Why Trade With Us?

Trust

With over 50 years’ experience connecting clients across the world’s financial, energy and commodities markets TP ICAP has a proven track-record of operating global electronic trading platforms, as well as long-standing relationships with wholesale market participants.

All clients accessing Fusion Digital Assets will be subject to TP ICAP’s onboarding and customer due-diligence process that has been developed through decades of experience in traditional asset classes.

Fusion Digital Assets will be operated by TP ICAP E&C Limited and is a cryptoasset exchange provider registered with the Financial Conduct Authority.

Transparency

Our model differs from other central exchanges in that we believe clear and segregated roles and responsibilities are an essential prerequisite for creating a fair and transparent marketplace.

Fusion Digital Assets is a non-custodial exchange, we operate a fully disaggregated and interoperable model for execution and settlement. Separating your execution and settlement is key to effectively understanding and managing your risk as you enter this new asset class.

Liquidity

Our liquidity is sourced from the world’s leading market makers and aggregated with uncorrelated flow from across TP ICAP’s global client base. Built on a proven institutional technology infrastructure, this addresses some key liquidity concerns of institutional participants:

- Deep, genuine liquidity that can be relied upon during all market conditions

- Anonymous by design to allow clients to offset risk with minimal information leakage

- A dedicated Liquidity Management team focussed on working with each client individually to optimize their execution and limit their market impact

Connectivity

Built on a proven low latency matching engine, Fusion Digital Assets offers electronic and GUI trading via multiple access points:

- FusionConnect – TP ICAP’s FIX API using FIX 4.4 protocol

- FusionMarkets – TP ICAP’s award winning OTC GUI

- Liquidnet – Liquidnet’s desktop trading GUI

- 3rd Party OEMS – Future integration with 3rd party OEMS’s to be announced

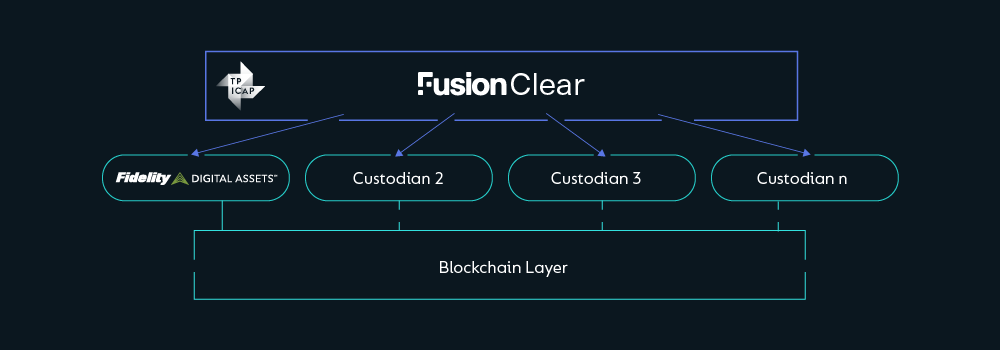

Digital Asset Settlement

Imagine a world where settlement is measured in hours rather than days. Fusion Digital Assets offers a fully electronic post trade settlement process whereby trades are bilaterally netted and sent for settlement to our custodial network via FusionClear on a T+0 basis.

Segregated Custody

Segregation of roles and responsibilities is key to the design of Fusion Digital Assets. The exchange is operated by TP ICAP, whilst settlement services are provided by independent third-party custodians.

Through the FusionClear API TP ICAP has built a post-trade solution with API connectivity into multiple custodians. This allows clients to access the Fusion Digital Assets exchange whilst their assets remain at their custodian of choice, held in their own name. Client assets moving from client accounts on a post-trade basis during the market settlement cycle.

Fidelity Digital AssetsSM will provide initial custodial services, with additional custodians to be announced in line with client demand.

FIND OUT MORE

Subscribe for the latest updates from TP ICAP Digital Assets