Overbaked – Part II

It was neatly outlined in yesterday’s note why our cynical selves would be inclined to make a considerable downward revision in oil prices – simply because the underlying overwhelmingly bullish fundamental backdrop is being overlooked for now and economic anxiety caused by high borrowing costs, brewing credit and debt crises makes investors wary and risk-averse. The cynic, as Oscar Wilde observed, is a man who knows the price of everything, and the value of nothing. Our pragmatic selves, on the other hand, firmly believe that the supply-demand equation will prevail, oil is currently undervalued going into the second half of the year and recalcitrant bears will ultimately cave in.

The updated OPEC forecast is almost chillingly price supportive. Whilst 1H 2023 will have seen a swelling of 430,000 bpd in global oil inventories the trend will reverse rather spectacularly during the second six months. Global oil consumption will reach record levels and the producer alliance will cut output, firstly as part of its supply management strategy and partly due to capacity limitations from smaller producers. Demand for OPEC oil will rise by 1.65 mbpd from the first half of the year to the second and worldwide oil stocks will decline at the rate of 1.18 mbpd – 880,000 bpd in 3Q and 1.48 mbpd in 4Q. Historical data suggests that around 40% of the global stock movement occur in the developed part of the world, accordingly OECD commercial inventories, which show high inverse correlation to the price of Brent, will also be depleted. The latest snapshot foresees them to fall to 2.796 billion bbls in the July-September period and to 2.742 billion bbls towards the end of the year. Current stocks are above 2.8 billion bbls in the wealthy part of the globe.

This upbeat view is backed up by estimates between 2011 and 2013 (using OPEC data) when OECD inventories were only slightly below the estimated 2H 2023 level. It was the time when the price of Brent fluctuated between $100/bbl and $130/bbl, considerably higher than today’s price level, admittedly helped by a weak dollar. Its index against six major currencies traded between 73 and 85 more than 10 years ago versus 102 presently. To stay on a like-for-like basis it is only reasonable to compare the stock and price movements in the second halves of these three years with the expected oil balance of 2H 2023. The immediate perceptible factor is that throughout these quarters (3Q and 4Q of 2011/2012/2013) front-month ICE Brent averaged in a very narrow range of $3/bbl, between $109/bbl and $112/bbl. This compares with the current curve of around $74.50/bbl and $73.50/bbl. With the exception of 3Q 2012, global oil inventories declined between 100,000 bpd and 1 mbpd, less than the predicted drawdowns for the upcoming six months.

OECD oil stocks were somewhat lower than the projections for 2H 2023, they stretched from 2.565 billion bbls (4Q 2013) to 2.728 billion bbls (3Q 2012). It is, therefore, only sensible to expect oil prices averaging below the above-mentioned $109-$112/bbl band. But how much lower? Seasonal comparison of OECD inventory levels and Brent prices implies that Brent ought to jump to $88.30/bbl in 3Q and $90.90/bbl in 4Q 2023, meaningfully higher than the 3Q-4Q curve.

Another intriguing aspect of the OECD inventory/Brent relationship is that every time stocks drew down in 2H from 1H this decline was coupled with higher average Brent prices in the latter part of the year. It has happened on six occasions in the past 15 years. Logic, thus, dictate stronger 2H price levels than what we have been seeing this year, so far, which is just above $80/bbl.

The stage seems to be set for a confident price rally unless oil demand markedly deteriorates, the producer alliance fails to back up its pledge with action and the projected fall in stockpiles does not materialize. Most of the supportive news, record consumption, OPEC+ determination to provide a price floor, have been in the market. As a result, when economic headwinds are downgraded to a breeze, investors will grow ever more optimistic that the perceived depletion of oil inventories, the function of galloping consumption and dwindling output, is turning into reality. This change in sentiment will plausibly occur when the danger of the US default is irrevocably removed.

Relief rally

After four weeks of cheapening oil the new week kicked off with a fresh batch of buoyancy. The upside retracement was partly the result of supply issues. Oil exports from the two heavyweights of the OPEC+ coalition are reported to be thinning. Russia’s April seaborne product shipments stood at 11.383 million tonnes, 5% lower than in the preceding month, Reuters calculates based on data from industry sources. The first half of May saw a plunge of 11% in gas exports to Europe from the average April level. Saudi Arabia is forecast to export 6.48 mbpd of crude oil in May, tanker tracker Kpler estimates, a decline of 1.1 mbpd on the month. OPEC+ countries with quota produced some 2.6 mbpd below their combined ceiling in April, Energy Intelligence finds, and a meaningful improvement is not anticipated, even after Iraqi production normalizes – the latest cut came into effect at the beginning of the month.

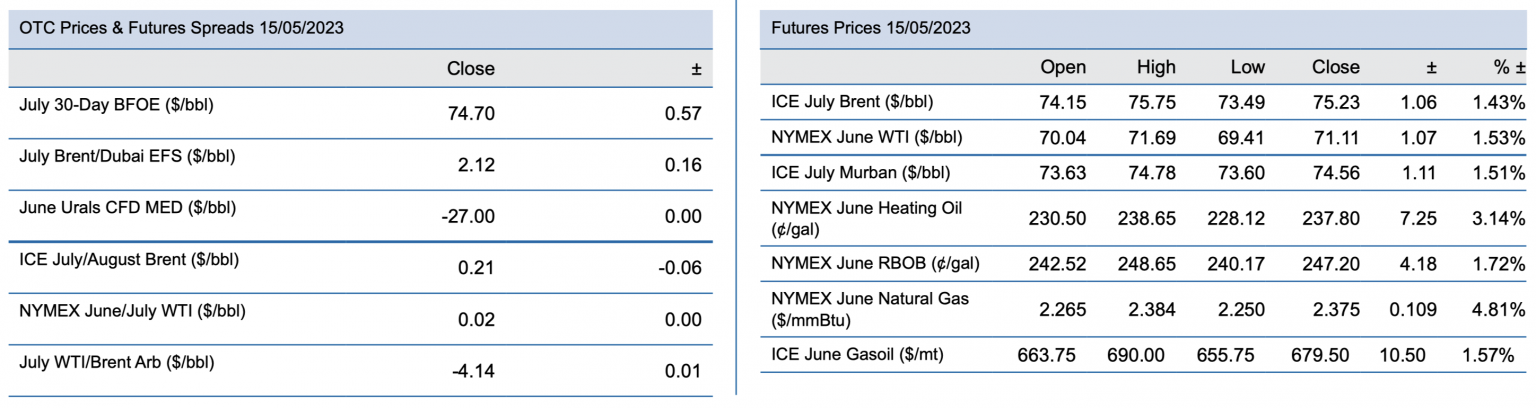

WTI and Brent rallied more than $1/bbl on the day whilst RBOB settled $3/bbl equivalent higher. The lates drilling report from the EIA, which showed US shale output rising to a record high of 9.33 mbpd in June only caused a temporary dip post-settlement. The move higher was helped by the weaker dollar and the advance in equities, perhaps a vote of confidence that the US default will be avoided. Until the picture becomes clear risk assets could easily keep see-sawing just like this morning. An early rally triggered by the DoE plan to repurchase 3 million bbls of SPR crude for August delivery coupled with a decent jump in China’s April refinery throughput is being countered by lower-than-expected industrial output and retail sales in the world’s second biggest economy. Although the current investment climate is not unambiguously sanguine one thing appears obvious: the bottom end of the medium-term trading range, which is around $70/bbl basis Brent is not in danger of being breached and the test of the upper end around $85/bbl and above is more of a question of when and not if.

16 May 2023