A Symbolic Response?

Oil The sounds of explosions in Iran will be greeted by the myriad of doomsayers across all manner of media today with the emboldened, frightening language of a full-blown Middle East War. Bull’s that have not been flushed by the recent correction will breathe a sigh of relief as M1 Brent futures has traded up above $90 again. Iranian state media reported air defence systems had been actively operated around the city of Isfahan, which is not only the site of a major Iranian airbase but is associated with Iran’s nuclear program including the underground enrichment facility, Natanz.

It was confirmed that Israel had carried out an attack against Iran by US officials, but as the morning unfolded the attack and damage appear to be both limited. An Iranian source, via Reuters, said that there were no incoming missiles and the explosions heard were 3 drones being shot down by ground-to-air defence. After the initial knee-jerk reaction, M1 Brent has pared gains back to circa $88 but remains considerably higher from settlement. Commentators are speculating that the strike is largely symbolic, and if greeted by Iran in that same vein it will not meet the requirement for Iran to either respond or indeed consider it an act of war. Press from Iran remains mixed and there is a deafening silence from Israel at present.

The wider investment suite adheres to normal behaviour in such circumstances. Gold, which has found particular preference among those that reach for safe havens takes a hike along with fellow ports of storm. The USD and JPY rally against counterparts and all major bourses in APAC, Europe and US futures are all approaching being 1% lower. Whether or not the stock market softness is due entirely to the Middle East is not exactly clear. Equities are still pressured from interest rate woe as another strong showing in US jobless claims adds another tier of resistance of when the Fed might be able to cut. The markets are in for a morning of reactionary headline watching.

Funds may be moving money, but is to oil?

Last week, the US CPI year-on-year for March rose 3.5%, which was not only higher from the previous reading of 3.2% in February but also still higher than the 3.4% forecast. Even though the PPI reading of 0.2% offered a little soothing to markets, inflation is very much endemic in the US economy. The stickiness of inflation is likely to see a continuing interest in commodities. It may be somewhat of a circular phenomenon, but as commodity prices in the main tend to take an upward path when inflation increases, being long assets within the genre offers a protection against such rising prices.

US retail sales continue to shock to the upside. The more than robust rise of 0.7% month-on-month in March versus a 0.4% call shows a US public that is not only ambivalent to the higher interest rate environment, but also to the worry of inflation. US Services PMI still registers comfortably above the ‘50’ number of expansion and has done so for the last 13-consecutive months. With the labour market in no hurry to calm down, there are more people in more jobs with more money to spend. Therein lies the demand beast or possible ‘super-cycle’, as covered by Tamas yesterday. There is an element of self-fulfilment because the following goods and services increase lifts demand for the commodities that produce them culminating in the upward spiral. The longevity of any such spiral will be retrospective in proof.

Open Interest measurement is something of an art rather than pure science in terms of how longs and shorts are represented by the different constituents of the market, and while ‘managed money’ is tracked, what sort of money manager or fund is not specified. However, we will take a sweep at suggesting there is continued interest from longer term investment or institutional length because of the size of the increase in open positions since the start of the year. On the first trading day of 2024, Brent futures total Open Interest was 2 million lots. The total is now 2.5 million lots and it is hard to imagine that there is a 25% increase from producers and users in hedging requirement. This also coincides with reports that some funds are exiting equities in a big way. As reported in the WSJ, Goldman Sachs analysts estimate that pensions will unload $325 billion in stocks this year, up from $191 billion in 2023.

It is impossible to commit the increase in positioning to long-term funds alone. Oil demand in the US is still healthy, India is after more oil than ever before, and China is not as desperate as crude imports have recently shown. The Red Sea shipping attacks and conflict spread coincide with the belated effects of OPEC cuts are reason enough for ‘fast’ money to be long. But with ‘higher for longer’ interest rates still as fresh on the lips of US central bankers as it was last year, some of the equity sheen is already being rubbed off and monetary flight cannot just land into the US Dollar. Incidentally and interestingly, the strength of the greenback has failed to sit on the higher paths of Gold, Copper and Oil suggesting that current oil length will not be chased out by currency considerations.

Such suggested fund length will have outsize influence when times of position rolling are at hand. Yes, Crude markets are always influenced by distillate contracts but the state of Heating Oil and its loss of 10c/gallon in M1/M2 backwardation over 6 weeks is not exactly new. Nor is the likelihood of ‘fast’ money making a clean slate of oil after the quiet period post-Iranian barrage. The correction lower is much more to do with the burgeoning length that has been present in crude and particularly Brent as the monthly cycle approaches expiry and position limits need to be adhered to. Such moves and price flushes will become more commonplace in the months ahead if it is indeed institutions that are in charge of length. It is way too early to call a commodity super-cycle and the evidence is tenuous that massive long-term funds are in for the duration. However, it would be rather short-sighted to not at least consider and argue the case.

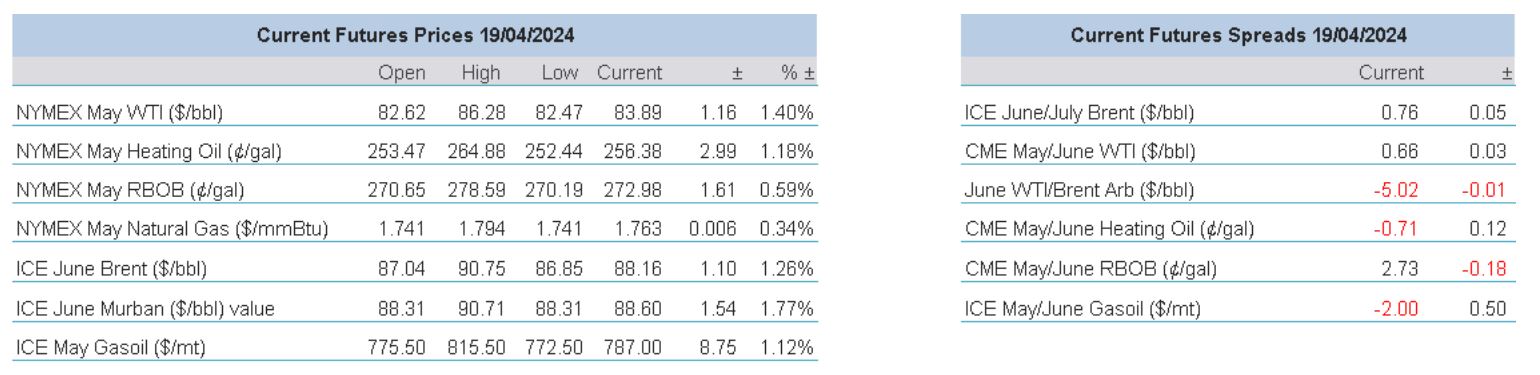

Overnight Pricing

© 2024 PVM Oil Associates Ltd

19 Apr 2024