Ukraine Drones Spoil President Putin’s anointing

Last week the US Department of Defence (DoD) announced additional security assistance for Ukraine. It is the Biden Administration's fifty-fifth tranche of equipment to be provided from DoD inventories for Ukraine, this Presidential Drawdown Authority (PDA) package is valued at up to $300 million and includes capabilities to support Ukraine's immediate air defence, artillery, and anti-tank requirements. It has been pointed out to us by a keen eye in the oil fraternity that there is a rather large element of irony in this new military relief. An accepted political maxim is that the price of Gasoline in the United States can be a campaign buster, therefore the major rally in oil prices last week, particularly that of the sensitive motor fuel, was stirred by Ukrainian drone attacks into the refinery infrastructure of Russia which in the future might well be funded by the US Presidents PDA. It is doubtful that the monies being granted can be covered in a caveat that President Zelensky must refrain from hitting anything that makes Gasoline prices go up, one can only imagine the answer, but fortunately no-one here knows Ukrainian swear words.

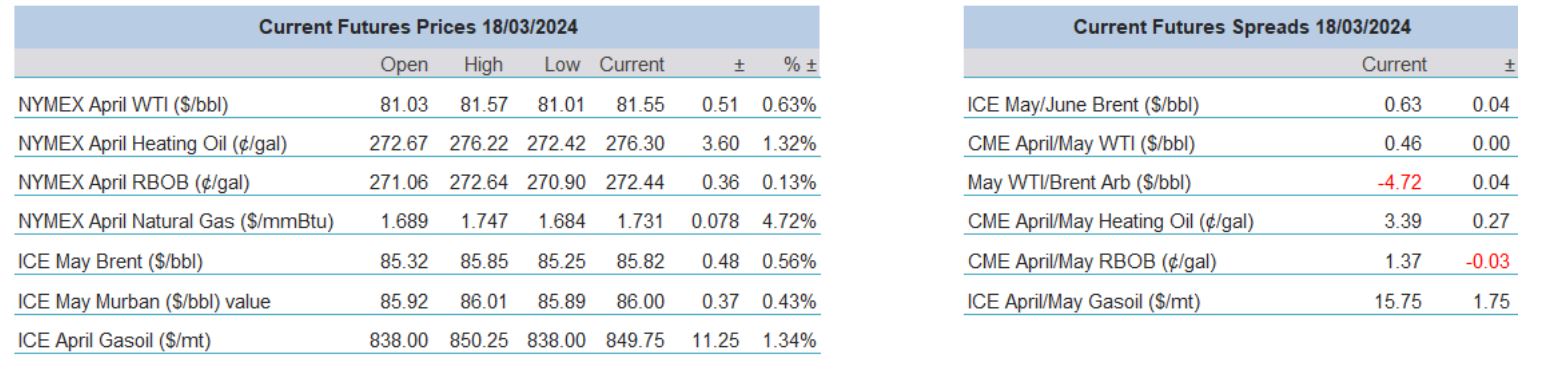

Another fleet of drone attacks launched over the weekend saw the 170,000bpd Slavyansk refinery in Kasnodar hit, and although a fire has been reported the extent of damage is not yet known. According to Reuters analysis, some 7 per cent of Russian refinery capacity has now been halted as a direct consequence of attacks. As a result, RBOB M1 futures led the way last week gaining 19.36c/gallon (7.66%), spurring WTI on by $3.03/barrel (3.88%), Brent by $3.26/barrel (3.97%), with Heating Oil and Gasoil making much more laggardly progress, increasing by 8.61c/gallon and $11.50/tonne respectively.

Because of the weekend drone attacks oil prices maintain the strong closes of last week and at present the rally remains in revival. However, an unexpected boon is received from China data this morning where Fixed Asset Investment increased by 4.2 per cent year-on-year over the first two months of 2024. But what is more encouraging for bulls is that Industrial Production Jan-Feb YoY rose 7 percent and that Retail Sales in the same criteria rose 5.5 per cent. There seems no particular fallout from the Russian Presidential election cakewalk, and the ceasefire talks of Gaza keep a guessing game going on with subtexts of quotes only adding to exasperation rather than anything that might influence oil prices. The most important events this week, and touched on below, are the many interest rate decisions to come from Central Banks where what happens at the Bank of Japan might actually outshine what emerges from the usually all-important FOMC decision.

GMT | Country | Today’s Data | Expectation |

10.00 | EU | CPI Final YoY (Feb) | 2.6% |

The Land of the Rising interest rates, well possibly.

The world stands on the cusp of a new era of interest rate easing, and even though the great and the good of the central bank world procrastinate in ever-decreasing circles, the markets at least believe that the barriers obstructing a loosening of fiscal grip on the monies of the globe are coming to an end. There is little to believe that any sort of shock in decision will come from the varied meetings of some of the gang of ‘tighteners’ to include the Bank of England on Thursday, preceded tomorrow by the Reserve Bank of Australia, on Wednesday by the US Federal Reserve with the added smaller puzzle pieces in the fiscal picture being that of the Swiss National Bank and the Norges Bank.

Wires will no doubt treat us with all sorts of language autopsies and there will be dissertations on nuance or any unlikely faux pas. However, in the face of a continuing standoff by the aforementioned; the decision on Tuesday by the Bank of Japan might just prove to be the most salient and provocative market driver of the week and possibly the foreseeable future until a global roundhouse of easing is finally delivered. Having beaten its own path of hitherto limitless easing, Japan’s fiscal journey has been so much very different from the rest of the world’s realisation and then decision that the over-compensation doled out during and after the pandemic years that initially fuelled inflation and accelerated by supply bottlenecks due to the Ukraine invasion, needed to be tamed. Taking the history of the US FED as being the most relevant, the first interest rate hike was exactly two-years ago when rates moved from 0.25 per cent to 0.5 per cent and in the convening period there were ten-further rises culminating in the current rate of 5.5 per cent where it has resided for the last seven months.

In January 2016, Japan’s key short-term interest rate stood at zero per cent after years and years of ultra-low rates due to stagflation, the domestic banking crisis of 2000, made worse by the global banking fallout of 2008 and the failure of subsequent quantitative and qualitative easing (QQE); introduced in 2013 to kick start an ailing economy stuck with a hierarchal, ageing and low producing work force. Little success was achieved; therefore, the short-term rate was cut in February 2016 to -0.1 per cent where it has stood ever since. QQE since 2013 has been expanded with government bonds and ETF buying but the BoJ had to introduce a Yield Control Curve because the negative interest rate experienced at faster expiring loans dragged on forward investment where longer yields needed to stay positive because of the risk to pensions and insurers. Longer yields found a floor and began to rise which was then combated with another bout of 10-year bond buying in unlimited amounts in 2022 and 2023. Charges that BoJ have created its own fiscal vicious circle may be justified, but the central bank has shown that it has been prepared to go all out in not allowing Japan’s economy to deflate, stagnate and whimper as it has done for much of this century.

This insistence on staying with such a loose strategy has borne fruit in recent history and has attracted investment from those seeking to take advantage of economies that are basically underwritten by the state. At the end of 2022, when the FED was three-quarters through its cycle of interest rate hikes, the Nikkei 225 was trading 26,000, at the beginning of this month Japan’s bourse printed over 41,000. The stock markets of the US are extraordinary, and the AI rally need not be explained, but can it really be argued that monies started migrating into Japan from markets experiencing the thumbscrews of fiscal tightening into those that have a very economic-easy policy? A certain Mr Warren Buffett did not think so and Berkshire Hathaway among others went public last year on increasing exposure to Japan with investors also attracted by a restructuring of the Tokyo Stock Exchange and corporate buybacks. Fortune also played a part. China has fallen foul of diplomatic relationships, seen external investors shun its shores and Japan has been a beneficiary for those looking for another high-tech producer of semiconductor and other such hardware, with all things covered by the security blanket of stimulus.

Last month the IMF said that inflation is expected to converge in the medium term to BoJ’s two-per cent target. The return of sustained inflation follows a persistently above-target inflation outturn and the highest base wage growth since 1995 amid intensifying labour shortages. This year, the unions are asking for a pay rise of more than 5% and they may well get it judging by the part-success shown so far as Nissan and Mitsubishi among others acquiesced on Friday to the Japanese Trade Union Confederation, also known as Rengo. Opinion pieces from many economists agree this could make a BoJ decision to ditch its ultralow interest rate policy this week much easier. Such increases into household income will indeed allow an exit from the current policy stance, but will an interest rate hike mean a full-blown curtailment in asset purchases leaving investment and lately longs in all that is Japan vulnerable to a marketplace no longer in the succour of the state safety blanket?

This contemporary renaissance in the fortunes of Japan will have little effect on its thirst for oil. According to the IEA, overall demand is set to fall by 30kbpd in 2024. With the exception of the immediate post-pandemic rebound in 2021, Japanese oil consumption has fallen continuously since, being 1.3mbpd lower from 2012 to 2023. With demand at well under 2.5mbpd, any influence Japan might bring to bear on the state of oil will be through financial comings and goings and the sentimental fallout suffered by investors if any moves from a monetary policy shift see price shocks to one of the world’s most current watched bourses. The Bank of Japan’s decision on Tuesday will have little fundamental reasons for any oil moves, but the fallout on stock markets and the relationship between the US Dollar and the Japanese Yen will. Oil’s entanglement with the macro world, for good or ill this week is likely to be cemented rather than uncoupled.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

18 Mar 2024