Fusion Structured Products

All-to-All Electronic Secondary Market Trading

for Structured Products

At TP ICAP, we’re re-writing the future of structured products, with FUSION Structured Products, the first-ever SEC regulated ATS (Alternative Trading System) dedicated to structured products, providing an electronic, all-to-all secondary market.

The Challenge

The lack of a centralized secondary market means that trading remains highly fragmented and disorderly, which lags other asset classes in terms of operational efficiency and liquidity:

- Illiquid Markets: Buyers and sellers rely on bi-lateral agreements with investment banks, limiting their ability to sell or unwind positions from a broader liquidity pool.

- Inefficient Processes: Current transaction methods are outdated, manual and time consuming.

- Lack of Transparency: No centralized market order book makes best execution a struggle - with no systematic, visible way to purchase products in the secondary market.

The Solution: An All-to-All Electronic Secondary Market

Fusion is transforming the structured products market with a groundbreaking platform that delivers:

- Market Efficiency: Access a live, transparent view of mark-to-market and bid prices through a web-based platform, existing OMS infrastructure, or API connectivity.

- Liquidity Expansion: Greater transparency and a centralized market attracts more participants, enhancing liquidity and price discovery.

- Streamlined Operations: Optimize desk operations and execution flows, freeing up resources for increased trading volumes, reduced costs, and overall business growth.

- Regulatory Oversight: As a SEC-regulated ATS (Alternative Trading System), conform to evolving regulatory expectations by participating in a centralized, transparent, and standardized trading environment.

Connectivity

Fusion is accessible via several methods to accommodate a variety of needs:

- Direct access on the FUSION SP web-based platform

- Via your OMS connectivity

- API connectivity

How it Works

FUSION Structured Products, is designed for simplicity and efficiency:

- Data Visibility & Plug & Play Integration: Provides real-time pricing of all live U.S. structured products trading in the secondary market - capable of seamlessly integrating with existing desk operations and infrastructure

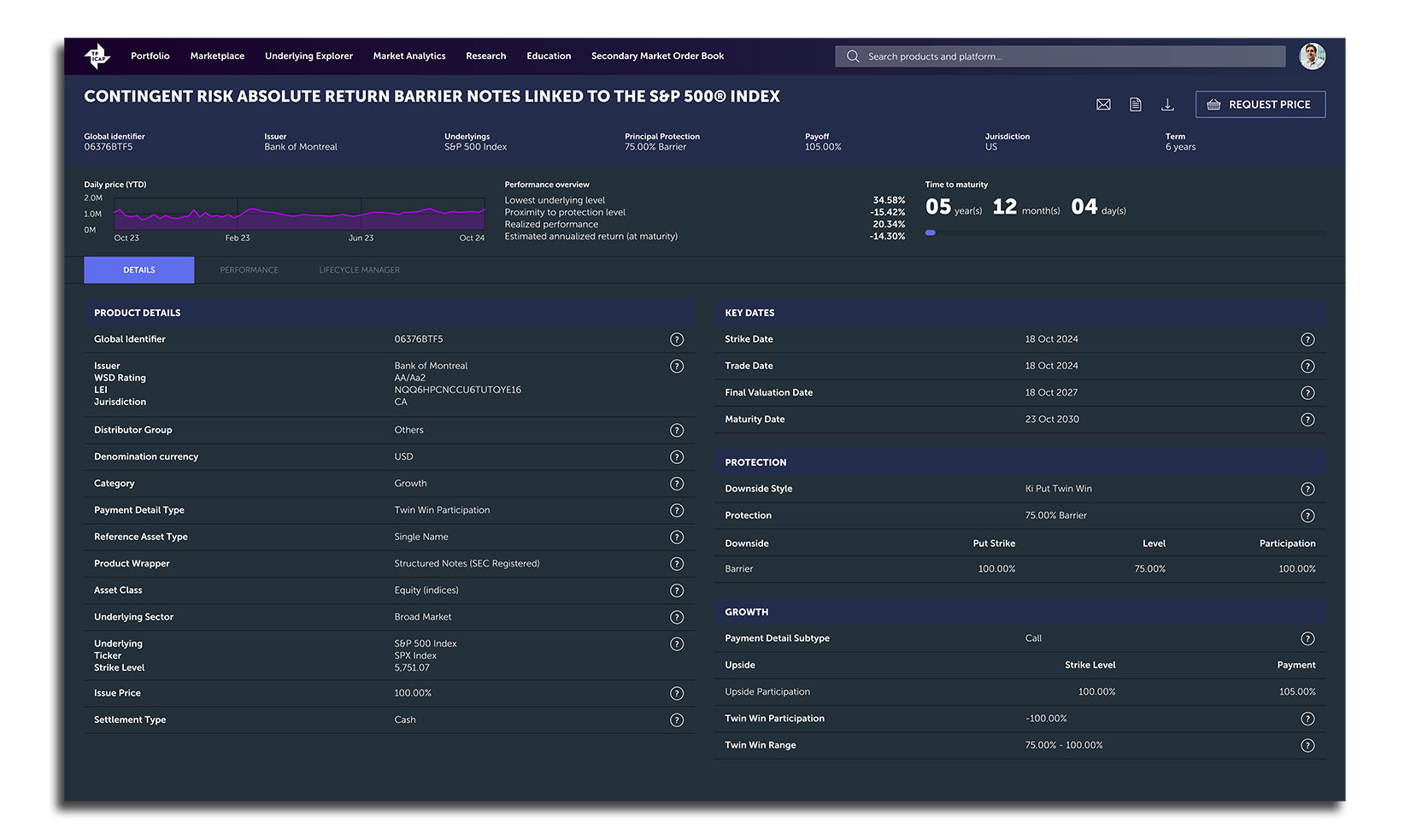

- Comprehensive Market View: View the entire U.S. Structured Products marketplace (+80,000 CUSIPs), with individual product description pages, mark-to-market prices, product term sheets, and analytics

- Order Placement: Place buy or sell orders directly to the order book – with real time order and market insights

- Anonymous Bidding: Submit anonymous RFQs and Bids directly through the order book, ensuring confidentiality in a broader liquidity pool for Best Execution

- Portfolio management: For buyside clients who require it, our dedicated Lifecycle Management Tools are available to manage their structured products portfolios, providing a single view of existing holdings and enabling seamless RFQ in the electronic secondary market.

The Primary Market Reimagined

We are focused on delivering innovation and product transparency, and helping clients navigate the complex landscape of issuers and product payoffs. Our market-leading functionality includes:

- FlexFUSION Structured Products: Full mark-to-market price transparency and risk sensitivities throughout the life of the investment on the optionality of the structure with ‘FlexFUSION Structured Products’, with embedded FLEX Listed options-available on point-to-point, single underlying structures and with select Issuer Banks

- Grey Market & Calendar Offerings: View products available to purchase in a centralized Grey Market, and Monthly Calendar Offerings from select Issuer Banks

- Credit Customization: Tailor structured products with flexibility in terms of Issuer credit exposure and product payoffs

- Best Execution: Leverage our broad liquidity reach in OTC and Listed options for the best execution available

- Broad Offerings: Includes US and Offshore structured notes, CDs, warrants, and unfunded Listed & OTC option strategies.

Our Product Offering

Why TP ICAP?

At TP ICAP, we’re uniquely positioned to redefine the future of structured products trading by creating the first-ever regulated ATS for an electronic, all-to-all secondary market for structured products.

Unmatched Market Expertise

- As the world’s largest liquidity provider, we execute hundreds of millions of transactions daily, bridging the gap between buyers and sellers.

- Our experience in complex financial instruments makes us the trusted partner for creating a structured products secondary market.

Extensive Global Network

- We’re connected to major institutional clients, including banks, asset managers, hedge funds, insurers, and pension funds.

- We operate 15+ trading venues across 63 offices in 28 countries making us the world’s largest financial markets infrastructure provider.

Proven Technology & Infrastructure

- Building on our history of successful electronic trading platforms like FUSION, we bring the scalability, security, and reliability essential for this market.

- Our exclusive data partnership with an external vendor ensures full visibility of all essential structured products data in the U.S. market.

Trusted Regulatory Expertise

- With decades of compliance and governance experience, we’re trusted to be a neutral and professional intermediary.

- Our close relationships with regulators worldwide enables efficient market integration.

Meet the Team

Robert Romano, Head of Structured Products Americas - Private Wealth Networks

Robert is a seasoned professional in the financial markets with over a decade of experience in the structured products industry. Currently, he serves as the Head of Structured Products for the US and Latin America at TP ICAP, the world's largest provider of financial markets liquidity, infrastructure, and OTC pricing data.

Before joining TP ICAP, Robert held positions at leading investment banks and financial institutions across the US, Canada, and Europe, specialising in private wealth management networks and cross-asset derivatives. He holds a Master's degree from a prestigious university and is recognised for his strategic and innovative vision, leadership skills, and deep understanding of the financial markets.