June 2023 - Digital Assets Monthly Roundup

June 2023 - Digital Assets Monthly Roundup

- The SEC takes further legal action against Coinbase, Binance and its CEO Changpeng Zhao.

- Blackrock files for a spot Bitcoin ETF, shifting sentiment and momentum to close out the month at a 6-month high for the price of Bitcoin.

- Volatility returns to the market leading to an uptick in volume for BTC futures and options on the CME.

Introduction

Good and bad, up and down, bullish and bearish: the month of June has felt like a month of contrasts and transformation. From fear of impending doom due to the US regulatory crackdown, to rising confidence and fear-of-missing-out (FOMO) buying off the back of Blackrock's spot Bitcoin ETF submission. The pace of change this month has felt rapid and the resultant volatility and its effect on the price has been a much-welcomed positive shift for the market.

Regulatory developments

The first half of June was dominated by downward pressure on cryptoassets as we moved from $27k down towards $24.7k on the back of further regulatory action taken by Gary Gensler and his SEC against industry members. On the 6th June, the SEC brought enforcement action against Binance and its CEO Changpeng Zhao, accusing the exchange of both mishandling billions in customer assets as well as listing unregistered securities; of which all tokens in the top ten by market cap were listed excluding Bitcoin and Ether... Just one day later the SEC then brought further legal action against Coinbase for operating as an “unregistered broker, exchange and clearing agency”. The resultant effect was further liquidity fleeing the market and a number of exchanges having to honestly reassess their position across different jurisdictions. This led to Crypto.com winding down their US institutional business and Binance withdrawing from several European nations such as Belgium, Netherlands, Austria, Cyprus. On the flipside the SEC have also potentially found themselves in hot water in their ongoing legal case against Ripple Labs, in which they claimed that XRP (the token of Ripple) was a security. As part of the case, emails from the SEC's former chairman William Hinman have been released which Ripple argues show Hinman having unfounded bias on what he would classify as a security or not and effectively 'choosing winners'. While the US regulatory landscape continues to develop, it is important to stress that this asset class and industry remains a global one. Whilst many industry participants will fight their cases through the legal system, there are already indications that other global financial jurisdictions may benefit, for example with previously US-based participants moving their operations overseas. This month venture capital giant Andressen Horowitz, who has taken a prominent role in the crypto ecosystem, announced they would be opening an a16z crypto-focused office here in the UK, one of the jurisdictions keen to become a global crypto hub.

Institutional Adoption

As we pushed into the middle of the month, sentiment across the market underwent a dramatic shift. As majors dragged toward their monthly lows, the market was hit with arguably the most significant bullish piece of news for a long time: Blackrock, the world's largest asset manager with $10T AUM, had filed for a spot bitcoin ETF with the SEC. A spot Bitcoin ETF has long been sought out by industry participants as it would act as an easily accessible bridge for less tech-savvy investors and at the same time would see a swathe of traditional institutions buying and holding spot Bitcoin for the first time. While many big names have tried and failed to register a spot BTC ETF before to no avail, Blackrock has a record of 575-1 ETF approvals from the SEC, it's safe to say the odds are in their favour... Shortly after, several other large institutional firms like Invesco, Fidelity Investments, ARK Investments and more also followed suit by filing for a BTC ETF in the same format as Blackrock or amending their current filing to reflect Blackrock's. The wave of institutional adoption is far from subsiding, with further players like Deutsche Bank registering for a digital assets custody license from BaFin and even the investment wing of the Bank of China has partnered with UBS to issue ~$28 million in tokenised structured notes.

Spot + Derivatives

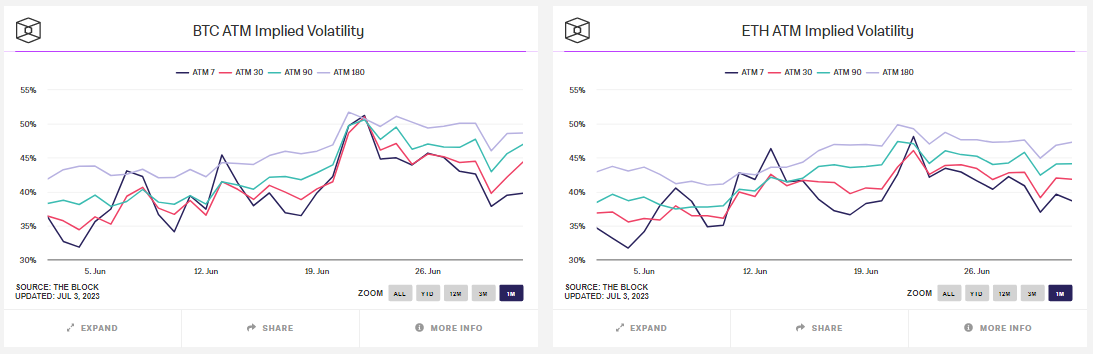

As one can imagine this plethora of bullish catalysts led to a healthy rally in the underlying markets, with Bitcoin hovering below $25k ahead of the Blackrock news before shooting up to near $31.5k just 7 days later. With the main bullish catalyst being Bitcoin-related, its unsurprising that Bitcoin dominance (its market capitalisation compared to the wider cryptoasset market capitilisation) continues to rise to ever high levels: rallying to a yearly high of 52.15 compared to just 41.02 at the years start*. While there have been momentary catalysts for a number of alts, Bitcoin has continued to outperform other cryptoassets since the start of the bear market for a number of reasons. Not only is it the premium in being #1 but also it is truly decentralised, its status as a commodity isn't even denied by the SEC and it's the main point of focus for institutions in being a politically neutral censorship resistant store of value, a 'Switzerland in the sky' if you will. The same effect can be seen across the derivatives market where BTC makes up the lion's share of trading across the CME and other crypto exchanges. As expected, volatility had a much-needed bounce this month, with the BTC 30-day ATM implied volatility jumping up to 51.04% from just 34.39% at the start of the month compared with ETH that increased to just 46.06% from 35.07%*. Leading to volumes on BTC options reclaiming above $1B after two months below and ETH options inversely falling slightly month-on-month.

Conclusion

Whilst many believe the worst of the bear market is behind us, it's becoming increasingly clear that evolving regulatory demands are instigating a change in the location and profile of venue providers within this asset class. Many of the exchanges prominent within the last bull-cycle, were largely based “off-shore” in non-major financial jurisdictions such as Malta or the Bahamas and are now having to reduce their global footprints and withdraw from servicing some of the “on-shore” regions they previously had. Whilst they work through their legal issues, they’ll likely continue to try and gain licenses and registrations across more traditional financial hubs. Doing so will allow them to service the growing client demand for venues operating ‘onshore’ within major financial jurisdictions, where investors have more confidence in accessing markets.

Will liquidity follow? It first requires these financial centres to finalise their regulatory framework for digital assets, a necessity for more traditional regulatory-focused clients to enter the market. With the raft of recent spot ETF filings, it's clear institutions still believe that there is demand for this asset class. As these asset managers ready themselves to enter the spot bitcoin market there will be a need for reputable and trustworthy venues that can meet the market requirements for depth, tight pricing, surveillance, oversight and risk management. The question remains, will this gap be filled by those crypto exchanges that evolve, or by new entrants, that come from more traditional financial backgrounds?

As always please send any feedback, suggestions or comments to the Team mailbox.

Best Oliver Wink, on behalf of the Digital Assets team.