US Consumers Bring Cheer

The last of the week's most important data yesterday was good news and greeted as so. Unlike most contemporary readings in which data that miss expectations are happily seized upon as bullish mana, as all investor tourists believe time and again that this will be 'the one' that the Fed will not be able to ignore and impelled to cut interest rates. US Retail Sales jumped 1%, the Census Bureau reported, which beat the 0.3% expectation by some margin. Whatever doubts there were concerning the US consumer were allayed, and when coupled with a lower reading in Jobless Claims, both Initial and Continuing, electronic shouts of 'soft landing' whipped up a stock market already benefitting from good results from the High Street favourite, Walmart. Where logic did ensue was the reduction of pricing of a 50-basis point cut from the FED in September. An uncowed US consumer base and a better job market is not something the FED will wish to fan, therefore if a cut does actually come, a 25-basis point one will be more appropriate.

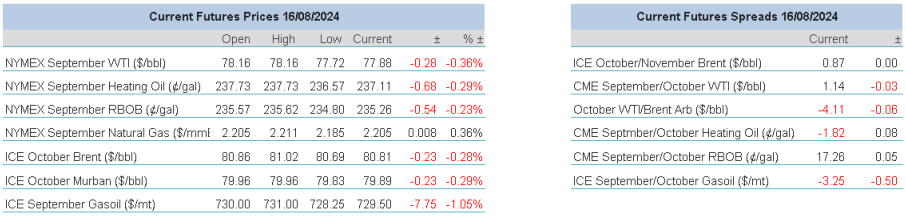

Oil prices benefitted from the idea of a US market that has staying power and at present looks to avoid the doomsayers' predictions of recession. While the oil market looks set to close the week out contained, there is no getting away from the morass of the Middle East. In strange, fringe theatre, that would not go amiss in Edinburgh at present, ceasefire talks resumed in Doha, where Qatar, Egypt, the US and Israel are negotiating terms without the presence of Hamas. If the success of talks is a caveat in which Iran might stay a retaliatory strike, then markets have reason to believe that the threat remains.

Countdown to difficult Central Bank decisions

The ECB has less than a month to start lining up and gathering the copious data detail, in which study might find supportive indicators to deliver what most citizens and businesses of Europe want, namely an interest rate cut. If any proof were needed that confidence within the Union is in a troubled state, one need not look further than this week’s ZEW Economic Sentiment data. To offer perspective, the last three readings for the index have been 47.0 for May, 51.3 for June and 43.7 for July. Analysts and commentators had been expecting a fall in the index and forecasters predicted a 35.4 reading for August. Therefore, a drop by 25.8 points to 17.9 is a crushing indictment on the morale within the EU. Falling twice in as many months and at a three-quarter year low, the disconcertment regarding current monetary policies, economic outlook and the worrying backdrop of political strife will add to the headache of how the ECB balances its fight against inflation while trying to incentivise not only the economy, but in some ways, the more important state of confidence and sentiment.

Market expectation would suggest that a further interest rate cut in September is a foregone conclusion if the 90% pricing probability can be believed. Yet, there are issues that make such high pricing just a little questionable. Eurozone inflation increased to 2.6% in July against a 2.5% expectation. When broken down energy saw rises of 1.3%, a large contributor to price pressure, services, food, alcohol and tobacco and industrial goods all saw increases and core inflation (excluding food and energy) registered at 2.9%, above the expected 2.8% and therefore in line with the headline figure. There are also concerns surrounding the wage hikes witnessed in Germany, which is obviously the biggest source of influence in any ECB decision. The Financial Times quotes WSI, the German trade union research group, which predicts wages to increase by 5.6% in 2024 which the FT says is the fastest rate of increase this century. Robert Holzmann, the Austrian Central Bank Governor and the lone hawk of the ECB addressed the issue highlighted by the FT, “against this background, monetary policymakers are well advised to look at a very broad set of data and to remain extremely vigilant.”

With such words one can only presume that Mr Holzman will once again vote against a rate cut in September, but he does not really stand in isolation when trying to adhere to decisions that based around contemporary conditions. Indeed, in a recent press conference the ECB President, Christine Lagarde, tried to calm conservatives by repeating that the bank is not pre-committing to a particular rate path, decisions will continue to be data-dependent and made on a meeting-by-meeting basis. If this was then taken at face value, then the sticky Eurozone inflation and the wage hikes in Germany together would be enough to stymie a rate cut. However, the ECB is not just about data, it is about politics and for too long the southern part of Europe has had to dance to the tune of the German economic beat. Lastly, with GDP growth in Europe grinding at 0.3% after a stagnant year in 2023 and the sentiment data outline above, one wonders if the ECB can ill afford to ‘follow the data’, no matter how bad it is.

Overnight Pricing

16 Aug 2024