Too many influences but Heating Oil the bulls’ boon

The tepid week-on-week change in the likes of WTI and Brent belies some of the moves experienced under the influences of very strong opposing market drivers. As it is, the 7-week rally in crudes was brought to an end and the Friday to Friday closes saw WTI lose $1.94/barrel and Brent $2.01/barrel. RBOB showed fractious behaviour all week and in the end did not surprise by losing 14.17c/gallon over the same period. However, the drivers of the oil market remain very much in the distillate contracts with Heating Oil leading the way by securing a weekly gain of 3.82c/gallon which was not quite lofty enough for Gasoil to achieve a positive week and closed -$0.50/tonne on the week, although it did have to endure quite a fallout from an expiry.

We list later our opinion on what the oil market’s main drivers are at present and will likely pick over them during the week but for this morning, and inevitably, market thoughts and moves are based around the (short)comings and goings of China. The market awaits stimulus news that has been so heralded from the top table of China’s government but thus far has been a drip-drip affair and today sees little change in urgency. The 1-Year Loan Prime Rate is cut this morning by 10-basis points from 3.55% to 3.45%, but the 5-Year LPR is left alone at 4.2%. This meagre easing is unlikely to shore up confidence and the market wonders how many more bad signals need to be seen before decisive action is taken, or if action will be taken at all rather than rhetoric. What we have seen from China, something to be touched on at a later date, is a willingness to clam up on data release. Last week, the decision not to report youth unemployment anymore was followed up by a convoluted threat in sharing energy information. This appears at first to be aimed at proprietary new alternative energy technology but it might just prove a massive headache for China watchers if that moratorium spreads to oil data.

Still, for oil, the main protagonist for this rally remains Heating Oil which has opened firmer again and is looking at its 7-month high recently posted in early August. The narrative of tighter products due to refinery issues or capacity remains unabated and thoughts of winter supplies in any energy form remain in the oil market’s foreground. Woodside Energy is the latest company to be informed of possible strikes by Australian gas workers, this time at the North West Shelf platforms. Europe has yet to sate its need for alternative gas supplies after halting Russian gas, therefore any hiccup in supply to LNG imports will have a tightening influence on gas prices at a time when the ‘switch’ substitute in generation, namely distillate, is itself scarce.

A steady but rightly cautious market

Markets are giving such conflicting signals that even futures and options commitment of traders sees indecisiveness. Managed length shows a reduction in WTI of 28,752 lots, an increase of 5,503 lots in RBOB and a small dip in Heating Oil of 657 lots according to CFTC and aggregated by Reuters.

This almost ambivalent change to positioning is hardly surprising given the circumstances those that take on risk find the oil market in. The trouble with trading at present is not only the very mixed news, but also that the market is suffering from a severe bout of August. Traders at the screen-face are thinned and therefore the volumes, serving only to exacerbate both the sometimes-fickle nature of the price moves and a subdued mood. Arraigned against risk are powerful oppositional forces and in no particular order (with probably some missing) the combatants stand as listed.

In the bull corner; the increasing fear of a refining sector that will not be able to supply enough products to a market already a little gasoline tight. But more importantly, as we approach the darker months of the Northern Hemisphere, a distillate shortfall which is represented by the outperformance of Heating Oil and the doubling of the value in the Gasoil/Brent crack in 6-weeks. Unfortunately in this world, there is always conflict adding sensitivity to prices. A Russian warship fired warning shots across the bows of a merchantmen last week as tension grows in the Black Sea, where up until now there has been a lack of will in attacking oil infrastructure including tankers, but the current spate of drone attacks from both Russia and Ukraine does make more incidents likely. The weather will always play its role, the high temperatures across the world are not just a headache for refiners unable to run lighter crudes, there may well be meteorological damage to come. The wildfires breaking out in British Columbia, Canada will bring thoughts returning to how Alberta stopped oil flowing south and then there is a hurricane season. California’s battering by Hurricane Hilary might not see profound oil influence, but one must imagine if such a storm barrelled into Corpus Christi, Texas, affecting not only crude flows but refineries as well.

In the bear corner; China. Not something usually associated as a negative influence, China’s fall from industrial and economic grace is dramatic and the current ill winds blowing through its financial system and judging by the state of Evergrande and other property names, will take months, if not years to remedy when considering the downgrading of its GDP forecasts by a swathe of banks. There was an interesting opinion piece from Reuters last week which needs to be borne in mind, suggesting that China is currently drawing on its massive crude inventories and therefore might no longer be as thirsty for international feedstocks. Then there is the possibility of higher interest rates, again. The recent FOMC minutes suggest that the battle for inflation is far from won and with further ‘pinching’ from the FED likely to be reciprocated from other central banks, global investors are already wandering into havens as seen by the resurgent US dollar, making oil in FOREX terms more expensive. Lastly, and counterintuitively, refinery runs. Products will tighten for sure, but the amount of crude without homes is set to increase, with any resultant crack widening confusing rather than an aid to clarity.

Heating Oil and by association, Gasoil is and are the commodities to watch. Distillate will be the determinative on how the oil complex performs. However, what is like trying to hit a flying insect with a bazooka is determining whether the current bullish nature of Heating Oil and the like is enough to rally the oil complex or just hold it in face of some of the influences listed. The oil market in August needs an equivalent of the stock market mantra, ‘sell in May and go away’. But our adage will have to involve a warning of not to expect too much.

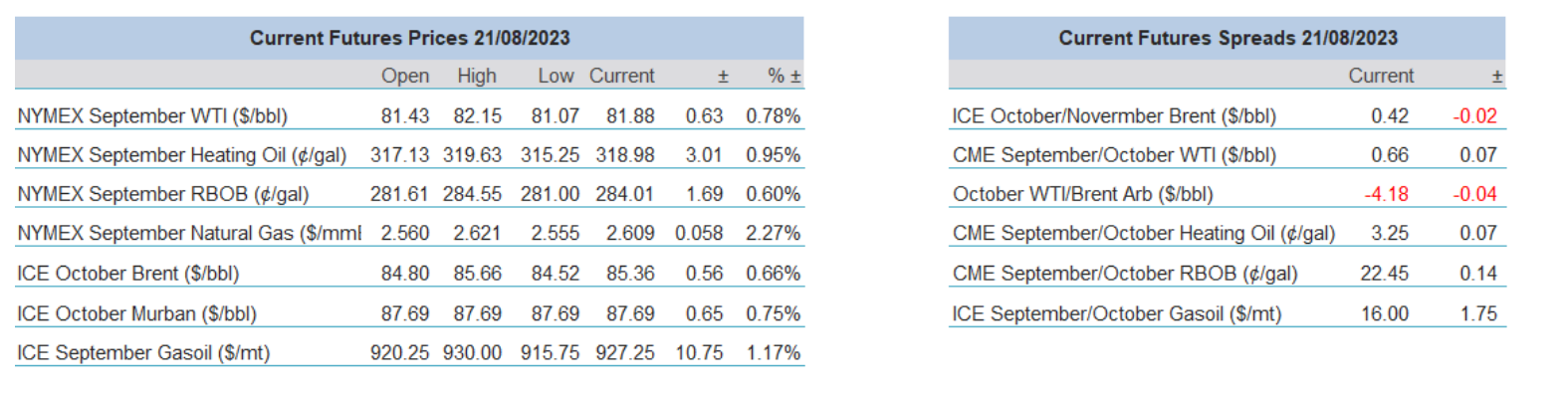

Overnight Pricing

21 Aug 2023