The Weekend Awaits

Oil prices have once again become defensively bid as another weekend approaches. Those that have taken to the buyside of the market can hardly be blamed for not wanting to come in Monday morning with an unspeakable incident having occurred without any sort of upside cover. Reluctant or not, net-long positioning has once again inflated and using MifID data, Bloomberg report the sharpest increase since 2018 from funds and their like. Inspiring the surge in length is a media that drips with attack expectancy from Israel into Iran, fed by aggressive rhetoric, or an almost promised and even more sentiment building 'wait and see' stance from Israel's hierarchy in interviews. Yoav Gallant, the Defence Minister said, "Iran’s attack was aggressive but imprecise, on the other hand, our attack will be deadly, precise and above all surprising”. With former Prime Minister Naftali Bennet, earlier in the week pondering on a once-in-a-lifetime opportunity to strike at Iran's nuclear capability, oil market participants must react in kind, no matter if there remains an argument against demand at present. Running as a bullish wingman story is the fallout from Hurricane Milton, that according to the mayor of Tampa and Florida's governor might have been a lot worse. However, the extent of the damage and how long the clean-up will take is unclear, so is the massive increase in Gasoline demand caused by Florida's reliance on seaborne deliveries to sate the current swathe of empty gas stations.

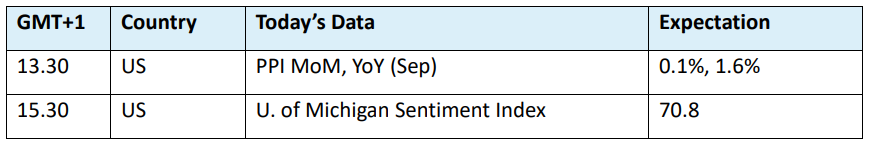

Elsewhere, the macro suite this morning is feeling the uncertainty too of the Middle East and is likely one of the reason bourses drift. Within China thinking, much has been made of this weekend's press conference from policy makers where sizeable new spending might be announced, but it would appear that some doubt remains and passions cool. The US CPI came in slightly hotter than expected, with influential FED member Raphael Bostic saying he is open to pausing a rate cut in November, and with higher jobless claims the market perceives that the next central bank meeting might not be as straightforward as once seemed. The debate will continue into today as the US PPI is due, although it is unlikely to much of a game-changer for FED attitudes.

Free trade for all

The idea of globalisation is certainly taking a barrage of knocks. The swipes and bites inflicted on international trade is something close to an epidemic and while the world watches as the Middle East serves up portents of doom, a calamity in the free movement of goods and monies between nations ought to offer as much fear as what the consequences of a scorched earth outcome might be on oil infrastructures. In the latest bout of tit-for-tat tariffs, China recently targeted and increased penalties on brandy imports from the European Union when previously in August it had refrained from doing so. As innocuous as a brandy tariff might seem, the effect on the share prices of companies that own the digestif brands was of course negative. If such a slump in alcohol names can occur one can only assume that such deleterious influence will be seen in other industries. Indeed, and on Tuesday, the Commerce Ministry intimated that it would carry on assessing how tariffs might be raised on imports of gasoline powered cars from the EU into China. Car makers in Europe have seen this coming, and for some time have been calling for negotiation before the situation worsened. Their protestations have proved prescient, because last Friday the EU voted to impose up to a 45%, five-year term tariff on EVs imported from China, hence the follow up scrutiny of European gasoline vehicles and the brandy tariff. The CEO of BMW called it a “fatal sign for Europe’s car industry” and yesterday warnings against an escalation in protectionism were sounded by Spain’s Economy Minister, Carlos Cuerpo, in an interview with Bloomberg. He envisaged a “lose-lose” situation for both economies and insisted the only way forward was through dialogue and negotiation.

China’s trade with the world, particularly the United States exploded after it joined the World Trade Organization (WTO) in 2001, and while the benefits have reaped rewards for all concerned, the disquiet of its trading partners has grown as China, by some nation’s standards, has enjoyed a trading upper hand. The Obama administration began a process of pushback, which would accelerate. On receiving the keys to the White House in 2017, Donald Trump set about a confrontational passage of history that continues today. Accusing China as the main reason for loss of manufacturing jobs, of product dumping and of currency manipulation, an aggressive economic approach ensued. President Trump, under the so-called ‘Phase One’ agreement raised tariffs on billions of dollars of trade goods, negotiated China to increase US purchases by $200 billion and withdrew from the Trans-Pacific Partnership. More importantly, Trump threatened to withdraw from the WTO, blocked new appointments and basically hamstrung the organisation for many years. Classed by some as an assault on free trade, it now appears that such moves were a precursor to further trade restrictions rather than a cure for them. For under the Biden regime, not only were billions of dollars’ worth of sanctions retained, further actions evolved such as a targeting of TikTok, banning US tech companies in sharing with China, while tripling and quadrupling tariffs on EV’s, steel and semi-conductors among others. There is little likelihood that a Harris win or a trade stomping Trump one in the Presidential race will see any sort of calming in trade hostilities toward China.

It would be wrong to think that this was just a Sino/US problem, the EU and China have many more tariff sensibilities including the lucrative pork market in which China is accusing Europeans of dumping practices. The other thing to consider is what might come to pass with EU/US relations in the event of a Trump win. Outside of China, the former president has promised a blanket 20% tariff on all US imports. At present, any trade tariffs with Europe have been largely shuttered by the Biden government, but it is more than plausible that The Donald will revive trade disputes with the EU and probably the UK over aircraft, metals, cars and luxury goods. During his previous reign, the EU drew up a retaliatory plan that at present is suspended until 31 March 2025, but a resumption and extension of tit-for-tat behaviour is only a ballet box away.

Protectionism is alive and well and for all its cries of believing in free trade, one of the worst instigators in what could very well be a global spiral, is the US. As for the oil market, costs will increase for consumers everywhere, no matter the country, and with energy such a driver in expenditure, the passing on of trade costs will ultimately lead to lower demand. But not only that, with such a hard and nearly won battle with inflation, higher prices across the commodity suite will also cause inflation and again less demand. Choice becomes limited, future investment uncertain and with strained trade relations across usual allies, will the resolve to keep away from Russian, Iranian and Venezuelan crude for example dissipate? National security, post-COVID and during two unfolding wars is understandable enough. However, the very idea that keeping free trade under lock and key can benefit anyone other than communists and socialists that still believe it exploits workers, is a massive misjudgement and one that will have unpleasant costs and consequence for us all.

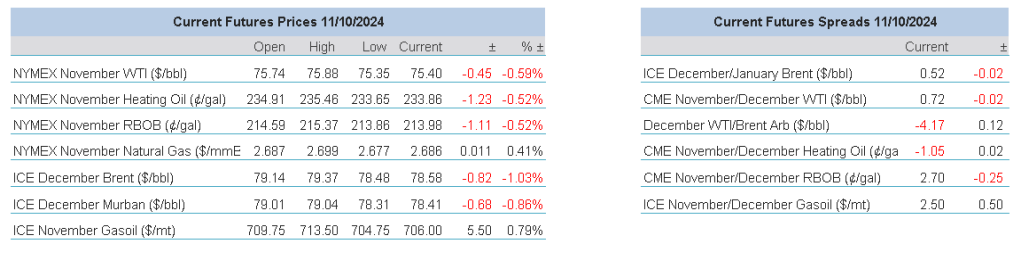

Overnight Pricing

11 Oct 2024