Trump-Putin Meeting is in Focus

Investors do not appear to be overly concerned about the US tariffs that came into effect after midnight. Although the global trade war is now truly, and possibly irrevocably, underway, the Nasdaq Composite Index settled at yet another all-time high, while the S&P 500 Index closed broadly unchanged. US initial jobless claims rose to their highest level since July 5 and exceeded forecasts, but the odds of a September Fed rate cut remain comfortably above 90%, according to the CME FedWatch tool. The Bank of England narrowly voted for another interest rate cut, with four out of nine rate-setters opting for no change.

As for our market, geopolitics remains the primary driving force. The latest, and highly controversial, Israeli plan to take military control of all of Gaza is dwarfed in relevance by the Trump–Putin summit scheduled for next week. It is far from clear what will be achieved at the meeting, which will take place without Ukraine at the table. The Russian leader is expected to insist on having his territorial demands granted, a hard sell for the invaded country, while his US counterpart will push for a ceasefire. No breakthrough is anticipated, and the US following through on its threat to impose secondary sanctions on those dealing in Russian energy, including China and India, remains a possibility.

Nonetheless, the market does not expect a significant tightening of the oil balance, as an oil price rally would run counter to US interests. Consequently, oil has been struggling to gain momentum recently and is on track to record its lowest weekly settlement since June.

Embarrassing Surrender or a Smart Move?

“RECIPROCAL TARIFFS TAKE EFFECT AT MIDNIGHT TONIGHT! BILLIONS OF DOLLARS, LARGELY FROM COUNTRIES THAT HAVE TAKEN ADVANTAGE OF THE UNITED STATES FOR MANY YEARS, LAUGHING ALL THE WAY, WILL START FLOWING INTO THE USA. THE ONLY THING THAT CAN STOP AMERICA'S GREATNESS WOULD BE A RADICAL LEFT COURT THAT WANTS TO SEE OUR COUNTRY FAIL!”

This is the triumphant message the US President posted on the Truth Media platform on August 6. For the purpose of this paper, we shall ignore the fact that the tariffs imposed are not truly reciprocal, as they also apply to countries running trade deficits with the US. We will also set aside the historical advantages the US enjoyed over developing nations, particularly in the agricultural sector, through subsidising its own farmers after signing trade agreements with exporters. Finally, anyone claiming that there is a radical left in the United States has never studied history, and as for why the courts would want to destroy the country, well, that defies comprehension.

Of course, this post, like so many others, is part of the ongoing narrative, a message to the electorate, and possibly a deflection from potentially humiliating past personal matters. Thus, the market is more than willing to overlook it and focus instead on what matters: the tariffs and their potential impact on the US and the global economy.

These punitive measures are being adjusted weekly at the whim of the Commander-in-Chief. The latest snapshot suggests that tariffs now range from 10% (on the UK) up to 50% (on Brazil, and possibly India). China and Canada are subject to temporary rates. US tariffs do not merely aim to reduce the trade and budget deficits; they also function as political tools. The 50% excise duty on Brazil is linked to the prosecution of its former far-right president. Canada has been penalised with additional levies for its intention to recognise the state of Palestine. India’s closeness to Russia may cost it an extra 25%.

It is a perpetually shifting and complex picture. As of August 1, the average US tariff rate, including sector-specific measures, stood at 18.3%, according to the Budget Lab at Yale. This is the highest rate in 90 years, and its impact is already being felt. While US economic data is turning ominous, the federal budget posted a surprise $27 billion surplus in June, though all it managed was to trim the fiscal-year-to-date deficit by 5%, bringing it down to $1.34 trillion.

The next move by the US Administration, be it a further increase or a relaxation of tariffs, is simply unpredictable. The stock market’s performance, along with the slightly improved budget and trade balance, justifies the latest actions and suggests that the President is content with progress so far. What is rarely mentioned is the nonchalant or even pliant attitude of America’s trading partners, many of whom have been coerced into accepting these fait accompli measures.

Take one of the US’s largest trading partners, the EU. Under the Most-Favoured-Nation principle, the applied EU tariff rate was around 5% pre-Trump. In fact, in 2023, 73% of US exports to the EU were exempt from tariffs. Yet the bloc has now been hit with a punitive duty of 15%.

And its response? To delay retaliatory measures until at least March 2026. Cowardice? Not quite, opined a Harvard professor, Jason Furman, writing in the Financial Times this week. He argues that the sudden increase in import duties, from 3% to nearly 20%, is already shrinking US exports and eroding the benefits of imports for American consumers. After all, import taxes are effectively VATs. Retaliation would only make sense if it resulted in a rollback of US tariffs, something President Trump’s innate world view makes improbable.

Instead of trying to gain leverage through reciprocal duties, which would likely cause further harm to themselves, the “victims” have chosen the path of least resistance: refraining from imposing excise duties on US exports. As a result, consumers in these countries stand to benefit more from lower tariffs on US goods than Americans will from the reverse. If this thinking proves accurate, then one can reasonably conclude that inflationary pressures are more likely to re-emerge in the US, at least relative to other parts of the world. This would make reducing borrowing costs less likely in the world’s largest economy, widen interest rate differentials, and potentially strengthen the dollar, with all the attendant side effects on debt servicing, exports, imports, and the oil balance.

Staying put still hurts, but it may prove to be the least damaging strategy.

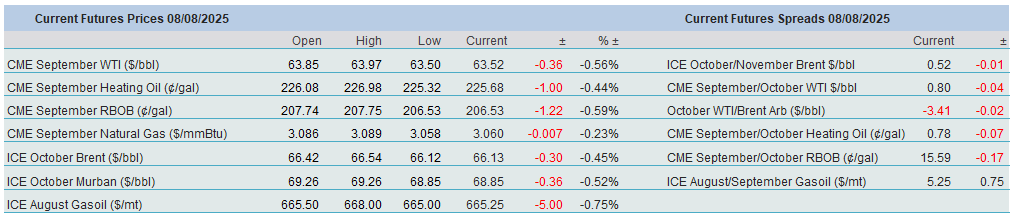

Overnight Pricing

08 Aug 2025