Swimming in Oil

The move lower in oil prices continued yesterday, and given the updated EIA report on the global balance, one might be perplexed as to why daily losses in WTI and Brent amounted to a mere 60 cents/bbl. We will take a deep dive into the numbers after OPEC and the IEA release their own findings tomorrow. For now, based on the EIA’s view, it is a dead cert that an oil shortage is unlikely in 2026. Although demand will grow faster than non-OPEC+ supply, global oil inventories are expected to swell by more than 2 mbpd in every quarter but one next year, bringing the annual average build to 2.265 mbpd. This would lift OECD commercial inventories to 3.075 billion barrels, up more than 300 million bbls from 2024 and 156 million bbls from 2025.

The substantial losses in ICE Gasoil and CME Heating Oil suggest that optimism for an agreement, and the potential lifting of Russian sanctions, has been revived. True to this observation, and in his latest attempt, the US President reportedly gave President Zelenskyy until Christmas to accept an amended peace proposal that includes Ukrainian territorial losses in exchange for vague US security guarantees. The currently fashionable phrase in English football circles, ‘thrown under the bus’, comes to mind. Overnight API report showing product stock builds outweighing the crude oil draw will help limit any upside potential, at least until after the EIA statistics this afternoon.

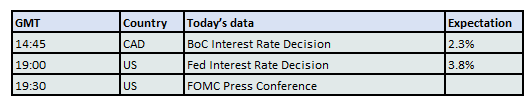

Equities were understandably quiet, although the modest rise in October US job openings helped stocks advance. All eyes, however, are now on today’s Fed decision. Investors pencil in a 0.25% cut, and barring any negative surprise, it should provide a solid base for further strength. And in the longer term? Numerous variables could shape sentiment in either direction, including trade tariffs, inflation, exchange-rate movements, unemployment, and more. However, the latest report from the Institute of International Finance proves an ominous read. Total debt rose to $345.7 trillion by September, roughly 310% of the value of global goods and services. Emerging markets will need to refinance $8 trillion of debt next year, and mature markets twice as much. Imagine if renewed inflationary pressure results in comparatively high borrowing costs. There is no impending debt crisis—but there might be one.

Lest China be Forgotten

Markets react sensitively to anything Donald Trump, Jay Powell, Vladimir Putin or European leaders say, pledge, promise or do. The two main drivers of influence are currently US economic policies, both fiscal and monetary, and the ongoing war on the eastern flank of the Old Continent. The latter is probably more pivotal for oil; at least, this is what the general reaction to headlines about peace talks, or the absence of them, suggests. As investors are preoccupied with these factors, the state of China and its economy have somewhat lost relevance. Yet it is worth reiterating that it is the world’s second-biggest country in several respects, such as population and economic or political might; therefore, a roundup of the latest data appears well-deserved and justified.

The country’s recent troubles are well documented. After the pandemic, the economic miracle of China has been waning. Long gone are the years of 10% growth. Domestic aggregate demand is in retreat as consumers have become pragmatic and prioritise savings, the property sector has been unable to recover from the doldrums, and the manufacturing sector has not been humming as convincingly as it used to.

Weak domestic consumption and demand make their presence felt across numerous segments of the economy. Manufacturing, once the heartbeat of growth, has been unable to expand. Its index, apart from the occasional and brief pop above 50, which separates contraction from expansion, has reliably remained below this critical level and has done so since March, after four successive months of growth. The latest figures show the manufacturing PMI dropping from 49.8 in October to 49.0 last month, the lowest reading since December 2022.

Again, manufacturing activity faithfully mirrors consumer behaviour, which is also reflected in both factory and consumer prices. The year-on-year increase of 0.7% in consumer inflation due to rising food prices and the persistently deep factory gate deflation entails weak domestic demand. Unless deflationary pressure reverses, the economic outlook remains bleak.

Sluggish aggregate demand has a discernible impact on exports and imports and therefore a tangible effect on the global economy, or at least on China’s trading partners. The latest customs data suggests that China’s imports rose 1.9% in November to $218.6 billion. Whilst this is a month-on-month increase, the stubborn downturn in the property sector continues to weigh on consumer spending and business investment. Yet the rise in crude oil imports implies that the country’s economy is in a buoyant state. Foreign oil purchases rose more than 5% from October, 4.9% from November 2024 and amounted to 12.38 mbpd, the highest monthly average since August 2023, according to Reuters. The economic significance of this figure, nonetheless, must be taken with a healthy dose of salt, as the lion’s share of foreign oil will probably find its way into strategic storage.

The increase in exports considerably outweighed the rise in imports in November. The value of Chinese-produced goods sailing abroad was estimated at $330.3 billion last month, an annual jump of 5.9%, above forecast and a more than decent recovery from the 1.1% contraction registered in October. The yawning gap between exports and imports must be noted, but should not take anybody by surprise. Whatever Chinese factories churn out must find a home somewhere if domestic consumers are reluctant to open their purses.

Accordingly, the Chinese trade surplus, the alpha and omega of any friction with trading partners, keeps ballooning. It reached $992 billion in 2024, official data shows, and surpassed the magical $1 trillion milestone in the January–November period of this year. Because of the tentative trade truce between the world’s two biggest economies, Chinese exports to the US fell around 26% on an annual basis. Therefore, and conversely, exports increased significantly to Africa, Latin America, Southeast Asia and, most importantly, the EU, and this could plausibly be and is leading to erecting trade barriers, worsening trade tensions between these juggernauts.

Notwithstanding the inauspicious outlook for domestic consumption, industrial output and higher-value manufacturing, coupled with fiscal and monetary policy support, will remain the most salient tenets for achieving the centrally declared growth target of 5%. This will inevitably lead to protracted economic conflicts and rising protectionism between China and others, particularly Europe, another nail in the coffin of globalisation.

Overnight Pricing

10 Dec 2025