Tit-for-Tat

The underlying market dynamic has not changed. The oil market is being given every opportunity to ascend but it is reluctant to do so. In the Middle East last week’s US/UK strikes on Houthi rebels have not fulfilled the desired goal, quite to the contrary. Rebel hostilities persist and yesterday a bulk carrier was struck in the Red Sea. Almost simultaneously the US carried out a fresh strike in Yemen against anti-ship ballistic missiles whilst tension between Iran and Iraq escalated as the former launched strikes against targets in Iraq’s Kurdistan region. Cold weather in the US Gulf Coast forced refiners to shut down, yet the initial rally in CME products ran out of steam and the two major crude oil future contracts closed broadly unchanged.

The risk premium is AWOL and milder temperatures later this week sent US natgas price tumbling bringing Heating Oil down with it. Fed governor Christopher Waller, albeit admitting that the inflation target is ‘within striking distance’ warned against elevated hopes of imminent rate cuts. Consequently, expectations for such a move in March have been lowered, the safe haven status of the dollar appreciated, and equities retreated. Sombre Chinese economic data overnight inflames the grim mood. Simply put it, apart from widening Brent backwardation and upbeat CFD market there is a visible lack of conviction of developing upside potential.

GMT | Country | Today’s data | Expectation |

10.00 | Euro Zone | Core Inflation Rate YoY Final (Dec) | 3.4% |

13.30 | US | Retail Sales MoM (Dec) | 0.4% |

Tumultuous Year

Last year was undoubtedly volatile and vicious as inflation and the battle against it, the rise in geopolitical risk towards the end of 2023 and the ongoing transition from fossil fuel to renewable were on the forefront of investors’ thinking. Much of the same is anticipated in 2024. The Ukrainian war enters its third year with no ending in sight, the Israel-Gaza conflict is intensifying, central banks are contemplating a move towards lowering borrowing cost, attempts to transition away from fossil fuel are growing and finally around 2 billion people in 70+ countries have been or will be able to cast their votes in 2024. The most significant of these elections is the US presidential elections in November as sending Donald Trump back to the White House will make the currently precarious investment environment even more uncertain. As at the beginning of each year, the Energy Intelligence Annual Outlook coupled with its survey provides a useful insight as to how the incumbent year impacts our market.

Investors, just like last year, will have to deal with risks from all directions. The Ukrainian crisis is one of them and the salient question in 2024 is whether Western support will continue unabated, and the US and its allies will be willing or able to support the country militarily and financially. It will also be crucial to see whether Russia’s economy will remain resilient in the face of Western sanctions. In the Middle East, the conflict that started on October 7 last year shows no signs of subsiding. It is escalating if anything and complex political relations and antagonism might easily lead to supply disruption in a region that is the home of more than 20 mbpd of oil production. Further risk might come from the US where a re-elected Donald Trump would almost certainly re-write the US foreign policy.

In the light of the risks described above Energy Intelligence lowered its 2024 Brent price forecast to the $75-$85 range. Oil demand grows, it is set to rise until 2030 peaking at 106 mbpd. Non-OPEC supply is able to keep up with the increase in global oil demand, chiefly due to solid growth in the Americas. This, together with increases in capex will make sure that the chances of a supply crunch fade. Because of the resilience of non-OPEC+ supply the producer alliance is unlikely to unwind production cuts implemented in 2022 and 2023.

Energy Intelligence expects global oil demand to expand by 1.1 mbpd in 2024, down from around 2 mbpd in 2023, returning to the average growth rate registered pre-Covid. The non-OPEC+ supply growth of 1.5 mbpd is more than sufficient to satisfy the increase in consumption. Global spare capacity and high Chinese stockpiles should be able to cushion the impacts of eventual supply disruptions.

Momentum grows in energy transition. There are multiple headwinds, including supply concerns, high interest rates, supply chain issues and electoral politics but these will plausibly be countered by tailwinds, such as the global climate policy agreed in COP28 and technological advances, which makes renewable power competitive and help batteries scaling up.

The second part of the annual report, the survey, makes for an intriguing read. Respondents believe that the top two geopolitical risks are the US presidential elections (over 60%) and the Russia-Ukraine conflict (nearly 40%). The major driving forces of the oil price outlook will be macroeconomic considerations and the OPEC+ market management strategy. More than half of those who answered expect oil to average at $80/bbl or lower this year. Only 8% anticipate prices at $100/bbl. The majority of the participants in the survey expect global oil demand to peak by 2030 and/or2035. The industry’s priority remains dividends and share buybacks in 2024.

Views on the fight on climate change and transition are also curious. Most of the respondents (28%) believe that net zero carbon emissions will never be achieved, 26% think it will be reached by 2070 and only 11% of the replies suggest that the often-quoted 2050 target is realistic. Decarbonization tops this year’s energy agenda but underinvestment in oil and gas supply remains a significant concern. And finally, most would expect a constitutional crisis in the US to be the main ‘black swan’ event this year followed by a war in the Middle East. Whether these expectations are well-founded or misplaced will become clearer as the year progresses, nonetheless, the turbulence and uncertainties the market will have to keep dealing with in 2024 were laid bare in this year’s EI Outlook.

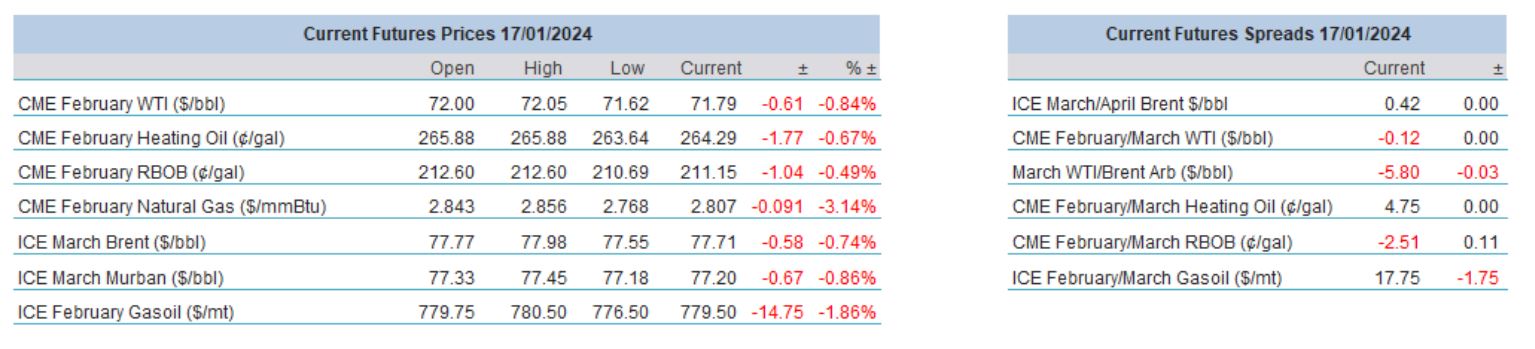

Overnight Pricing

© 2024 PVM Oil Associates Ltd

17 Jan 2024