The Week’s Action Begins to Build

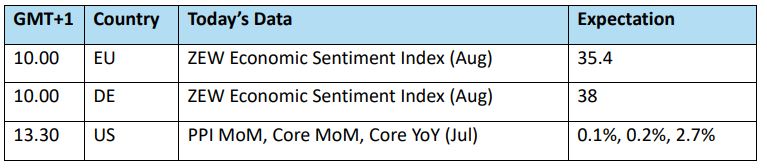

There is something of a hiatus in proceedings this morning, although paths are still very much positive across most of the asset classes. Today sees the start of a bout of Tier 1 data that will define whether or not progress can be maintained and affect a reaction from the Federal Reserve when it comes to the much debated rate decision in September. The important ZEW surveys in Europe are a keen watch for the comings and goings of the Eurozone populace, Germany is touched on below, but the main contender in today's running is the PPI data from the United States. With both the headline and core readings expected to see reductions, any confirmation to such forecasts will be the first part of an inflation story, completed tomorrow with the CPI reading, that will be seized upon by buyers trying to jump the gun on a FED rate cut.

Still, where the wider suite stands with oil is the situation in the Middle East. An escalation will obviously see oil prices march on, but aggravated war-like scenarios never plays well for the confidence in the wider suite. The US is now joining in with Israel in expecting a direct attack into Israel from Iran. There are also reports on wires, which are unconfirmed, that Israel has told allies it would respond to any Iranian attack by hitting targets in the heart of Iran. Faced with such rhetoric and fear, oil remains in an edgy mood which is added to by the current incursion of Ukraine into Russia and the blame trading of responsibility for damage to the dormant Zaporizhzhia nuclear plant. Forward momentum might have seen another push if it were not for OPEC's trimming of its demand outlook. The Organization of the Petroleum Exporting Countries said world oil demand will rise by 2.11 million barrels per day in 2024, down from growth of 2.25 million bpd expected last month. It will be very interesting to see how that forecast compares with IEA's Monthly Report and their normally much more conservative/bearish view on the prospects for oil.

Sporadic good news from Germany might not be enough

The industrial heartbeat of Europe has experienced something akin to arrhythmia ever since Russia’s expansionist desires into the Ukraine exposed just how much the German economy was leveraged against a future of continued cheap energy. Taking Russian oil and gas away from an economy that could burn, heat and generate with abandon, has, by its own standards, left a few years of economic back waters with both a manufacturing and industrial sector uncompetitive and floundering. Maybe the cracks were already there, it just took a massive reality check in higher energy pricing to reveal them. Earlier in the year the IMF had been warning on temporary and structural issues that might continue to haunt any sort of economic recovery.

The raised interest scenario causes the German citizenship to be cautious and investment to dwindle allowing for an ensuing depression in housing construction and general domestic demand. The heavy reliance on manufacturing means that the country has missed on the growth seen in the services sector as witnessed elsewhere in the world. All temporary possibly, but not an ageing work population that at some stage will need to be financed in retirement. Nor the structural issues of burgeoning red tape that can only be lifted when Germany joins the twenty-first century in digitising government processes. Productivity has been falling, but one of the biggest weights against growth has been the lack of public investment. According to OECD/IMF data, percentage of GDP investment between 2018 and 2022 was just over 2.5%. In comparison, the UK was just over 3%, the US and France around 3.75% and Japan 4%. Returning to contemporary issues, inflation has caused more burden for spenders and monetary behaviour has been defensive. However, inflation is starting to see a slight downward cycle, German Consumer Prices rose 2.3% year-on-year in July. This figure was in line with the market expectation. On a monthly basis, it was unchanged at 0.3% versus 0.1% prior and any country maintaining inflation close the Valhalla of 2% might just be rewarded in lower interest rates, particularly the influence Germany’s economy has on ECB decisions.

It was therefore also heartening to see the performance of German Industrial Production as per the data issued last Wednesday. On a month-on-month basis, June output grew by 1.4% which registered higher than the 1.0% forecast while being so much better than the contracted -3.1% of May. This welcomed performance is attributed to the car industry which was 7.5% higher than the previous month. Aiding this more palatable data were increases in electrical equipment, capital goods, intermediate goods and energy production, so says statistics from Destatis. These are all energy-intensive, and although a mere blip in what has been, at the minimum, uneven demand, such data will be welcomed by those that are looking for Germany to emerge from its funk. Early days indeed, but when Germany starts to use more energy, the market will listen. Destatis expanded, production in energy-intensive industrial branches rose by 1.4% in June 2024 from May 2024 and was 1.3% higher in the 2nd quarter of 2024 than in the 1st quarter of 2024, up 3.8% in June 2024 compared with June 2023.

Sadly, intermittent good data is not enough to thwart a negative trend. A GDP growth figure that is revised down by 0.1% would normally not even make the news. But with the IMF predicting growth to be 0.2% for the whole of 2024 such a trimming of forecast needs attention. Gross domestic product will rise 0.1% in 2024, down from a prior prediction of 0.2%, the median forecast in a monthly Bloomberg survey shows. Analysts also trimmed their outlook for 2025 by the same amount, to 1.1%. Running alongside this dampener is also data from Bloomberg that highlights the elevated cases of corporate insolvency that increased in May by 30% on a year-on-year basis. The above listed concerns of earlier this year from the IMF continue to find agreement from varying analysts. An ageing populace is no easy fix, but productivity and a sweep of all that is red tape must be. But the easiest fix is investment, the public finance type into infrastructure in all its guises will aid more than just a monthly favourable as seen in Industrial Production. The trouble is, Olaf Sholz, the German Chancellor, cannot get a fractious coalition to stand still on a draft budget. Massive constraint also came from last year’s Constitutional Court decision to enforce the debt brake which only allows a federal deficit of 0.35% of GDP. A thriving Germany is what the world needs, but unless isolated parts of its economic structure do not receive sustained aid, not just in monetary terms, but in management, those that look for a renaissance in demand that will affect oil prices higher will have to remain patient.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

13 Aug 2024