A Time for Discipline

The mixed messages surrounding when, if and how top-up tariff/sanctions might be placed upon Russia are starting to try the patience of any peace optimist or oil bull. While President Trump keeps his attitude of ‘after you ladies and gentlemen of Europe, please,’ on who might go first in applying any additional punitive action, further instances of oversupply emerge to keep oil prices pressured. There is something of an inevitability when mentioning Iraq as one of the first countries taking advantage of the newly returned OPEC barrels allocation. Its oil ministry admitted production in August of 3.38mbpd will likely increase to 3.4-3.45mbpd for September. How this sits with Iraq’s promise of an output quota cut to compensate for the years of overproduction with its OPEC membership is one consideration, but another is support once again is given for those holding a view that in the cartel’s striving for market share recapture, all corporate discipline will disappear. It is doubtful that de facto leader, Saudi Arabia, will allow a free-for-all, while it wields a big stick of historic precedence when the Kingdom in 2020 gave Russia and OPEC a lesson and crushed crude prices, Iraq’s irritating behaviour is not as much a threat, but unity is vital, even if only cosmetic. Additionally, as seen on Reuters, Kuwait’s oil production capacity is now at ten-year highs and if other such news emerges, oil patrons are now being served practical evidence to theorised oversupply. Saudi and OPEC would do well to immediately bring out their best dancing shoes and be seen to chasse between market share ambitions and burying crude prices.

The trouble with expectation...

In yesterday’s report my esteemed colleague summed up the drivers which herd our market into a state of somewhat ambivalence. The report touched on our continued belief that a healthy oil market can only be representative of refined fuel demand. Can there be any doubt that the slump over the recent months in crude oil prices have been inspired by a lack of support from the usual seasonal vanguard, gasoline? It is too premature to hail the motor fuel’s season as over, after all, the National Hurricane Centre has just reminded us of our frailty in the face of nature. Hurricane ‘Gabrielle’ has just been upgraded to Category 4, with winds potentially reaching 140mph and while it is unlikely to blow disaster through the oil stuffs of the United States, there are always reasons to not rest comfortably in this reactionary world and our newfound violent weather incidents.

Yet, on the whole, the ‘driving season’, our buttress for summer oil price strength, did not turn up. Barrels supplied of gasoline, the proxy for demand, week after week in the EIA Inventory report showed measurement congregating around 9mbpd. For any dent in stock and a following rise in price, that reading needed to measure much closer to 10mbpd. Using data from GasBuddy, prices on the forecourts of the United States have hardly moved for most of the year being between $3.10-$3.20/gallon, the American fuel platform also points to the prices paid over the recent Labour Day weekend were the cheapest for five years, the national average is down 1.8c/gallon from a month ago and is 2.8 c/gallon lower than a year ago.

While the gasoline story is very much skewed by an American accent, the lack of fulfilment in expectation might just offer a lesson in the growing belief on how distillate is about to rescue the oil complex from its current malaise on a global basis. The main industrial character in the odyssey of oil, distillate is arguably much more important across the world given its use as diesel, heating oil, a burner for power stations and many more. This is made increasingly poignant as we approach the darker, colder months in the Northern Hemisphere. The expectation, as expressed in futures prices of Heating Oil and Gasoil, has been the cushion that softens the disappointment of its underachieving gasoline cousin and probably halting crude prices from seeking very concerning lower levels.

The geopolitical ramifications of sanctions and tariffs are influencing the type of crudes refiners are able to run. With restrictions on Russian and Venezuelan grades leading to Middle Eastern producers keeping heavy crudes within their own geographical remit, crude blends that go into the front of processors have become much lighter and by doing so cause a reduced yield in distillate emerging from the back. These yields will be to the scrutiny of us all going forward but there are quite a few issues in addendum that are lining up which bulls are hoping will keep distillate supply tight.

Russia’s influence on the world’s oil ecosystem is a many and varied thing with no let up in sight of its part in significance. Despite the pariah state brought upon itself, Russia could be relied upon to furnish a duplicitous world with up to 1mbpd of diesel/gasoil. That is of course until a new ‘gloves off’ attitude being adopted by Kyiv. Recently, Volodymyr Zelensky said, “the most effective sanctions – the ones that work the fastest – are the fires at Russia’s oil refineries, its terminals, and oil depots.” It has been successful; Russia has now resorted to making up lost revenue from exports of refined fuels by increasing those of crude. How this becomes awkward is where the extra crude might find a home and if it will undergo the magic formulae of turning it into something useful. The relevance of which can find no greater example than that of India.

As pointed out in Energy Intelligence, if India is unable to import its source of cheap crude from Eastern Russia because of extra sanctions bestowed by the US on New Delhi’s complicity in allowing the Kremlin’s oil coffers to keep being recharged, the consequence for diesel prices will be expensive. E.I. continues, “India has shipped 123kbpd of diesel to Europe on average so far this year, data from tanker-tracking firm Kpler shows; at least some of that was derived from Russian crude.” The world is starting its distillate season on an inventory back foot. With decreased global stocks and plenty of factors causing supply issues further to those touched upon above, the commencement of distillate consideration will round on how refinery turnarounds and maintenance is about to put an even bigger strain on supplies. The bullish distillate story is gathering drivers and acolytes.

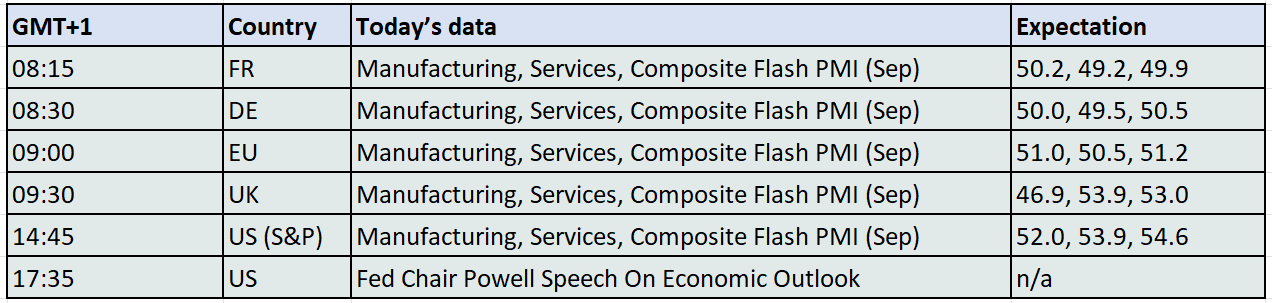

However, gasoline stands as a cautionary tale. The playbook for heating oil, diesel and their pals is already starting to become dangerously tinged with complacency. Repeating again that nature’s events and timescales can never be taken for granted, but the last few years have only seen a few teeth marks of winter, not biting temperatures freezing more than localised infrastructure and have also not seen billions of folks reaching for thermostats. And what of industrial demand? The very sanctions and tariffs that might just cause oil disruptions are the same curbing demand. Trade wars are seeing China struggle to maintain its target GDP, countless countries experiencing abject Manufacturing PMIs and Central Banks playing chicken with inflation because economic activity and employment are more important than prices paid. We do not dismiss the concept of a tight distillate market that proves saviour to the oil complex, we just worry that it is being ‘baked in’ too soon.

Overnight Pricing

23 Sep 2025