Venezuelan Oil is to be Shipped to the US

It always takes a day or two to diligently assess any earth-shattering event that has the potential to shake markets to their very core. In the current scenario, this refers to the impact of the Venezuelan crisis, precipitated by the US capture of the country’s former strongman and the appointment of his replacement—his deputy—rather than the legitimate opposition leader.

After Monday’s rally, nerves have calmed. The subsequent assessment, together with yesterday’s drop of around $1/bbl, suggests that the market does not fear a further reduction in Venezuela’s output. In fact, the prevailing view is that, much to the chagrin of Canada and to the delight of US Gulf Coast refiners that were slated to process heavier crudes, the Latin American OPEC country’s output may begin to grow gradually, thanks to US oil companies re-entering the country. As an overture, Venezuela will redirect sanctioned oil stored in tankers and in stockpiles worth $2 billion from China to the US, Donald Trump announced overnight – hence the follow-through selling.

Of course, the US’s coercion to acquire Venezuelan oil opens a new front in confrontation with the allies of the latter with ambiguous consequences, but the consensus holds that, with or without increased Venezuelan output, a supply surplus will prevail throughout 2026, a foretaste of which came last night via the API report, which showed product builds massively outweighing the drawdown in US crude oil stocks.

Equities remain buoyant, and sentiment could brighten further if Friday’s monthly employment report points to interest-rate cuts in the near future. Focus will also shift to the Supreme Court’s rulings, due on Friday, which may include a decision on the legality of Donald Trump’s trade tariffs. There is, of course, much to ponder and digest, and 2026 is expected to be as erratic as—if not more erratic than—its predecessor.

Some Certainty Amidst Unpredictability

Investors spent much of 2025 trying to evaluate the impact of the second Trump administration’s capricious activity on political, economic and trade relations between the US and its former allies and foes alike. It does not take a professor emeritus to conclude that 2026 will also be dominated by the new world order. The US, and most nations around the world, are at the whim of the US president, mainly because he has successfully dismantled domestic checks and balances, be it the judiciary, the legislature, or the media. Impromptu decisions and sudden U-turns will likely characterise the new year; nonetheless, 2025 offers a few clues as to how 2026 will be shaped, and the prospects, depending on which segments of society one looks at, are both bleak and sanguine.

A philosophical axiom holds that hurting others hurts me, too. In primary school, we were all taught the mantra: “Don’t do to others what you would not like them to do to you.” Translated into the language of politics, economics and commerce, cooperation is an absolute necessity if you wish to enrich yourself while enriching others. Everybody wins. This is the very definition of enlightened self-interest; this is what globalisation was all about, and this is what the incumbent US administration wilfully ignores and even despises. Its transactional approach is akin to the practices of the great powers of the Industrial Revolution. Back then, the choice was to cooperate with trading partners in the search for natural resources or to colonise them. The latter prevailed, and today economic colonisation and the rush to secure supplies of critical minerals, in the race for AI hegemony and in the name of national security, have re-emerged. This inevitably leads to friction and tension between the US and others, something the world’s strongest nation does not appear to be concerned about. Just ask Denmark or any of the 57,000 inhabitants of Greenland.

There is little doubt that neo-colonialism will hurt US interests and competitiveness in the medium term. These self-inflicted wounds, however, may not manifest themselves this year. We would expect a resilient stock market for two reasons: the stratospheric rise of the AI sector and the TACO syndrome. The technology sector will remain a continuous source of optimism for investors, while, given the midterm elections and the current affordability crisis in the US, the tariff war is unlikely to intensify. Nevertheless, investors, both domestic and foreign, will remain suspicious of Donald Trump’s economic policies, and the trust that was lost in 2025, particularly after the ill-fated “Liberation Day” tariff announcement, will not be rebuilt. This will harm the dollar, which is not expected to recover from last year’s slump, with consequences for emerging markets servicing dollar debt and for oil demand from importing nations.

As the US continues to rattle its economic sabre any way it can, the question is whether there will be a rapprochement between trading blocs such as the EU and China. This would be a logical move, as it would further isolate the United States; however, given China’s own troubles, it is reasonable to expect persistent tension, as the Far Eastern juggernaut will try to export its way out of a domestic economic slowdown.

Although a weak dollar will support oil consumption, global oil supply is expected to exceed global oil demand. Worldwide and OECD stocks will swell in 2026. Last month’s reports from the three main agencies suggest an average global stock build of 2.35 mbpd. This would translate into 3.2 billion barrels of oil in OECD stockpiles by the end of 2026, an annual increase of 280 million barrels. This average is probably inflated because of the IEA’s pessimistic take on the global oil balance, which will likely be gradually dialled down and aligned with the EIA’s and OPEC’s findings. Nevertheless, a supply surplus should be expected, and therefore depressed oil prices, which are likely to average below the 2025 Brent mean of $68.19/bbl.

Of course, geopolitical developments could upend this forecast. It is worth remembering that Venezuelan and Iranian upheavals could negatively impact oil supply, while tighter sanctions on Russia and intensifying attacks on its oil installations could also lead to shortages. However, unexpected supply disruptions can be neutralised to a certain extent by drawing on OPEC’s spare capacity. As for Russia’s war against its neighbour, which will enter its fifth year at the end of February, we believe the US will be unwilling and the EU unable to provide meaningful financial and military support. There is, therefore, a realistic chance that Ukraine will be forced to sign an inauspicious truce agreement, and sanctions will be lifted, at least partially, on the invader, removing another tentatively bullish factor from the equation.

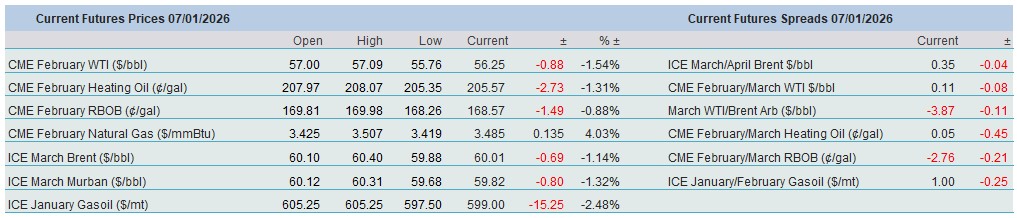

Overnight Pricing

06 Jan 2026