Yet Another J-Day

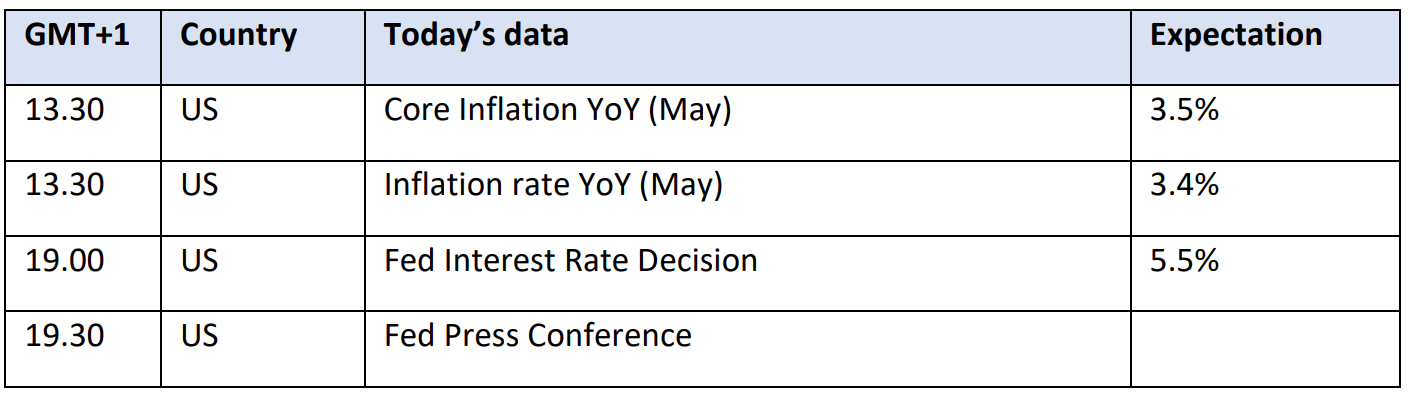

In today’s data driven environment every day feels like a judgement day. Two of the three monthly findings on oil balance, as discussed in the main topic of this note, warranted a decent rally but the market was understandably cautious and pragmatic ahead of today’s Chinese and US inflation reports. In the world’s second biggest economy consumer prices rose by 0.3% year-on-year in May whilst the producer price index fell 1.4%. Weak consumption, which underpins the country’s economy, and the continuous and related deflationary pressure is evident, and the latest survey might just call for further stimulus. After last week’s disappointing US nonfarm payroll release the inflation reading will perhaps play an even bigger-than-usual role in shaping investors’ mood and is expected to show a year-on-year increase of 3.4% (headline) and 3.5% (core). It will be followed by the Fed’s interest rate decision where borrowing costs will most likely be left unchanged, but the ensuing press conference could provide some guidance when loosening of the monetary policy might begin.

The pendulum of risk assets could swing widely this afternoon, the underlying economic backdrop, nonetheless, is solid, which is welcome news for oil demand. The World Bank upped its 2024 global economic growth forecast from 2.4% in January to 2.6% yesterday. Further encouragement arrived courtesy of the API, which showed a forecast-beating draw in crude oil inventories. Distillate stocks rose less than expected and the killer blow came from gasoline, which registered a sizeable plunge. If confirmed by the EIA it might insinuate that the US driving season will have kicked off entailing further upside or at least limited downside potential as the end of the first half of the year approaches.

Consistent OPEC

It is that time of the month again, and OPEC, in its updated supply-demand forecast has remained true to its recent self – with the exception of a small tweak from the past. It revised downwards its 1Q 2024 global oil demand aftercast by 100,000 bpd and upwards its non-DoC liquids production and DoC NGLs figure by the same volume leading to a reduction of 200,000 bpd in the call on DoC oil. It fell from 42.7 mbpd to 42.5 mbpd and as 1Q DoC oil production was left unchanged at 41.2 mbpd global stocks drew 1.3 mbpd in the first three months of the year, according to the new findings, and not 1.5 mbpd as believed a month ago.

The future, however, remains sanguine. For the incumbent quarter the DoC call is 42.7 mbpd as opposed to an average April-May output of around 41 mbpd from the members of the alliance further depleting global oil stockpiles by around 1.7 mbpd, something that has not been mirrored yet in the weekly US stock data. Estimates were left unchanged for the 3rd and the 4th quarter of the year. Demand will average 105.25 mbpd. The optimism arrives from two directions: expected rate cuts from major economic juggernauts, the US, the euro zone and the UK, will be auspicious for economic and therefore oil demand growth. Secondly, enhanced prospects for the industrial sector in non-OECD countries will also contribute to increased worldwide oil consumption. In the second half of the year global oil demand will increase 2.3 mbpd from the comparative period of 2023 whilst the annual growth rate is seen at 2.2 mbpd for the whole of 2024.

These estimates will result in elevated heartbeats in every ardent oil bull, even when the predicted supply from non-DoC producers is added to the equation. It is foreseen around 53.2 mbpd for the latter half of the year. The quarterly splits are 53.00/53.4 mbpd. Add to that the 8.2/8.3 mbpd DoC other liquids and you will get a call of 43.7 and 43.9 mbpd on the alliances oil for 3Q and 4Q. If accurate, then it was reasonable and even necessary to conclude during the last ministerial meeting that the 2.2 mbpd voluntary production constraints need to be unwound gradually.

It is more like art than science to predict future oil output from the group as there are several variables that must be taken into consideration: economic outlook, developments on the demand side, non-DoC supply, and the most relevant factor, price. The current combined quota is just under 34 mbpd. Add to that the latest monthly production data of countries not bound by ceilings (Iran, Libya, Venezuela and Mexico) as seen by secondary sources and you’ll get 40.77 mbpd with the May output level at 40.92 mbpd (broadly confirmed by S&P Global’s projection of 41 mbpd).

This is considerably below the prognosis on the demand for DoC oil resulting in massive draws in global and OECD inventories in 3Q – it would be 2.7 mbpd using the currently available OPEC estimate and our own production figure of 41 mbpd. This balance would not turn meaningfully looser in 4Q. The roughly 180,000 bpd easing of voluntary cuts would be partially offset by the 200,000 bpd increase in call quarter-on-quarter.

Judging by the price action, the market does not buy into these mega-bullish prognoses. If it did, Brent would be much closer to $100 than to $80. What is, nonetheless, intriguing to notice is that the narrative is not dissimilar to other forecasters’ view. Goldman Sachs expects a deficit of 1.3 mbpd under their base case scenario for 3Q and the IEA, releasing its own version this morning, will also likely pencil in global stock depletion for the rest of the year.

The EIA, which followed OPEC yesterday afternoon, certainly did. Both demand and non-DoC supply estimates were amended upwards and the call on OPEC+ oil would now stand at 43 mbpd in 2H 2024. Whilst the EIA predicts a significantly higher DoC supply of 42.48 it still envisages global and OECD inventories to thin in the second half of the year. Wherever one looks, the common feature is that inventories worldwide and in the developed part of the world will find themselves below the end-2023 ensuring stable prices and gentle upside bias in coming months.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

12 Jun 2024