Unwavering Borrowing Costs for 2024

The latest round of central banks meetings was deemed sanguine and encouraging. Interest rates in major economic hubs, the US, the UK, and the euro zone, were left untouched and some central banks, notably in emerging markets, the likes of Brazil and Poland, went as far as to cut the price of lending. There is a palpable conviction developing amongst investors and the acolytes of monetary policy that inflation has been reined in, consumer prices are on the retreat and there is no need for further hikes in interest rates – despite the Australian central bank going against this trend a few days ago. Notwithstanding the upbeatish outlook, the narrative of rate-setters is intriguing as almost all of them tread very carefully and uphold the right to re-launch monetary tightening if circumstances warrant it. Their actions in 2024 will have a profound impact on assorted asset classes. To evaluate their most plausible course of action it is useful to recap the mandate of central banks and compare the current economic environment with that of the last recession more than 10 years ago.

The role central banks play in the economy is simple and straightforward, but the execution requires skill, foresight, and a dose of luck. Monetary policy makers are tasked to ensure low inflation and economic growth. An economy is considered to be in a healthy state when inflation is comparatively low and so is unemployment. These goals, however, can be in conflict as was the case after the 2007-2009 financial crisis. Stubborn unemployment was coupled with high inflation. There inevitably must have been a trade-off as far as central banks’ actions were concerned. Whilst the Fed, led by Ben Bernanke, acted to support the labour market, and significantly cut interest rates, the ECB, run by Jean Claude Trichet, decided that inflation was the greater of evils and hiked borrowing costs in 2010-2011. It was the wrong call, and the European debt crisis sent the FTEurofirst 300 index 22% lower in 2011.

The picture is unambiguous this time around and the judgment call was plain. Inflation has had to be tackled since intense upward price pressure arrived from four directions: post-Covid jump in consumer spending due to generous government hand-outs, supply chain bottlenecks, fiscal stimuli, and Russia’s invasion of Ukraine leading to an energy price shock. The US consumer price index reached 9.1% by June 2022, the core reading stood at 5.9%. By that time unemployment had moderated from 14.7% at the height of Covid and from 5.9% in June 2021 to 3.6%. In the euro zone consumer price inflation peaked above 10% by October 2022 and core inflation at 5.7% in 1Q 2023. Unemployment in the common currency area, as a percentage of labour force descended from just below 9% to 6.7%. Priority was taming inflation; the tool was interest rates.

The cost of borrowing was raised from close to 0% in the first half of 2022 to the 5.25%-5.5% range 18 months later in the US. The ECB started tightening somewhat later, rates went from 0% in August 2022 to 4% last month. And the results? The US CPI fell to 3.7% by September with the core figure at 4.1%. In the euro zone the same numbers were 4.3% and 4.5%, falling further to 2.9% and 4.3% last month. The rate hikes have worked and the self-declared targets of 2%, based on consumer prices excluding food and energy, have been approached. The trend is auspicious on both sides of the Atlantic and in order not to trigger recession both central banks, together with their peers across the globe, decided to halt the increases. Despite the recent ascent in borrowing costs recession has been avoided and the US economy, for example, expanded by a stunning 4.9% annualized in 3Q. Unemployment remains low at 3.9% and jobless claims fell last week. The MSCI All-Country Index has risen 23% since last October. This tendency is likely to be unsustainable.

Since the desired goal of 2% is still not within reach, rate cuts in 2024, or at least in the first half of it, will be implausible. Conversely, further hikes are also considered unlikely in order to avoid economic contraction, unless inflationary pressure re-surfaces. The compromise, the high-for-longer mantra will persist, a rather ominous sign for 2024. With borrowing costs staying put but still elevated, maybe throughout 2024, consumer spending both in the US and Europe ought to be adversely affected. And high borrowing costs will have an unavoidable negative impact on corporate America and Europe as well as on governments. Companies will be forced to refinance their loans at higher costs. Debt defaults will rise. The definition of the value of goods and services (GDP) is consumer and government spending together with investment spending. Protracted high borrowing costs will hamper all of the above

There is a strong case to be made that governments will not be able to borrow at the current rates without impunity and this will pit them against central banks who will keep prioritizing delivering inflation targets. One will want lower, the other higher interest rates. Add China’s struggle to this list of grievances where stimulus measures are unable to kickstart the long-awaited bounce in economic activity. Economic headwinds will hinder equity markets and consequently global oil demand growth will struggle to match, let alone better, the performances of 2023. And only then will cuts be a realistic option.

The current plunge in oil prices came amidst impressively resilient equity markets implying that the supply side of the equation - rising OPEC and US production, empty Russian promises of exports cuts, receding fears of Middle East supply shock and bulging European gas inventories - have been the major overriding forces. Since global oil inventories are still expected to draw in 4Q the move down, however vicious it has been, is not expected to last. Nonetheless, grim economic prospects foreshadow limited upside potential for 2024, unless the Middle East crisis, admittedly a salient factor in forecasting, considerably disrupts oil supply from the Persian Gulf.

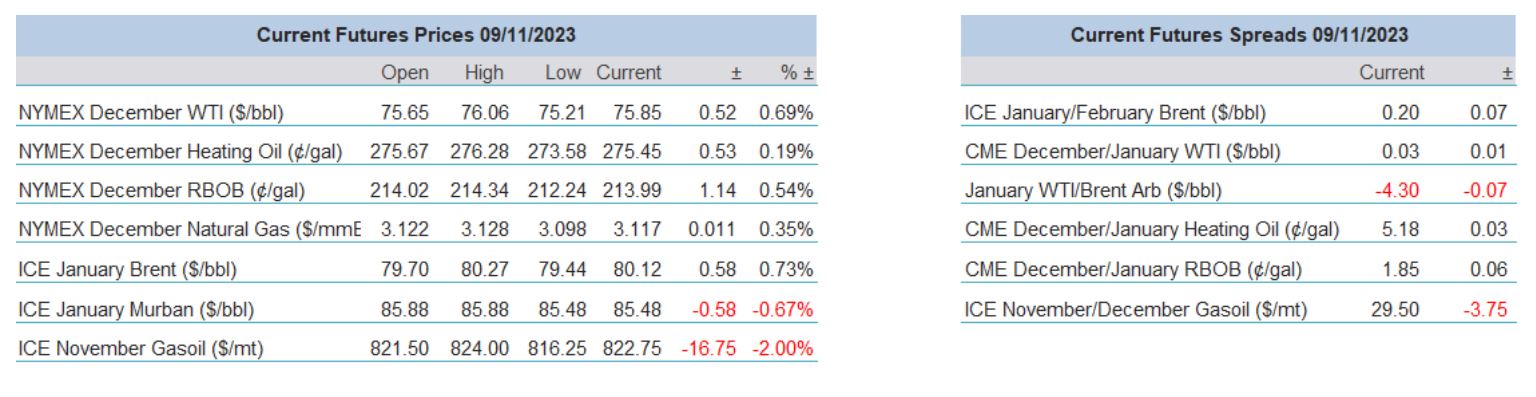

The sharp price drop might not last for weeks but yesterday’ price action did not suggest an impending reversal of fortune. Crude oil prices crawled higher but in the absence of the weekly EIA statistics attention was on the API data and the enormous build in crude oil stocks helped the front-month WTI spread flip into contango for the first time since June. The reported lifting of the remainder of ban on Russian product exports as early as next week pressured Heating Oil and Gasoil. The Israeli pause of military operations in northern Gaza for four hours a day might also be considered a relief development by the eternal optimists.

So, when could the advertised recovery begin in earnest? From the technical perspective decisive moves and closes back over the 200-day moving averages will undoubtedly carry significance. However, their relevance will be dwarfed by next week’s updated supply-demand outlook from OPEC and the IEA. In case the 4Q oil balance remains tight those with bullish propensity could easily swing into action but again, high rates will provide a ceiling and a sustained break above $100/bbl seems improbable under the current circumstances.

Overnight Pricing

10 Nov 2023