You Cannot Ignore AI Stocks, but You Can Ignore Oil Stocks

The cost of the AI buildout for Meta, the necessity to raise capital from a bond issue, and the amazing $35 billion Microsoft capex for the first quarter caused fleeting concern within the effervescent tech community. Whenever there seems a pause for thought surrounding AI, negative navel gazing is always interrupted by a bullish intervention which this time came from the results of Apple and Amazon after the bell. The demand for new iPhones is outstripping supply, but Amazon really musters the bulls again with a reported 20 percent income rise in its AWS cloud service giving a massive 14 percent rally in its shares overnight. The S&P and Nasdaq are helping themselves to reclaiming most of the lost ground of yesterday with the latter punching back through 26,000. Armed with another US FED cut and a stop gap agreement between China and the US to be buddies for a little while, the snorting stock market bulls will not be cowed.

As we often comment on, it remains within our market’s domain to play the role of pragmatist. The drawdown in the EIA Oil Inventory Report ought to have seen much more of a reaction. Additionally, reports of refined fuel draws in Europe and Singapore run ally to the US situation, but time and again the market is reminded in a narrative of more crude cargoes coming as and when one might want them. We touch on the ignoring of Russian sanctions, both in political circles and physical trading below, and the impending output decision by OPEC+ on Sunday. But the kick to the ankle for oil prices this morning is a report on Reuters outlining a plan by Saudi Arabia to once again cut its December official selling price (OSP) of its flagship Arab Light grade into Asia by up to $1.50/barrel. The Saudis do not often get the market wrong.

Soybeans, rare earths, port fees? Absolutely, but let's not talk about Russia

In old-school restaurants around the world, we recall how at the end of meal, a server would bring around the sweet trolley. This was a cart, full of delectables which were described in sumptuous and practiced terms by the earnest person trying to tempt us into calorific waist extensions. Imagine then their dismay after much highlighting of the essence of pear in this, and creaminess of texture in that; they were sent away in total deflation by the words, “nothing for me today, thank you.” This then is how the oil community feels after the billboarded Trump/Xi meeting. Apart from secondary effects of currency and equity shifts, there was a big fat zero for those of us trying to plot a path in risk or narrative for oil. An exercise in political window dressing then, designed to take the sting out of a trade war spiral and one that, predictably, offered little on any advancement in the possibility of China bringing pressure to bear on Russia and its evildoing in Ukraine.

Fresh in the news on how some of China’s refinery sector are ignoring recently placed EU and UK sanctions, it appears whatever financial handcuffs have been placed by the US on Rosneft and Lukoil, the economic life blood of oil is still freely flowing from the ports of origin within Russia. According to sources and data of LSEG, Novorossiysk, Ust-Luga and Primorsk are still pushing out barrels to the tune of 2.33 million each day, adhering to Russia’s published monthly programme. It can be assumed that without much protestation from Trump when he met Xi concerning China’s ambivalence toward sanction threat, it will soon resume its oil business with Russia. Last week revealed Beijing’s attitude when its Foreign Ministry said, “China consistently opposes unilateral sanctions that lack a basis in international law and have not been authorized by the United Nations Security Council.” Nothing has also been made of the close to 1mbpd China receives by pipeline from Russia which is a long-term contract between CNPC and Rosneft. We should then expect the merry dance of new intermediaries chartering tankers in the cloak and dagger shipping game, which is made much easier by the bi-partisan relaxing on port fees which will make freight rates much cheaper.

Whenever there is a possible prospect of interference of Russian supply it is normally expressed in the price of the Dubai crude grade. At the back end of last week its positive differential to Brent in M1 futures reached $0.67/barrel, due to the combined influence of EU/UK refinery sanctions and the US targeting of Rosneft and Lukoil. Yesterday morning it had flunked to a low of $0.14/barrel. This recurrence was caused by speculative assumptions on how China, devoid of Russian crudes, would have to scoop other local and Asian grades. Not only does that seem unlikely now because of new sanctions being another round of things to ignore, it has also made wider flung crudes more affordable because of the reduced costs in landing them.

Speaking of Asian grades, their availability is about to receive another boost from OPEC+. Sunday’s meeting of the cartel, and its plusses, is signposted to bring back another 137kbpd of production. While this is only a modest increase, and one designed not to add to the ever-increasing use of the word ‘glut’, it does mean the total of barrels brought back to the market by the alliance amounts to 2.7mbpd this year. Much is made on whether the cartel’s constituents have the physical capability and spare capacity to fulfil these increase intentions, but with the dust sheets being pulled from closeted infrastructure under a regime of reclaiming market share, intention will eventually be made fact. There are no shortages of stories in the micro of Kurdish oil coming back online and Kazakhstan and Azerbaijan both looking to increase oil exports via pipeline. Future developments indeed, but our market has a penchant for reacting in the now to what might become. And that predilection at present is not curbed by immediate fear of a cessation of Russian barrels being supplied to the oil puzzle.

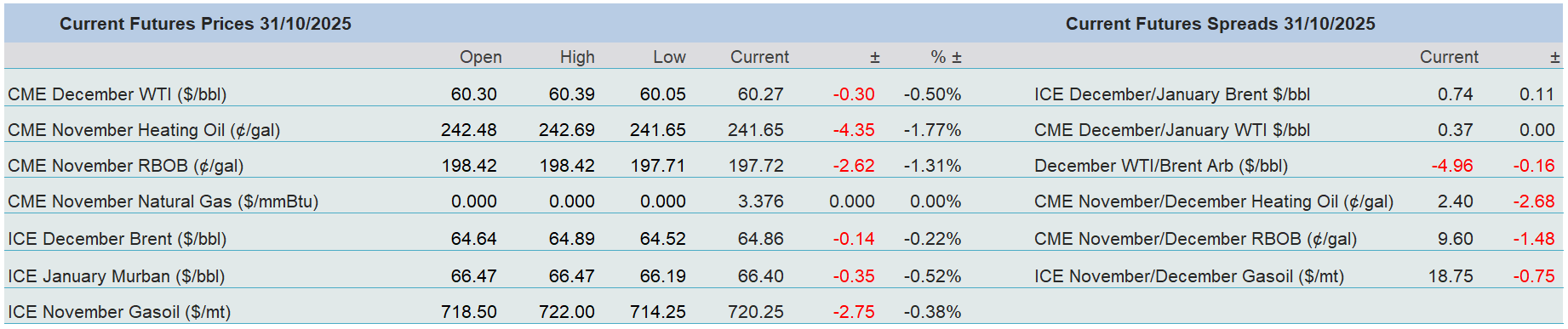

Overnight Pricing

31 Oct 2025