The third accelerated monthly increase, together with the fraying cohesion within the alliance, including resurfacing friction between Russia and Saudi Arabia, confirms this policy reversal. The group is on track to unwind the 2.2 mbpd constraint much faster than originally scheduled and at the current pace the whole volume would re-emerge by September. It is also worthwhile pointing out that this 2.2 mbpd is only a fraction of the total 5.9 mbpd that was taken off the market since 2022. There will be another 3.7 mbpd to be potentially unleashed after the 8 member countries re-add the 2.2 mbpd in its entirety.

Given the uncertainties lying ahead, which can shape both global oil demand and supply, it is reasonable to use a rudimentary approach when trying to depict how global and OECD stocks might change in the second half of the year. For the purpose of this exercise, OPEC data is used below. It is the most bullish prognosis compared to other forecasters but when the result is set against the predicted balance from a month ago, hopefully, a realistic picture emerges.

The group will have added 1.23 mbpd of oil by the end of July, maybe 1.64 mbpd by end-August and 2 mbpd a month later. Considering the April production level of 40.92, it is probably a fair assumption, under the present circumstances, that the group will supply around 42.6-42.8 mbpd on average in 2H 2025. This would be around 1.2 mbpd more than forecasted prior to the U-turn in strategy. As a result of this change in global oil inventories, OECD stocks, which absorb about 40% of the total fluctuation, historical data suggests, should be around 90 million bbls higher by the end of 2025 than previously estimated. Even though, OPEC projected global stock draws throughout the year, the excess demand for the second half of the year seen last month and before will now evaporate (and turn into a deep surplus by the estimates of the EIA or the IEA). It should lead to a downward revision of around $7/bbl in the price forecast for Brent for 2H 2025, which, our formula shows, was around $74/bbl a month ago.

With all other factors unchanged, the upside is, therefore, limited with more oil becoming available. Other factors, however, will not stay static. The impact of the trade war on economic growth is the biggest question mark, as Donald Trump’s volatile decision-making and the resultant adverse market reactions in bonds and the dollar must be carefully monitored on an ongoing basis. Non-OPEC+ supply will also be a factor and supposedly a negative one. Energy Intelligence calculates that Atlantic Basin producers alone, such as the US, Brazil, Guyana, Canada, Argentina and Norway, will add 880,000 bpd of production this year, most of which will come online in the second half. Yesterday’s price rally might have come as a surprise, but the recalibration of the supply/demand balance implies prices sub-$70 prices are justified. Anything above that, however, is implausible with abundant supply on the horizon – unless geopolitics, predominantly a potential Israeli attack on Iran, interferes.

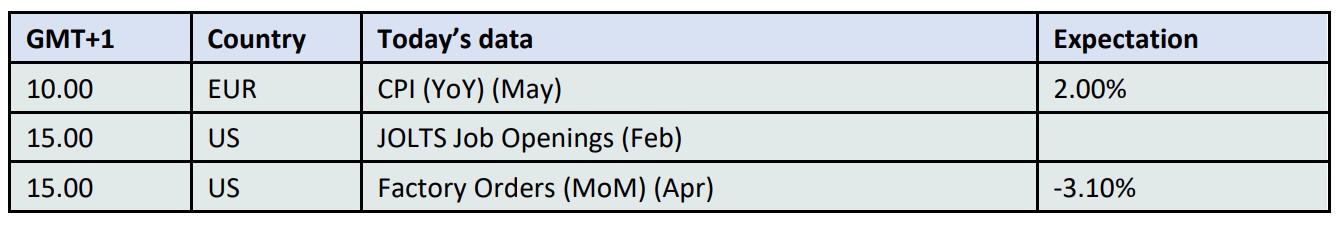

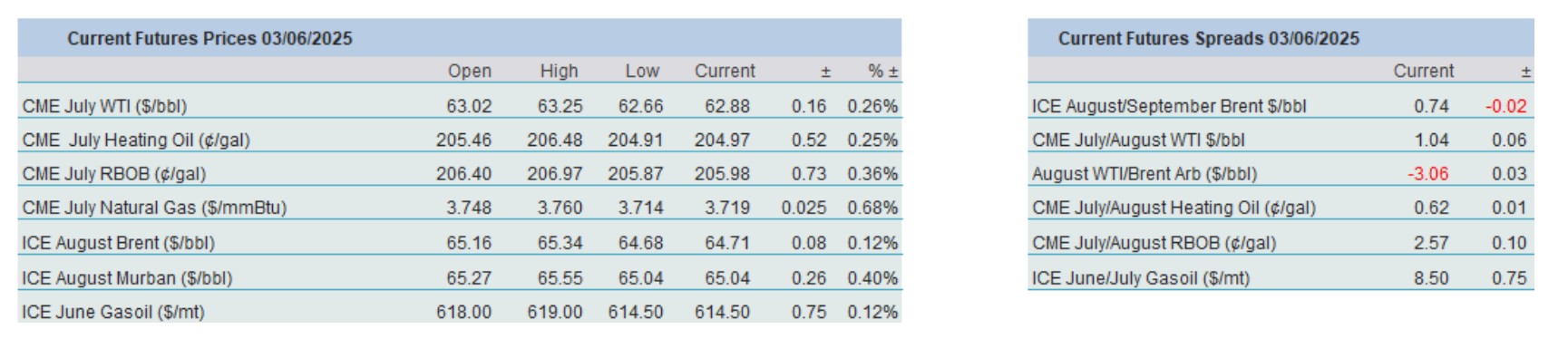

Overnight Pricing

03 Jun 2025