May 2023 – Digital Assets Monthly Roundup

May 2023 – Digital Assets Monthly Roundup

- Macro headwinds batter derivatives volatility across risk assets including crypto

- The evolving regulatory landscape in the US pushes big exchanges offshore and prominent market makers to halt trading in the region

- Spot trading volumes hit lowest levels since 2020, while transactions onchain hit new heights.

Derivatives and macroeconomic outlook

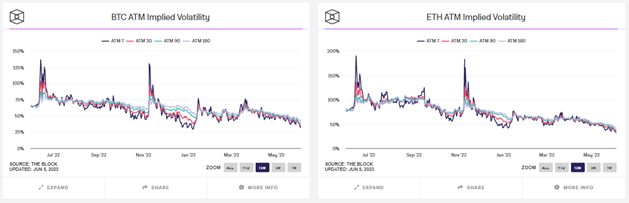

Much like in the equity space and many other ‘risk-on’ assets, cryptoassets continue to come strongly under the influence of macroeconomic headwinds. Most notably in May, the temporary raising of the US debt ceiling and the consequences this could have on the current regime of quantitative tightening by Jerome Powell and the Federal Reserve. The result of this for crypto has been a collapse in open interest across both BTC and ETH options and futures on the CME, further leading to both realized and implied volatility dropping down close to all-time lows.

Though Bitcoin, Ether and other large cryptoassets initially rebounded on the news of the debt ceiling deal, continued concerns around the US banking industry and a potential global recession have meant that many counterparts are unwilling to go risk-on. Instead, many sought out safer returns, meaning spot prices quickly retraced and any bump in vol was extremely short lived. The combination of high interest rates paired with a lack of reputable facilities for credit and leverage available in this market have further emphasized this risk-off sentiment. Given the pressure that the US banking system is already under, it's no surprise that the Federal Reserve was split on whether to continue to hike rates or not but given the better-than-expected job numbers in May it seems the fed are likely to continue along their path of rate hikes to curb inflation. It's safe to say Jerome Powell has found himself stuck between a rock and a hard place.

Regulatory concerns

Another area of focus currently affecting the liquidity of cryptoasset spot and derivatives is developments in regulation for this asset class. In the US, both the CFTC and SEC have brought charges against exchanges and potentially market makers. Leading to a few prominent market makers (who trade multiple asset classes, not just crypto) rethinking their strategy, or putting a halt to trading cryptoasset spot and derivatives out of the US altogether. The departure of these firms, for the time being, may be a concern to those already sensitive to counterparty risk, as known trusted market makers are replaced with smaller, less known and therefore less-credible alternatives. But also, in terms of the potential for downward pressure on the price of cryptoassets as market makers are integral in creating deep orderbook liquidity needed to meet demand.

This pressure from US regulators has had a secondary effect in pushing a number of prominent crypto-native exchanges to move much of their operations offshore; with Coinbase, Gemini and Binance all moving their derivative trading activity out of the US’ direct jurisdiction to arguably less restrictive jurisdictions. Concerns around exchange structure and oversight are rightfully something that regulators across several regions have been concerned about since the fallout of FTX. It is now well known that FTX had co-mingled client and exchange funds and engaged in a number of practices that many from traditional markets would intuitively see as counter to clients' best interests. Accordingly, rhetoric surrounding the ideal exchange structure and the need for segregation of roles and responsibilities is something that has never been more relevant and is something that has shaped our thinking with our own FCA registered spot trading venue; Fusion Digital Assets, which has independent custody provided at the outset by Fidelity Digital Assets.

On a more positive note, one regulatory development in May that would have caught most by surprise, is the revival of interest in blockchain, crypto and the metaverse from none other than the Beijing local government as well as other provinces from within the China region. It may be that as Hong Kong continues to propel itself forward as a crypto-friendly regulatory hub, China overall is warming again to the promise of crypto and blockchain-based finance. Some industry participants have noted that the timing of announcement was interesting, having been released just prior to the launch of crypto rules allowing for retail trading/investment in the asset class on 1st June in Hong Kong. Closer to home, the EU finalised and put into effect the long awaited MiCA regulatory framework for digital assets giving greater clarity to firms operating in the space and resultantly applying further pressure to the UK and US governments to follow suit.

Spot & Onchain developments

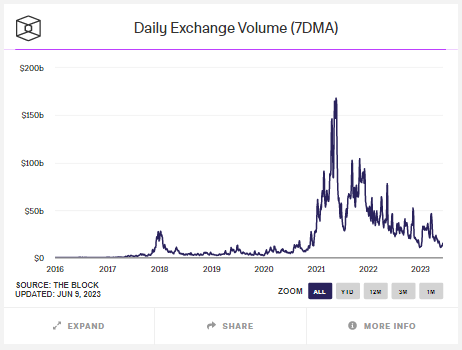

As spot liquidity has thinned out based on the prior discussed reasons, the price of BTC has indeed moved from highs of $29500 at the month open to close out at around $27000, marking Bitcoins first monthly loss in over six months. To add further salt to the wounds, the seven-day moving average for exchange volumes is at the lowest level since the beginning of the year, lows not seen since 2020, as shown on the graph below.

Whilst the larger more macro correlated tokens continued to tread a steady course and remain relatively range-bound across May, their network usage and fees on the other hand, rocketed up close to highs of 2020-21 as meme coins rallied on both Ethereum and Bitcoin alike. Meme coins on Bitcoin you may ask. Ordinal inscriptions were created earlier in the year by bitcoin developer Casey Rodarmour off the back of the taproot upgrade to the network; thereby allowing for the creation of 'digital artifacts' on Bitcoin. The wave of innovation started with NFTs on Bitcoin and followed quickly with BRC-20s (taking its name from the token standard ERC-20 on Ethereum), allowing for the listing and trading of meme coins on Bitcoin. This quickly clogged up the mempool (transactions waiting to be processed in a block) as demand for blockspace shot up leading to Bitcoin hitting its highest ever daily transaction level at 685k transactions. Whether this can be seen as a sustainable use case for Bitcoin and catalyst for miner fee accrual or simply the latest crypto fad, remains to be seen. However, use cases that drive awareness and adoption to Bitcoin for new subsets of people who may have previously been uninterested is always a net positive.

Conclusion

Whilst May can be categorised by downwards pressure on spot cryptoasset prices, thinning liquidity across exchanges and volatility more comparable to the likes of the oil markets than Bitcoin or Ether’s historical levels, it's not all doom and gloom. The crypto space has been going through a period of consolidation, correction and learning from the mistakes of previous cycles. As regulators and firms looking to enter the space come to terms with this maturing landscape, it feels like we are laying a solid foundation for real institutional adoption of this asset class. One that understands that innovation can go hand in hand with sufficient regulatory oversight and that affirming investor confidence and protection in this new paradigm is of the utmost importance to its future.

As always please send any feedback, suggestions or comments to the Team mailbox.

Best Oliver Wink, on behalf of the Digital Assets team.