August 2023 - Digital Assets Monthly Roundup

August 2023 - Digital Assets Monthly Roundup

- Contagion spread across DeFi after Curve is hit with a $116m exploit that has cascading effects across the sector.

- Bitcoin and Ether prices collapse to quarterly lows due to continued hawkishness from the Fed and fragile market dynamics.

- Grayscale win court appeal against SEC on their spot ETF approval, momentarily pushing prices back up 8% before retracing as excitement wanes.

August has been a choppy month for crypto markets. Despite volatility continuing its path of compression, a number of key events and headlines across the past month led to momentary spikes in activity and dramatic price corrections in both directions. The start of the month saw panic spread across the DeFi sector after a mainstay protocol, Curve, was exploited. Majors remained unaffected before taking a beating on reports of a continued hawkish perspective on rates from the Fed before bouncing back on news of Grayscale winning their court case against the SEC. To top things off those gains were then wiped out less than a week later, on the news that the SEC will delay its decision on all other spot ETF applications, pushing BTC back below $26k to end August. Even during the 'summer doldrums' there's never a boring moment in Crypto...

After building some positive momentum following numerous bullish announcements around EthCC, DeFi seemed poised for a revival this summer. Unfortunately, this newfound optimism was cut short by yet another exploit; with Curve Finance being exploited this time. For those that don't know, Curve is one of the most important pieces of infrastructure in DeFi and the wider crypto world. It's a decentralised exchange focused solely on stablecoin swaps; giving traders the availability to seamlessly swap between numerous stablecoins (USDC, USDT, DAI, FRAX, etc.) with minimal price slippage, providing consistent yields for LPs and finally liquidity and peg stability for stablecoin providers. On July 30th Curve was exploited for $61 million due to a vulnerability in the underlying Vyper programming language that allowed the attacker to drain numerous liquidity pools of capital using a 'reentrancy attack'. Contagion spread quickly across the sector not only due to widespread interdependency on Curve but also due to Vyper being one of the most widely used smart contract programming language across Ethereum. This was further compounded by the fact that Curve's founder Michael Egorov was holding ~$168M in loans across numerous DeFi protocol with ~34% of the current circulation supply of CRV tokens locked as collateral he had used to purchase a mansion in Australia... Despite the fears, the situation has since stabilised with Egorov selling off a large portion of his CRV holdings both OTC and on-chain. Furthermore, Curve and other exploited protocols have contacted the hacker in an attempt to orchestrate the safe return of the funds with a bounty of 10% of the overall funds to be retained and no legal damages (this bounty is now also open to the general public to DOX the attacker if they do not come forwards).

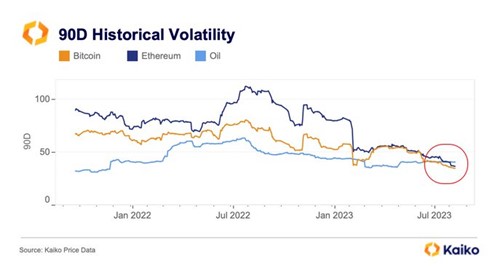

As the DeFi sector began to restabilise, focus in the market shifted back to majors, as BTC and ETH tumbled from the $30k and $1.8k levels they'd been straddling for the last few months to reclaim previous lows of $25.5k and $1.55k*. The sell-off occurred just ahead of Jerome Powell's speech at the Jackson Hole Symposium on the assumption that continued inflation concerns would lead the federal reserves to retain its hawkish position on monetary policy with further interest rate hikes to come, which is generally bearish for risk assets like Crypto. However market dynamics over the preceding months also likely played a factor in the price fall; majors have remained stagnant with volatility continuing to fall to its lowest ever levels for BTC and ETH alike (lower than the 90D historical volatility of oil at end of August**) and liquidity is thin with exchange volumes at their lowest since 2018, creating conditions ripe for a dramatic breakout in either direction.

Another reason cited in the market as a potential catalyst for the downward push was a general malaise around the lack of news or response from the SEC in reference to the numerous spot ETF applications awaiting response. However, this narrative was put to bed with market losses quickly reversing on the 29th August due to the news that the United States Court of Appeals had ruled in favour of Grayscale; stating that the SEC acted with discrimination by rejecting Grayscales application to convert its Bitcoin Trust into a spot ETF, thereby violating the Securities Exchange Act. The judge stated that Grayscale and Arca had shown that the market manipulation safeguards present in their proposal were "materially similar" to those present on the CME for the approved Bitcoin futures ETF's and thus the SEC acted “arbitrarily and capriciously” in rejecting the application. The news hit the markets as the landmark victory it seemed to be, with Bitcoin rallying up to 8% on the day, as sentiment shifted toward the view that a spot ETF approval was inevitable and around the corner. Yet, as the dust settled and the details surrounding the decision were assessed in finer detail it's become clear that whilst this is a loss for the SEC, it does not follow that the SEC must approve a spot Bitcoin ETF.

In fact, just two days later the market enthusiasm following the Grayscale decision came to an abrupt end, with Bitcoin falling 6% as the SEC chose to postpone their decision on six other spot ETF applications for at least another 45 days. Whilst some believe that the SEC is biding for time under the stress of numerous applications, ultimately, they will have to give a final verdict on each of these. If they do not appeal the recent decision in Grayscale’s favour, the court itself will specify how its decision will be executed, which could in theory lead to an outright instruction for approval of Grayscale's ETF conversion. Whilst that may be the outcome many want, it's more likely that the courts too will tread a careful course leaving the decision in the hands of the SEC to revisit the application again, after which they can reject or postpone their decision on other grounds. As the hike rates likely continue and Gary Gensler's SEC continues to stave off spot ETF approvals, patience remains the name of the game for those in this industry.

As always please send any feedback, suggestions or comments to the Team mailbox.

Best Oliver Wink, on behalf of the Digital Assets team.

*Pricing data sourced from Bloomberg

**Cross-asset volatility data sourced from Kaiko