US Employment, Fund Rolls and Gaza

Markets’ sentiments have returned to bad news equals good news again. The rise in Initial Jobless Claims in the US is taken as a weakening of the employment market, so very much watched by investors and the FED alike as it might allow for a bringing forward of any interest rate reduction. This notion has been given fuel from an earlier in the week rate cut by Sweden’s Riksbank by 25-basis points and the attitude in the post-unchanged decision from the Bank of England where the forward outlook suggested that a cut might come as soon as next month. With bourses given a boost, the US Dollar duly reacted to the script, took a dive lower which added more impetus to sentiment that pushed riskier assets along such as oil.

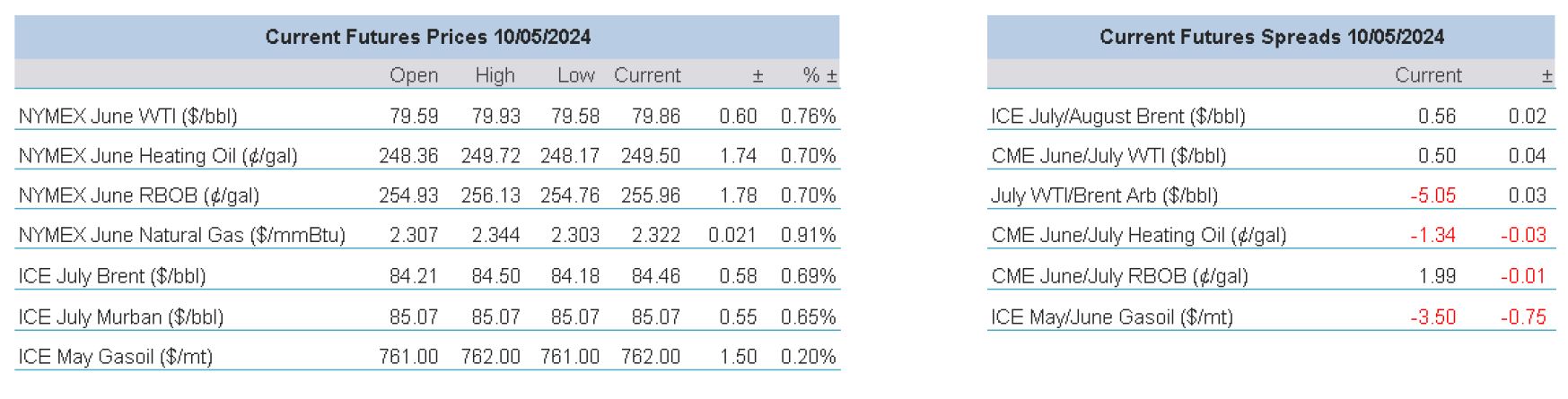

The oil complex has enjoyed something of technical bounce after WTI and Brent futures looked at returning 50% of the gains they had made over the course of this year, but in truth the range of highs and lows across each of the major futures contracts has been rather constrained in what has been something of lacklustre week for flat prices. This morning, concession to the upside is still given to the risk sentiment that has rolled into today, but jollying the strength along is Israel’s increased bombardment of Rafah as it confirms along with Egypt that current ceasefire talks remain at an impasse. Oil is then likely to find continued light buying into the weekend with some corners of our fraternity engaging in long positions designed to hedge against any escalation. With conflict in mind, there is price support to be found by renewed Ukraine drone strikes on Russian oil facilities. Today is the fourth day from five of the index rolls which have so far been applied with a light touch, and apart from a brief shunt in both crude backwardations, the likely pre-roll selling last week had caused more damage than the actual period in which they take place.

China green shoots?

Can the latest trade data from China be seen as some sort of inflection point for its elongated wait for the so-called post-pandemic bounce? Probably not, but it is a worthy consideration. One only needs to track back to March when the intention of manufacturing its way out of the slump was first outlined. Forsaking the headline-grabbing, miserable property market, China instead vowed to bolster manufacturing and exports in its quest to achieve a GDP of 5%. A report from the Ministry of Finance at the time said the central government would allocate 10.4 billion yuan ($1.45 billion) to rebuild industrial foundations and promote high-quality development of the manufacturing sector. If one accepts that the US is the only military super-power, then by sheer volume China is the world’s manufacturing super-power and has decided to wield its advantage. Indeed, analysts suspect that this year, China will make up 30% of global total which is equal to its next four competitors, namely the US (16%), Japan (6.5%), Germany (4.5%) and India (2.8%) combined. China also tops the world in terms of exports, consequently exploiting these two paths of least resistance just makes good sense.

Therefore, the news that China’s GDP in the first quarter of 2024 is estimated at 5.3% will be largely due to exporting of the newly found upswing in manufactured goods which is evidenced by a rebound to expansion of March PMI to 50.8. Yesterday’s trade data of rising imports and exports might be taken as another contributory factor to those that are in the business of China revival premonitions. Imports for April increased by 8.4%, well in excess of the predicted 5.4% with exports rising by 1.5%, just above the 1.0% call. All these good news factors are interesting enough but what is more poignant for us oil watchers are the increase of crude oil numbers among the raised imports. The feedstock inflows registered at 10.88mbpd equivalent (Reuters) being 5.45% above the 10.4mbpd seen in the previous year. Year-on-year then offers something of demand hope, but when compared to last month, there is a decrease of 5.8% despite the heavy passenger traffic seen over the extended Labour Day period and that air traffic increased 1.3% in April, according to OAG via Reuters. However, it is probably not any domestic drivers that have seen increases in commodity imports, they are more likely to be in service to the ambition of the manufacturing and export policy outlined by the grand powers of the Communist Party, pre-buying in front of increased summer demand and in the case of some agriculturals, while prices are subdued. Pieces of the puzzle further fall into place when aligned with the recent increase in export quotas for refiners. Consultancies and traders informed Reuters this week that a second round of export quotas have been granted to the tune of 18 million metric tons, consisting of 14 million for diesel, jet fuel, gasoline and 4 million for marine fuels. China has huge refinery capacity and new and shiny plants that need feedstock. Any sort of green agenda has been abandoned in pursuit of exports and motor fuels will count for a large part of goods that leave its shores and we ought to watch out how all this influences product prices and refiner margins globally.

As much as some of this increased activity is pleasing to a bullish eye and the China revivalists that have been wrong for two years, the data is in denial of continued issues within China’s domestic fabric. At around 25% of the economy, property hangs like a ball and chain on any sort of expansion hopes. It is the reason why consumer confidence remains weak along with retails sales and hampers economic growth markers such as industrial output. As house prices spiral lower so this circular negative outlook continues. Employment seekers are in a buyer’s market with too few places for too many people which is represented by a youth unemployment level of 20%. China has brilliant and historic manufacturing and export skills; it is no wonder that they are being leaned upon to bring relief. However, such a policy is causing discomfitures around the world where cheap Chinese goods exacerbate economic woe elsewhere despite China’s claims that it is helping global inflation and aiding in keeping trade routes healthy. One wonders how long this myopic panacea will last if The Donald comes marching back into the White House armed with an agenda of tariffs. As for oil, we can expect every barrel of crude that is imported into the vast China machine to be likewise exported as a tonnage equivalent in motor fuel. This really is no China turnaround.

© 2024 PVM Oil Associates Ltd

10 May 2024