Tariffs Cannot Be Ignored, Neither Can OPEC+

Whether or not it was OPEC+ intention to hide its revised output hike behind the melee caused by President Trump’s sweep of tariffs across the board of trade, be they for salient partners or not so, is conjecture, but it has not worked. The timing is frankly amazing, although there has been an inevitability to this action because trying to hold the oil price for the benefit of non-DoC members, losing market share and being undermined by the cheating actions of the same renegades needs a response. Maybe the writing was on the wall, and our market missed it.

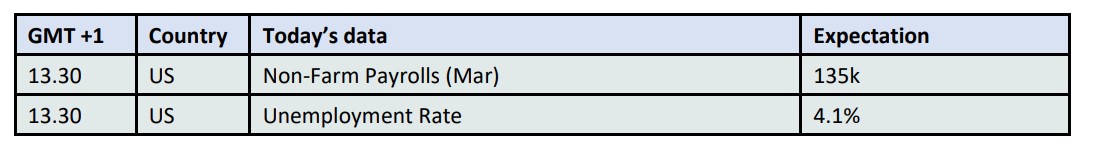

The recent shutting-in of some of the CPC capacity by Russia aimed at curbing the overproduction by an unapologetic Kazakhstan signals that there is dissention in the ranks. Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman met virtually, deciding to raise collective output by 411kbpd starting in May, against an expected 135kbpd. While towing a diplomatic line in not naming and shaming, the reason became clear in part of the ensuing press statement that the production increase would “provide an opportunity for the participating countries to accelerate their compensation.” No matter that there was qualification in it only representing two monthly incremental additions and that “any increases may be paused subject to evolving market conditions”, the market is now reckoning on the cork being out of the production bottle and believes, as we do, that it will not be pushed back in.

Much of the oil price crash yesterday, M1 Brent ended -$4.81/barrel (-6.42%), was reaped from the cascade of tariffs placed upon the world’s trade by the US administration and the OPEC+ decision is but an icing to this global bearish cake. With stock markets hammered yesterday, the DOW fell 4%, the S&P 5% and the tech-heavy Nasdaq 6%, the oil complex could do little but acquiesce to the type of selling not seen since the collapse experienced during the pandemic. That rout continues into Asia today and a trade war looms as many countries consider appropriate responses. However, the oil community had little chance to assess the OPEC+ news, and indeed, the wider macro environment will continue to drown out oil drivers but given a chance to scrutinise this change of state in the global oil balance and its probable future, there is little chance of our community being in any hurry to buy oil stuffs.

Interesting times for the Greenback

There is something strange going on in FOREX reckoning. Without any official position of late or usual supposed openness, but with suggestive hints, there is a growing argument that the US Dollar is being devalued. Such a notion is bringing shock to the normal way of things and once again shows hypocritical traits of the current administration which in its first incarnation riled against China which was accused of keeping its Yuan currency pairing with the Dollar artificially low and thus aiding its manufacturing and exports to the US.

The US Dollar is still the currency marker of the world, it is its most important of reserve money and used to price trillions of transactions in international trade. However, a strong home currency is one of the reasons the US President believes America is at a disadvantage because its goods are being priced out of international markets due to unfavourable currency pairings, which he believes are artificially held low. The stunning sideswipe of tariffs yesterday has not caused alarm bells of inflation and therefore Dollar-supporting higher interest rates. It has in fact brought the prospect of recession and with it a much-changed view in the pricing of interest rate expectation. The CME FedWatch tool has now seen a rise in probability of four rate cuts before the year is out, whereas the market had been settling into the idea of just two. Such pricing is as malleable as all current markets, and subject to caprice, but the greatest fear and Federal Reserve nightmare is stagflation. Cutting interest rates into a failing economy and rising inflation will serve as double-downer on Dollar prospects and natural devaluation will occur.

It must be presumed that in his bid to repatriate industry and manufacturing, the side-effect of a falling Greenback was not on the warning list of Trump’s doses of global trade medicine. Not that many allies are now inclined to be open to aiding the US economy, the current administration’s ability to curry favour with Europe is disappearing as quickly as stock market bulls. However, there is precedent in trying to arrange devaluation. Ironically, and with some amusing symmetry, the Plaza Accord (yes it was negotiated in the NY hotel) of 1985 saw a meeting of finance heads of state from the US, France, the then West Germany, Japan and the United Kingdom. The agreement was to depreciate the Dollar against the mentioned countries’ currencies and reverse its massive gains caused by the high interest rates and tight monetary policy deployed by the FED to counter the expansionist policies of Ronald Reagan. This was very much in the mind of Stephen Miran, the Chair of Trumps’s Economic Advisory Committee, who in November and during the campaign recharged the 1985 action as the ‘Mar-a-Lago accord’. Released under a paper called ‘A User’s Gude to Restructuring the Global Trading System’, and succinctly explained in Fortune, as a “program whose intended purpose is to restore American production and employment by devaluing the dollar and imposing tariffs on foreign goods.”

Lusting after a devalued currency does indeed come with the notion of decreased trade deficits, increased domestic industry and therefore increased employment. Yet, blaming the Greenback’s strength for many of the US economy’s woes is to forego any consideration to imbalanced policies that have caused a rise in interest rates. In fairness, both recent Presidents have undergone extraordinary global crises and some of the additional debt accrued is forgivable given the ravages of the pandemic closely followed by the Ukraine war. However, Joe Biden’s headlong delve into supporting anything that was supposedly green only exacerbated the overspend seen in Trump part I. According to the FiscalData website from the US Treasury, fiscal debt is nearly $36 trillion and debt to GDP is 123%. With an almost yearly battle to ever get a US budget agreed, US foreign affairs unreliability and the weaponisation of its currency in tariffs and sanctions has led to a groundswell of countries seeking to de-dollarize. The US currency is losing favour in terms of holdings. At the turn of this century, the Dollar’s share in global foreign exchange reserves stood at 72% and has fallen to currently 57% according to the International Monetary Fund. There are doomsayers predicting that figure might fall to as low as 45% by 2050, but who can call any asset moves for tomorrow let alone in 25-years’ time? The Greenback will cut a swathe of exceptionalism for many years yet to come no matter how much it is begrudged. Still, at this moment in time the US Dollar does not need devaluing, it is, by default, managing it of its own accord and bowing to the wishes of the Tariffian-era author.

Overnight Pricing

04 Apr 2025