Products to the rescue

The mid-day scare caused by the unforeseen swelling of US crude oil inventories quickly dissipated yesterday afternoon after the release of the US oil stockpile report and the oil complex built on the morning gains. The bellwethers of this impressive move higher were products in general and RBOB in particular. US gasoline inventories plunged 1.4 million bbls over last week and they are 0.8% lower than last year and 5.1% below the 5-year average as the US driving season is knocking on the door. More importantly, demand is robust. The 4-week average jumped to 9.1 mbpd, the highest reading since December 2021. Although distillate stocks remained broadly unchanged, they show a massive 15% deficit to the seasonal norm of the past 5 years. The tightness in the product markets is reflected in the substantial backwardation in the RBOB contract. It is also noteworthy that both the CME Heating Oil and the ICE Gasoil contracts on the front end are now commanding premiums over their longer-dated peers after a brief hiatus at the end of April and the beginning of May. The price action and the performance of refined fuels ostensibly foreshadows the perceived 2H tightness in the oil balance that has been the main feature of the monthly supply-demand estimates over the past few days.

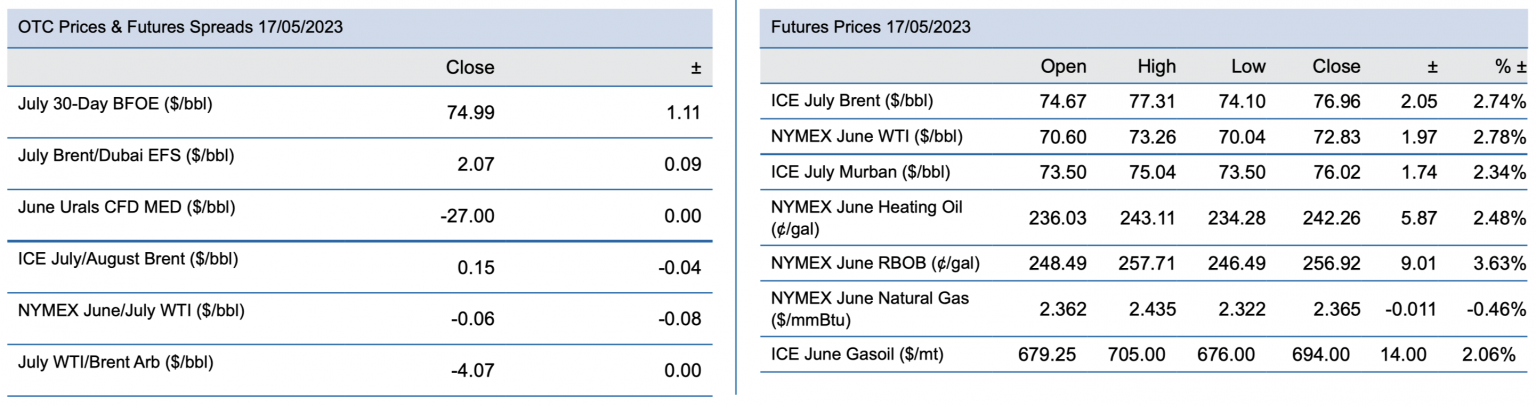

The two major crude oil contracts finished the day $2/bl higher, Heating Oil rallied $2.5/bbl equivalent, but they all looked sluggish compared to the $3.8/bbl equivalent advance in RBOB. Equity markets, assisted by a timely boost in US regional banks, proved a stalwart supporter of oil yesterday whilst concerns over the US debt ceiling seemed to have also eased somewhat.

Onerous but promising debt talks

One, if not the most, pertinent price and sentiment drivers currently is the persistent anxiety over whether the US government will run out of cash shortly and default on its obligations or what we have been seeing lately in the US Congress is just the usual political sabre-rattling. The impasse is so relevant that even the self-indulgent narcissist of US politics felt the need to share his dismissive opinion on the topic with CNN viewers last week. The former US president endorsed the default if Democrats do not cave in and downplayed the potentially catastrophic impact of the stand-off saying that “it could be really bad, it could be maybe nothing”. He is troublingly wrong. A failure to raise the debt limit would be simply disastrous, not only for the US but globally, too.

Every government has debt ceilings but only the US and Denmark set it as an absolute figure. A more widely accepted approach is setting the maximum of what governments can spend as a percentage of the GDP. Poland, for example, has a constitutional limit of 60% of its gross domestic products and a budget cannot be approved in case this limit has been breached. Anyway, back to the US, its debt limit is $31.4 trillion, and according to Treasury Secretary Janet Yellen, the government could reach this figure in just about two weeks’ time.

Negotiations are ongoing between the administration and the Republicans. The latter wants spending cuts, but Democrats resist. To be more precise, the elephants demand deep cuts to government programmes in the coming 10 years whilst the donkeys are offering modest reductions in the next two years. The debt ceiling market is currently 2 bid at 10 in terms of years. What is a no go from the Democrats is the repeal of the tax credits on clean energy, which is part of Joe Biden’s Inflation Reduction Act. Debt relief on student loans is another “sacred cow” for the incumbent administration. Differences might be narrowed, and a compromise could be found in applying savings from unspent Covid funds to a possible agreement and in hastening the process of issuing permits for big investment projects.

An eventual default, even if it only lasts for a brief period of time would push the US into recession, wipe out household wealth and lead to significant job losses. Consumer and business confidence would deteriorate, the credit rating of the US government would be downgraded and consequently interest rates would increase, and lending would become more expensive. The economy would contract. The federal government would be forced to delay and/or reduce payments for benefits and services, including Social Security and Medicare and tax refunds would not arrive in time. International implications would be severe, too. The global financial system would be destabilized, confidence in the dollar would decline, supply chains would be disrupted possibly resulting in a global recession. Closer to home, one can imagine what would happen to derivatives, such as options, if the government were to default on its interest payments on Treasury bonds, the yields of which are widely used in option pricing because it is considered a risk-free investment.

Whilst a default cannot be ruled out the chances of it are minimal for now. The market seems confident that an agreement will be found, and this optimism is reflected in the performance of the US stock market. The Nasdaq Composite Index, for example, is up 19% on the year and reached its highest level since last August yesterday. Nonetheless, and rather unsurprisingly, the cost of insuring against a US default, the price of the 1-year credit default swap, has increased tenfold since the beginning of the year although the CDS has started to decline in the last few days. It should hint at expectations of an avoidable default. A sanguine development from yesterday came courtesy of the Republican House Speaker who pledged to avoid default and said that a deal by the end of this week is possible. If true, then the seeds of a sustained rally are possibly being sowed.

On one hand, Republicans are keeping the US and the global economy hostage. They are using, as always, the debt ceiling as a political leverage. On the other, raising debts indefinitely is economically unsustainable. Whether there is a long-term solution to the frequently re-surfacing problem that could come in the form of abolishing the debt limit in its entirety or by establishing a fiscal framework with forward-looking spending and debt targets, as recommended by a former economic adviser to George W Bush is presently irrelevant. What is absolutely essential, and plausible, is that a consensus is reached within a short period of time, preferably before the X-day whenever it comes, for the sake of the US taxpayer and the global economy.

18 May 2023