A Tough Week for Oil, with Another to Follow

Last week was extraordinary, the moves breath taking, leaving participants feeling nauseous in dips and vertiginous in rallies in single day oscillations, and adding to the outer-world feeling is that the marker crudes chimed in with almost zero changes with WTI -$0.35/barrel on the week and Brent -$0.03. Bulls can claim some hope when tracking the positive finish to Heating Oil (+6.32c/gallon) and Gasoil (+$28.50/tonne), for any rally in margins or the crack representatives will bring back recent memories of the distillate inspired complex rally in September. Such notions were dealt several blows, not only from emotional drivers as Israel and Hamas conducted hostage exchange and the ceasefire held, the US again saw builds while maintaining high crude production, and the poor state of industrial demand around the globe was represent by contractive manufacturing PMIs from Australia, across Europe and into the United States. Those that were looking for clarity leading up to the scheduled OPEC meeting on Sunday were sorely disappointed due to the postponement and so the market churn began and one must say, with a negative bias.

Unfortunately, there will be no getting away from OPEC and the delayed meeting which will now take place this Thursday, there will be the usual ‘unnamed sources’ printing headlines across wires, adding to a market strung so tightly that the slightest misplaced word or phrase will have dollars of repercussions rather than tens of cents. Given that the US and its huge investor influence was out for the back part of last week due to the Thanksgiving holiday, it is rather a toss-up as to whether their returning volumes will be a calming influence on proceedings or an accelerative to whimsy and rumour. This morning, and according to Reuters, 4-sources have said that there is nearly a compromise to the hold up in agreement caused by African nations, however, last week Nigeria’s governor to OPEC Tanimu Aduda told Reuters he was not aware of any disagreements with other members of OPEC+ about his country’s production targets. Wire service headlines, and those that consume them, are about to be given another week of headline run-around.

OPEC, Nigeria and Angola

Following on from Friday’s report in which we suggest Saudi’s beef of overproduction ought to be with Russia and not African oil producing nations such as Nigeria and Angola, who have since been somewhat rounded on by their OPEC brethren as the naysayers in a convoluted plan to impel the world to believe that crude barrels are short at present. Whatever the cartel proposes might be an uneasy sell for the economic reality is that all African countries, be they oil producers or not, are hard-pressed in terms of their currency reserves.

According to the Brookings Institute, the high borrowing cost and rising debt is hindering Nigeria’s ability to finance its development agenda. Even though Nigeria’s bonds are trading toward record yield highs, there is a reluctance from opportunistic investors that eye the globe for such anomalies because of the exposure inbound monies experience with the Nigerian Naira (NGN) and its consistent 15-year fall, in October 2008 the NGN was trading at 0.0087 versus the US Dollar, today it stands at USD/NGN 0.0012. Nigeria has seen double-digit inflation from 2016 and in 2023 has recorded CPI levels of up and beyond 26%, its GDP was respectable at 3.3% for calendar 2022 but the GDP to debt ratio this year has been up and toward the government’s 40% limit.

In its Economic Overview of Angola, the World Bank observed that the West African country’s fortunes have been tied to global oil demand, which up until 5-years ago brought volatile growth and left the country with high levels of poverty and inequality, that is until fiscal stability was brought in by allowing central bank independence, easing of exchange rate control and allowing foreign and private institutions access. However, GDP growth is expected to register 1.3% for calendar 2023 according to analysts and has been revised down due in part to the recent downturn in oil prices giving a GDP to debt ratio of 84%, while inflation has continued to increase since June of this year and reached 16.6% in October being nearly at a 1-year high and caused by the depreciation of the Angolan Kwanza (AOA) which used to be fixed at 0.0061 versus the US Dollar up until 2018, but has fallen for 5-years to the current ratio of USD/AOA 0.0012 which is -80%.

Nigeria and Angola are heavily dependent on their oil and gas industries, they are the largest provider of foreign currency, particularly and obviously the US Dollar. With spiralling inflation and the amount of monies put aside in debt service there is great need for a continuation in petrodollar income, particularly if some of the debt is foreign based and will need to be serviced by currency reserves, for indeed, any foreign investment would demand that returning dividends be paid back in the form in which it was entered. Bloomberg Intelligence neatly puts it that a foreign funding squeeze in Africa will lead to an inability in maintenance of account deficits, lead again to more foreign exchange shortages and name Nigeria and Angola among others as being vulnerable because of overvalued currencies.

Whether or not OPEC are able to implement a ‘cease and desist’ order on Nigeria and Angola’s increased oil production quota aspirations or indeed, strong arm them into a reduction allowing a successful claim by the cartel of a successful cut, remains to be seen. Unfortunately for OPEC, the above outlining of the current state of play within these two West African economies means that negotiations will be less than straightforward and must come with financial incentives rather than threats or a comely ‘come on chaps, play the game’ associated with exclusive clubs.

Overnight Pricing

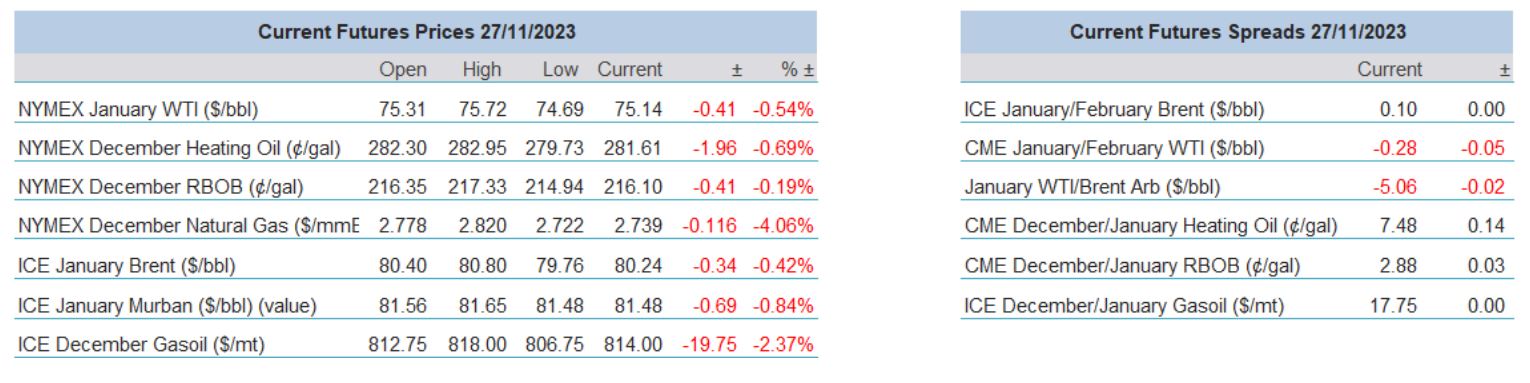

27 Nov 2023