Uncertainty rules – for now

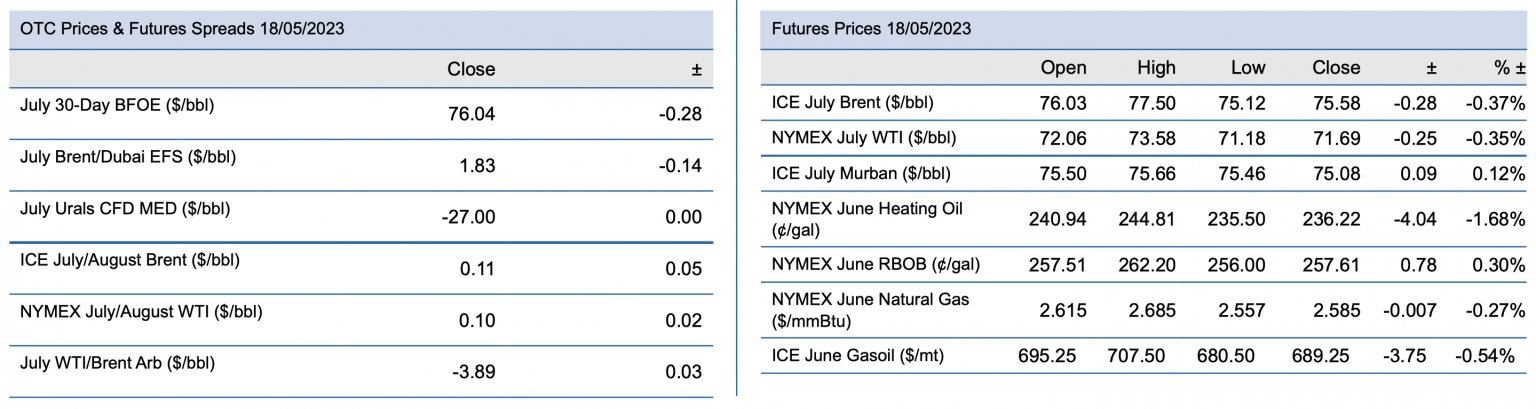

It is cumbersome task to go through a wealth of conflicting signals and draw a conclusion whether the current investment climate suggests a sanguine outlook for the balance of the year or those who expect renewed strength will be left bitterly disappointed. This ambiguity was on display last week. Oil managed to record its first weekly gain in five. The two major crude oil futures contracts settled $1.50/bbl higher. Yet, their structures on the front-end have considerably weakened. The expiring WTI will go off the board today at a discount to the July contract. The July/August Brent spread lost 16 cents on the week and could start flirting with contango soon. On the other hand, backwardation on products have widened implying tight market. On a flat price basis both Heating Oil and RBOB outperformed crude and consequently refining margins strengthened, an unmistakable sign of healthy physical demand. The 3-2-1 CME crack spread swelled $10/bbl on the week. It is as easy and convenient to find positive indicators as to point to potentially bearish data. Under these dubious circumstances it is a useful exercise to step back, look at the bigger picture and evaluate what the economic and inflation outlook and the supply-demand oil balance can hold for us in the future.

Economy/inflation: the fight against inflation is far from over, it is unreservedly ongoing. A few weeks ago, it seemed certain that the US central bank will pause the increase in interest rates. The impasse in the US Congress about the debt limit, stubbornly resilient labour market and a generally upbeat US economy forced two Fed policy makers to warn that inflationary pressure is not falling fast enough to stop hiking borrowing costs. Euro zone inflation hastened from 6.9% in March to 7% in April because rising service costs countered the slowdown in the increase of food prices. The bottom line is that the ECB will not stop raising interest rates either. It would be irresponsible to conclude that the global economic backdrop is ominous but currently it is not auspicious either. Yet, the global equity market is powering ahead. The MSCI All-country index gained 1.1% last week and the Nasdaq Composite index reached its highest level since August 19 last year on Friday. The Japanese stock market performed remarkably well. The Nikkei 225 index rallied nearly 5% scaling highs not seen for 30 years as the third biggest economy of the world proves robust.

Global oil demand: healthy economy and sanguine stock markets warrant unconditional demand optimism. This is what was laid bare in the updated monthly reports from OPEC and the IEA last week. For the second half of 2002 the former forecasts a consumption of 102.64 mbpd and the latter 103.05 mbpd, both record peaks. The energy watchdog of the rich nations, the IEA predicts that 55% of the 2H 2023 demand growth from the corresponding period of 2022 will come from China after the lifting of Covid restrictions. This optimism is underscored by the unusual phenomenon of Chinese refiners drawing on domestic crude oil inventories as processing rates remain elevated, and by the decline in the country’s April diesel fuel exports, despite industrial output and retail sales growth disappointed last month. Other pockets of demand strength are observed in the US where 4-week average gasoline consumption reached a 17-month summit last week at 9.1 mbpd and in India where thirst for the refined fuel is unquenchable.

Supply: recent events helped the global supply market tighten. These are the Alberta wildfire and the halt of Kurdish oil exports via Turkey. Canadian oil producers have been forced to shut in more than 300,000 bpd production whilst the Kurdish region stopped sending around 475,000 bpd of its crude oil to the Turkish port of Ceyhan because of a dispute between Turkey and the Iraqi government.

The broader picture is equally troubling. Non-OPEC supply, according to OPEC, will contract in the latter part of this year from 1H 2023. At the same time, as mentioned above, consumption will rise by a healthy clip. Thus, demand for OPEC oil will grow by a hefty 1.65 mbpd from the first half of the year. As the world needs more of the black stuff from OPEC, the organization, together with its 9 non-OPEC peers, decided to tighten the spigots further between May and December. Global and OECD oil inventories are bound to deplete from the first six month of the year. Russian oil production and exports, however, seem stable. Tracking company, Kpler, estimates that Russian shipments to China will reach 44 million bbls this month.

An evidently tight oil balance is greeted with less than enthusiastic market reaction. Brent has been unable to challenge the $80/bbl barrier ever since it broke below that level at the beginning of the month. What could be the reason for this nonchalant attitude? Well, one school of thought is that demand estimates are more inflated than consumer prices and the economic outlook is actually more depressing than it is currently believed, aggravated by the iffy debt ceiling talks. Secondly, resilient and underestimated Russian oil exports also help fill any supply gap that there is. Finally, the strong dollar, another indication that safe haven is in great demand, also creates significant headwinds.

Investors’ confidence in a price rally is presently AWOL. Just look at the latest Commitment of Traders report. Combined WTI and Brent NSL fell to 249 million bbls last week to its second lowest this year. The amount of money invested in these two crude oil contracts is $18 billion, a far cry from the annual peak of $39 billion. Notwithstanding this rather persistent gloom the view here is that the US default will hopefully and probably be avoided (talks resume today as the X-day is impending) and in the current two-tier oil export market “friendly nations” must be close to their limits of buying significantly discounted Russian oil. As a result, the market is unlikely to violate the bottom end of the medium-term trading range of around $70/bbl basis Brent and the recovery that could take the price to and above the higher end of around $88/bbl, whilst not imminent, cannot be far away as the second half of the year is fast approaching. Only an unthinkable US default and/or recession-induced downside revision in oil demand would upend this outlook.

22 May 2023