READ MORE

Our Brands

- Announcements

- Debt Investors

- Supporting our clients

Investor Relations

- Announcements

Our Brands

Search Results

Search

Please note that a new volume discount has been added to the IOCD Credit segment of the ICAP UK OTF rate card and takes effect from 3rd March 2025.

Please direct any questions regarding this Market Notice to:

Email: islotfoperator@tpicap.com

Post: TP ICAP Broking Limited, 135 Bishopsgate, London EC2M 3TP, United Kingdom.

Please note that a new volume discount has been added to the TSCD Credit segment of the TP UK OTF rate card and takes effect from 3rd March 2025.

Please direct any questions regarding this Market Notice to:

Email: tpsotfoperator@tpicap.com

Post: TP ICAP Broking Limited, 135 Bishopsgate, London EC2M 3TP, United Kingdom

This article originally appeared in GARP on February 20, 2025.

Discover how businesses are using weather derivatives to mitigate risks associated with adverse weather conditions.

Picture wheat farmers in Kansas, where the amount and timing of rainfall determines the health and productivity of their vast crops. Now imagine a wind farm on the coasts of Denmark, counting on Nordic winds to power thousands of homes and maintain company revenues. Both enterprises face the same daunting challenge.

The capricious changes in global weather patterns leave both at the mercy of mother nature’s unpredictability. Too much rain or one year of weak winds could mean financial hardship. But what if they could turn the uncertainties of wind and rain into a predictable part of their financial planning?

Welcome to the revolutionary world of weather derivatives. These financial instruments allow businesses to hedge against the risks posed by volatile weather patterns, transforming nature’s unpredictability into a strategic advantage.

What Are Weather Derivatives?

Weather derivatives are financial instruments that pay out based on specific weather-related parameters such as temperature, wind, sunshine, or rainfall levels. Unlike traditional indemnity insurance, which compensates for actual losses incurred, weather derivatives provide payouts based on the occurrence and magnitude of predefined weather conditions. This makes them a powerful tool for businesses whose revenues are significantly impacted by weather variability.

The Growth of the Weather Derivatives Market

The market for weather derivatives has seen substantial growth over the past decade. What was initially a niche market with limited participants and liquidity has more recently been driven by the impacts of climate change. Climate-related risk becoming more pronounced has created a paradigm shift in the way people view and model their weather risk, and the demand for these instruments has consequently surged. This added interest has naturally improved the depth of liquidity as the cycle of expansion has organically moved through phases of growth.

While most trades are still executed on an over the counter (OTC) basis, the listed market is an area of particular interest as traditional financial players — such as investment banks, hedge funds, and commodity trade houses — look to increase the diversification of their portfolios by trading new types of derivatives such as weather. The fact that weather derivatives are typically not correlated to traditional asset classes like stocks or bonds further adds to the appeal.

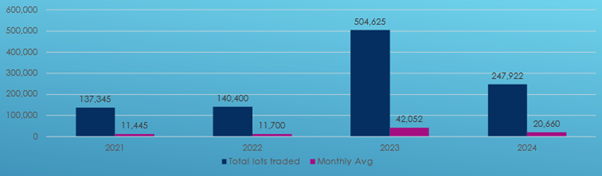

Currently CME group’s temperature contracts are the only cleared offering and trading volumes have increased substantially. In 2021 and 2022, the monthly average was around 11,500 contracts, which jumped to 42,052 in 2023, before reverting to 20,660 last year, as can be seen in Figure 1. The 2023 spike was a result of six new contracts being launched in the U.S. along with several hedging programs coming to market.

Figure 1: Historical Temperature Contracts Traded at CME

How Weather Derivatives Work

Weather derivatives are typically structured as futures or options with daily weather indices used to financially settle those contracts. The indices are calculated based on daily data of an atmospheric or oceanic parameter, such as maximum temperature or precipitation, from the area covered by the derivative (the so called surface and gridded observations).

As the indices are a fundamental part of the contract, it is important that the index providers offer robust, independent data to ensure user trust and confidence. Currently there are only two globally recognized providers — Speedwell Climate and Enwex — that provide high quality data.

These indices are used to settle every weather peril imaginable such as heating degree days (HDDs) for winter or cooling degree days (CDDs) for summer. The following is an example of how a contract works for HDDs:

• Heating degree days are the number of degrees that a day’s average temperature is below 65°F (18°C).

• For example, if a day’s average temperature was 55°F, that day’s HDD would be 10.

• If every day in a 30-day month was 55°F that month’s HDD index points would be 30x10 = 300.

• CME’s value — the tick value — per point is USD 20.

• So that month’s settlement value would be USD 6,000 (300 x USD 20).

A utility company, for example, might purchase a weather derivative to hedge against the risk of a mild winter, which would reduce the demand for heating and consequently impact their revenues. If the weather is warmer, the average daily temperature will be closer to or above the base temperature of 65°F (18°C), indicating less need for heating. As a result, the HDD value on such days will be lower or even zero. Consequently, a warmer month’s final settlement will be lower.

Typically, a utility company wanting to protect itself from a milder winter would do so by transacting a contract that would result in a payout if the winter was warmer than a pre-agreed temperature. That is, if the predetermined period’s index settled lower than the agreed value (the strike price). For example, Utility Company A sells 500 contracts of New York LaGuardia

Airport January HDD Swap at 350, to protect themselves from a mild winter in New York. This gives them a short index position at 350 in a notional amount of USD 10,000 (500 contracts x USD 20). Therefore, if January’s average temperature was 55°F for all 31 days, its settlement for the month would be 10 x 31 = 310, and the payout received would be (350 – 310) x USD 10,000 = USD 400,000.

Another example relates to wind energy and its ever-increasing amount of power generation, as seen in Figure 2. In 2024, wind energy once again had the largest share of German electricity production with around 33% (net).

Figure 2: Make Up of Power Generation in Germany

While this shift to renewable energy sources helps to reduce climate change-related risks, it doesn’t come without risks to producers and the millions of customers reliant on consistent energies supplies. Low wind (wind drought) during periods of high demand can see power markets exposed to extremely volatile short-term pricing swings. Conversely periods of high wind and low demand lead to periods where producers can’t sell their power and/or curtailments where wind turbines are switched off.

These risks are extremely unwelcome, but weather derivatives can provide those exposed with viable hedging possibilities. For example, if a wind farm wanted to hedge against the risk of low wind, which can lead to reduced electricity generation and revenue, they might buy a put option with a strike price of 35,000 MWh. This means that the wind farm is protected, if their electricity generation falls below 35,000 MWh, by exercising the put option (selling at the pre-determined strike price).

A tick size of EUR 0.25 represents the smallest price movement for the option. This means that for every MWh below the strike price, the wind farm receives EUR 0.25. So, if 30,000 MWh were produced in a given period, the wind farm would receive EUR1,250 (5,000 x EUR 0.25).

Differences Between Insurance and Weather Derivatives

While both indemnity insurance and weather derivatives aim to mitigate financial risks, they operate differently. Traditional insurance compensates for actual losses incurred, often requiring a lengthy claims process. In contrast, weather derivatives and parametric insurance provide payouts based on predefined weather conditions, offering quicker and more predictable financial settlements. This can be particularly advantageous for businesses needing immediate liquidity to manage cash flows.

Real-World Applications and Benefits

Weather derivatives are used across various industries. For instance, agricultural businesses use them to hedge against the risk of poor crop yields due to adverse weather. Energy companies use them to manage the risks associated with fluctuating demand for heating or cooling, and fluctuating supply, as shown in the examples above. Events companies use them to protect against potential losses that may occur as a result of inclement weather.

The flexibility of OTC weather derivatives allows for tailored contracts that directly reflect a company's specific risk needs.

The growth in liquidity and adoption of weather derivatives has led to more competitive pricing and cheaper hedging tools. This has spurred interest in trading weather derivatives, particularly in the energy and commodities sectors. As renewable energy markets have grown, activity in temperature and wind segments has increased, creating a virtuous cycle of development.

The Future of Weather Derivatives

As the market for weather derivatives continues to expand, there is potential for more innovative use cases. These contracts can be as bespoke or as vanilla as a client needs them to be. Furthermore, many users find the effective and predictable financial settlements attractive, often within 72 hours of a risk period ending, based on robust parametric data triggers.

The suppliers, customers, and users of weather derivatives are constantly evolving, and the diverse nature of the industries that are accessing them is driving the next wave of growth.

Parting Thoughts

After years of being viewed as an esoteric market, weather derivatives are gaining mainstream acceptance. They are a robust risk transference tool that help to protect businesses against unexpected financial losses and improve management strategies.

There isn’t a company on the planet that doesn’t have weather-related risk, and every company, no matter the industry, should be taking a proactive approach to support its operational resilience, foster investor confidence, and ensure stability and predictability of its revenue streams.

If you'd like to find out more about the innovative weather risk management solutions we offer, please visit our Weather Derivatives page.

Tim Boyce has 25 years of experience at TP ICAP, including 14 years in interest rate swaps. He spent a decade in Singapore managing thermal coal and iron ore businesses. Currently, Tim is the European Head of TP ICAP's Global Weather Team.

Venue Update

Please note that the Liquidnet segment MICs for Cash Equity (LIQU) and Corporate Bonds and Securities Debt (LIQF) have been added to the TP ICAP UK MTF and takes effect from 24 February 2025.

As a result, the venue rulebook and rate card have been updated to include the new segments.

Please direct any questions regarding this Market Notice to:

Email: tpicapukmtfoperator@tpicap.com

Post: TP ICAP MTF Limited, 135 Bishopsgate, London, EC2M 3TP, United Kingdom

Please note that the Interest Rates Derivatives (IOIR) section of the rate card has been updated and takes effect from February 14th.

Please direct any questions regarding this Market Notice to:

Email: islotfoperator@tpicap.com

Post: TP ICAP Broking Limited, 135 Bishopsgate, London EC2M 3TP, United Kingdom.

3 Feb 2025 07:30

The purpose of this Market Notice is to advise that an updated Ratecard has been made available on the Venue Page. The headline rates on the EU MTF/SEF Orderbook Market and the EU MTF Targeted Streaming Market remain unchanged.

Capitalised terms used in this Market Notice shall have the meaning ascribed to them in the iSwap Venue Rulebook, Rate Card or iSwap Market Maker Programme Rulebook.

Please direct any questions regarding this Market Notice to:

Email: i-swap@icap.com

Post:

iSwap Euro B.V.

Vijzelstraat 68 unit 109,

1017HL,

Amsterdam

Please note that the Execution and Order Handling Policy has been updated.

Please direct any questions regarding this Market Notice to venuequeries@tpicap.com

Post: TP ICAP E&C Limited, 135 Bishopsgate, London, EC2M 3TP, United Kingdom

Please note that the Execution and Order Handling Policy has been updated.

Please direct any questions regarding this Market Notice to:

Email: tpsotfoperator@tpicap.com

Post: TP ICAP Broking Limited, 135 Bishopsgate, London EC2M 3TP, United Kingdom

Please note that the Execution and Order Handling Policy has been updated.

Please direct any questions regarding this Market Notice to:

Email: islotfoperator@tpicap.com

Post: TP ICAP Broking Limited, 135 Bishopsgate, London EC2M 3TP, United Kingdom.

Copyright © 2026 TP ICAP