DIGITAL ASSETS - APRIL 29TH MARKET UPDATE

DIGITAL ASSETS - APRIL 29TH MARKET UPDATE

- Bitcoin's Halving Sparks Price Surge: What Lies Ahead for Crypto Investors

- Ethereum ETF Speculation and Layer-2 Surge: Catalysts Behind ETH's Rollercoaster Ride

- Traditional Markets Rattled by Inflation: Crypto's Volatility in the Storm of Economic Uncertainty

As we continue to navigate through the tumultuous seas of the crypto market, one thing remains certain: volatility is our constant companion.

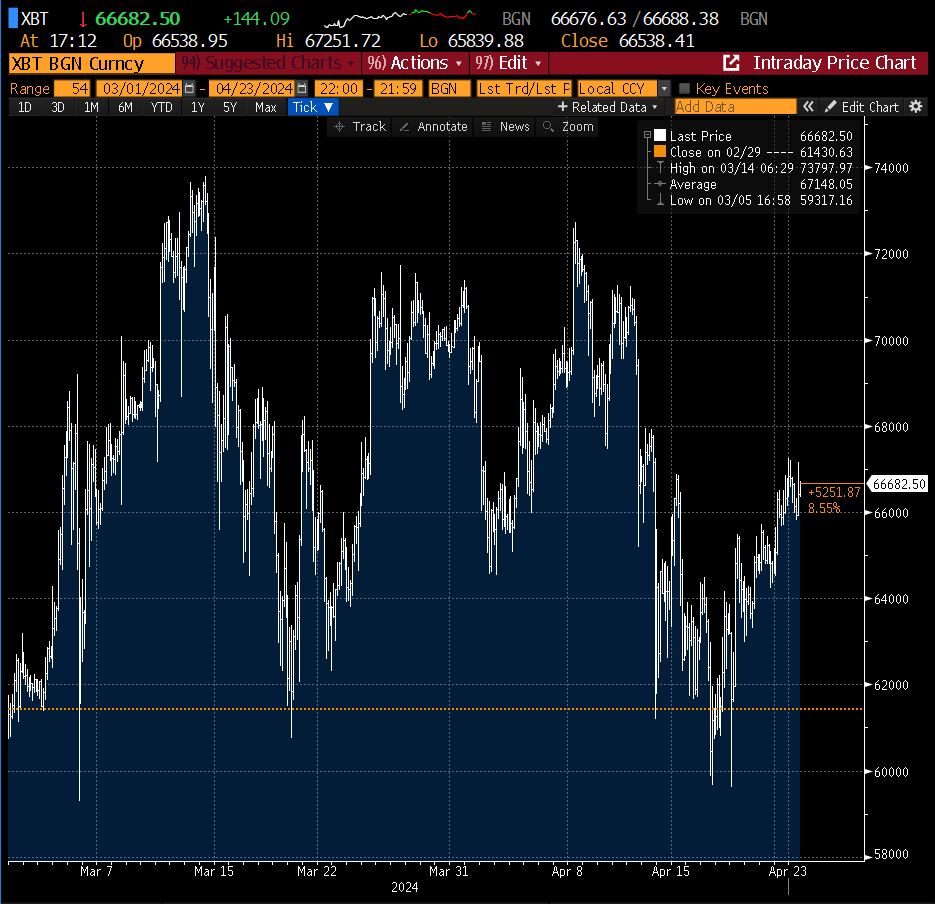

Bitcoin Price Action

On March 14th, Bitcoin reached a new All-Time High (ATH), touching $74k for the first time in its' 15-year history. This marked a significant moment in this new crypto bull market, but what’s perhaps most notable is that it was accompanied by significantly less fanfare and hype than the last time we broke an ATH in November 2021. A positive sign for the asset class’s maturity. By the end of the month, the price had retraced slightly and found stability in the $63k to $71k trading range. However, in keeping with April’s variable weather, a further rally led Bitcoin back to $72k on April 8th was followed by a sharp 5% pullback on April 12th, in the process, triggering over $400m of liquidations in Bitcoin and Ethereum leveraged positions. Despite Bitcoin’s historical volatility being higher than Ethereum’s, and the pullback from the recent ATH, Bitcoin is up 112% year over year, a remarkable return.

Key Market News - The Halving

On April 20th 2024, the fourth Bitcoin halving event took place. Occurring every 210,000 blocks, or roughly every four years, the halving reduces – by half – the block reward, or payment, made to miners for validating, or mining, the Bitcoin network. Historically, the price of Bitcoin experiences its’ most notable surge 1-2 weeks leading up to halving events, and in the following 12 months as traders have anticipated the reduction in supply to the market that this event will cause. This most recent halving event has reduced the block reward given to miners for mining a successful Bitcoin block from 6.25 Bitcoin to 3.125 Bitcoin. Additionally, as more miners support the network, the Bitcoin difficulty – energy and time – required to receive a block reward increases. Therefore, with more limited and difficult to obtain mining rewards, it is possible that a supply shock event could occur and lead to significant price appreciation.

Ethereum Price Action

Shifting focus to Ethereum, the second-largest cryptocurrency, it has yet to achieve a new ATH like Bitcoin. However, in the latest rally, it reached its' highest price since its' peak at $4.7k in November 2021, touching $4.1k on March 14th. Following this, it retraced significantly to $3.1k before rallying back to $3.7k on April 8th, mirroring Bitcoin's movements. On April 12th, Ethereum, like Bitcoin, faced a substantial correction, triggering $400 million in liquidations across leveraged positions in both Bitcoin and Ethereum, dropping as low as $2.9k on April 13th. Despite being up 63% year over year, Ethereum's performance still lags notably behind Bitcoin's. This recent price discrepancy could be attributed to Ethereum not benefiting from the inflows seen in the spot Bitcoin ETFs over the past month, despite their traditionally closely correlated trading patterns.

Key Market News - Spot Ether ETF & Layer 2's

Two key ongoing market developments are likely contributing significantly to Ethereum’s price action, the ongoing deliberations by the SEC on whether to approve U.S. Ethereum Spot ETFs, and the developments in the underlying Ethereum technology that contribute to increased scalability in the network.

On April 4th, news broke that the SEC invited comments on U.S. Ethereum ETF applications from Grayscale, Bitwise, and Fidelity. Although similar to the Bitcoin ETF applications which also received their own comment period and would later go on to be approved, an Ethereum ETF has different concerns from a regulatory standpoint. The legal status of Ethereum and whether it is a security is still under investigation within the U.S. This may or may not be due to Ethereum’s, proof-of-stake consensus protocol, or its relationship with the Ethereum Foundation – a non-profit foundation that supports the growth and development of the Ethereum ecosystem.

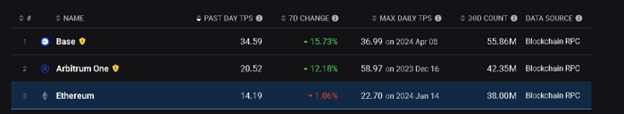

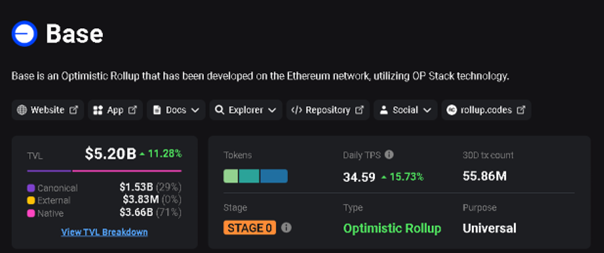

Despite ongoing uncertainty regarding Ethereum’s classification as an asset in the U.S., technology breakthroughs in scaling solutions for the network have demonstrated some strong “on-chain” metrics in the last month.

As of April 10th, Coinbase’s Layer-2 network, Base, had achieved a 30-Day ATH transaction count of approximately 55 million – a number that superseded Ethereum’s 38 million during that same period. Transaction count – or transaction volume – can help determine if a network is being utilized or not since it measures the number of transactions that have occurred within a cryptocurrency’s blockchain network.

Partly due to the recent meme coin mania on the Coinbase-supported network, this achievement is indicative of the demand for additional cheap block-space on Ethereum – the foundational layer of these Layer-2s – benefiting from their continued adoption in the longer term. What’s good for the goose is good for the gander, right?

Traditional Markets

Volatility was not limited to Bitcoin only as the wider market’s concern over sticky inflation continued. Although the U.S. Nonfarm Payroll data revealed significantly higher than expected employment results, a continued hotter than expected U.S. CPI print for March, and the Federal Reserve’s tenacious attitude to achieving maximum employment and targeting inflation of 2 percent made a greater case for rate cuts to be pushed back further this year. This “higher for longer" case caused continued concern over the effectiveness of risk assets such as cryptocurrencies, and for their risk-return profiles to be reevaluated.

Will April Showers Bring May Flowers?

Despite concerning macro-economic indicators such as sticky inflation, and a somewhat underwhelming market reaction following Bitcoin's surge to a new ATH of $74k in March — sending crypto traders to seek value in the depths of Coinbase's Base layer meme coins — there are positive aspects to note.

The Hong Kong spot crypto ETFs which are expected to start trading on April 30th, and the Bitcoin halving that took place this month — which may spice up volatility of the crypto scene — might exert a lasting price impact throughout the rest of the year for Bitcoin, and possibly the entire crypto market. It will certainly be interesting to see how the price of Bitcoin will adjust according to, a possible supply shock event, in conjunction with continued retail and institutional demand from spot ETFs and exchanges – whom are all reaching from a total supply pool that is limited to 21 million Bitcoin.

With this, one would expect Bitcoin to follow the previous post-halving trends of heading higher, but the winding roads may make for a bumpy ride!

As always please send any feedback, suggestions or comments to the Team mailbox.

Best, Xavier Berolo, on behalf of the Digital Assets team.