Well into the Last Mile

Economic data, especially if it is inflation and particularly if it is from the US, has an outsized influence on our market. As for the updated US CPI release, the most effective way to assess its impact is two clicks away. Go to the CME website and see how its FedWatch tool changed after the release. Yesterday morning there was a probability of 75% for a September rate cut from the Fed. After the June figures were disseminated in the afternoon these odds jumped to 84% and for a good reason. US June consumer prices, excluding food and energy, unexpectedly fell from May and rose 3% on the year, less than forecast. Naturally, the dollar weakened, nonetheless, a noteworthy round of profit-taking in the tech sector sent the Nasdaq Composite and the S&P 500 indices sharply lower.

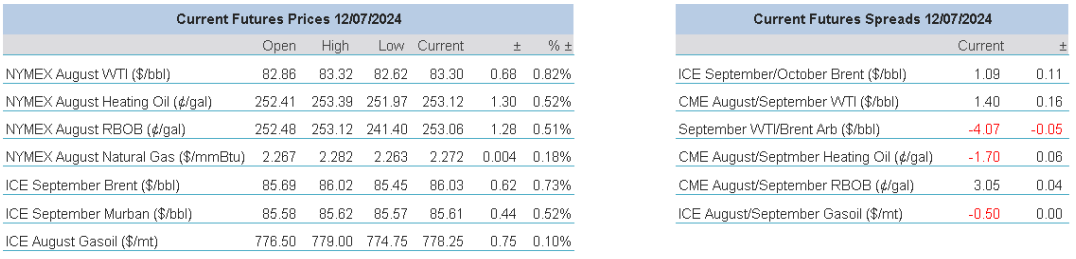

Despite sluggish equities showing, oil edged moderately north aided by the weaker greenback and falling bond yields. Whilst the lukewarm performance might have caused disappointment it is worth noting that the complex seems to be re-gaining its mojo. The convincing jump in front WTI (+21 cents/bbl) and Brent (+10 cents/bbl) spreads suggests that refinery appetite, the possible bellwether of seasonal growth in consumption on the northern hemisphere, is on the rise. The recent downside correction is evidently over, although the speed of further ascent might be hindered by falling Chinese crude oil imports, which plummeted 11% in June from the previous year.

The Beautiful and Arduous Task of Forecasting

Everything one needs and wants to know about the state of the oil market -economic growth, inflation and interest rates expectations, the possible movements of the dollar, the reaction of non-OPEC+ producers to the moves of the alliance etc.- is ultimately reflected in the monthly supply-demand reports from assorted sources. They are the implicit collection points of all the factors that form the price of oil and shape the thinking of investors. They provide guidance of the backdrop a year ago, and of the outlook a year ahead. In them one will find references ranging from global economic growth expectations to weather patterns, anything that has and possibly could influence the underlying oil balance, hence oil prices. Every headline and salient development between the releases of these updates, which makes trading exciting and even volatile and unpredictable, is then accounted for, directly or indirectly, in the latest reports in the form of adjustments from the previous issues. So, anyone wishing to form a reliable view on what might happen to the oil balance must look no further than these publications and align her prior opinion and position to the latest available version, correct? Well, yes and no. Of course, the forecasts contain invaluable information on one hand, but on the other, the interpretation of economic and oil data can be and is subjective or even biased, one might conclude. It could lead to greatly diverging views as it was laid bare in the latest updates from OPEC and the IEA.

The yawning cleavage in projections is as, if not more, perceptible as ever. The story remains the same. The producer alliance remains upbeat on global oil demand prospects, the energy watchdog of the developed world sees declining consumption of the black gold. The former expects annual growth to be around 2.2 mbpd in 2024 and 1.8 mbpd in 2025. The same rates of expansion, in the eye of the IEA, are around 950,000 bpd for both years. According to the IEA, sluggish growth, which stood a meagre 710,000 bpd in the second quarter, is being underpinned by the fragile health of the Chinese economy. The Asian economic juggernaut is the beating heart of global oil demand growth, yet consumption contracted in April and May and in 2Q it is consequently seen below the comparable period of 2023. As for global thirst, the difference is probably even starker by historical comparison. From a year ago, the first time both published 2024 findings, OPEC upped its annual demand forecast from 104.24 mbpd to 104.45 mbpd and its growth rate remained stable at 2.25 mbpd. Conversely, the IEA cut the absolute estimate from 103.20 mbpd to 103.05 mbpd with year-on-year expansion declining from 1.12 mbpd to 950,000 bpd. In 2H of the current year demand will stand at 105.25 mbpd (OPEC) and 104.00 mbpd (IEA).

In non-DoC supply the opposite trend is observed, at least from the previous month. (Year-on-year comparison is cumbersome as non-OPEC production data was replaced by non-DoC figures in May.) Anyway, for those outside the producer bloc supply is estimated at 53.00 mbpd and 53.08 mbpd respectively, a yearly increase of 1.30 mbpd, OPEC reckons, and 1.58 mbpd, the IEA believes. The former thinks demand growth will outpace the expansion in non-DoC supply, the latter refutes these predictions. In the latter part of the year non-DoC producers will pump 53.2 mbpd, according to OPEC and 53.7 mbpd, the IEA finds.

Which leads us to massive discrepancies in 2H DoC calls. It is expected to reach 43.75 mbpd in OPEC’s view, an improvement of 100,000 bpd in the past two months. This prognosis is considerably contradicted by the IEA’s estimates, which shows a decline of 400,000 bpd during the same period and is now 41.65 mbpd. The only thing left for us to do is to pick an arbitrary number for DoC supply and we go with 41.7 mbpd as we include the gradual monthly unwinding of the 2.2 mbpd of voluntary cuts starting 4Q 2024. It shows us that global oil stocks are unlikely to change if you find the IEA figures credible but even ambivalent and hesitant bulls will enthusiastically push the buy button if they focus on the OPEC data as it shows a global stock depletion of more than 2 mbpd in the coming six months. These monthly updates do provide useful insight of what MIGHT impact global oil balance in the future, but they do not hold the crystal ball as to what WILL happen to supply and demand.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

12 Jul 2024